Chris’ note: Yesterday saw historic losses on Wall Street. First, oil crashed. Then, stocks around the world plunged… with the Dow dropping the most it has since the 2008 financial crisis. And investors rushed into safe-haven bonds.

But if you’re a Daily Cut regular… you’ll have been prepared. I’ve been shouting from the rooftops the importance of owning “disaster insurance” in the form of gold. I’ve also been begging you to follow a sensible asset allocation plan to make sure you never bet the farm on stocks.

For expert insight into the historic market turmoil… today, we’re turning to colleague Teeka Tiwari. Teeka worked on Wall Street for nearly two decades. He now heads up our Palm Beach Letter advisory. And he’s on a mission to mint more millionaires this year than any other newsletter writer in the country.

As you’ll see below, as the so-called experts yell uncle… Teeka is putting hundreds of thousands of dollars to work. And he’s got his eye on opportunities in two niches in particular…

Now, over to Teeka…

Friends, welcome to this century’s version of the 1987 crash.

If you don’t remember it… on Monday, October 19, 1987, the Dow plunged 22.6% in one day.

It remains the single biggest one-day percentage plunge for the index in history. That includes during the Great Depression.

In 1987, I was just 16 years old. And I had no idea the incredible opportunity this stock plunge represented.

All I saw was the flood of headlines predicting the end of America. Just like we’re seeing today.

Crashes aren’t fun… But if you want the unbridled upside of living in a free-market system, they’re a necessary evil.

And the first step to accepting this is understanding what’s behind them.

What causes a market crash isn’t so much an external event like the coronavirus today… or the fear of a collapsing U.S. dollar in the 1987 version.

You may be shocked to read that… But it’s true.

What causes a market crash is leverage.

Let me explain…

There are two types of stock buyers in financial markets – investors and traders. And they treat leverage differently.

When you use leverage, you’re using borrowed money to invest, in the hopes that your gains will be greater than the interest accrued on the money you borrowed.

Investors look to the long-term earning power of stocks. They care little for day-to-day fluctuations.

Long-term investors typically don’t use leverage. This is how they can weather market volatility. They are secure in the knowledge that, over time, prices will recover.

But traders look to profit from short-term moves in stocks. And almost all traders use leverage. The biggest traders can use massive leverage. I’m talking 100-to-1 (borrowing 100 times their own money) or more.

These are the folks who cause market crashes.

It’s been almost exactly 11 years since the post-2008-crash low for stocks set on March 9, 2009.

And the longer a bull market goes on… the more leverage traders use.

Some get lazy with their risk management. Others get carried away with greed.

So when an unexpected event hits, and the stock market drops, traders have to sell. If they don’t, they face “margin calls.”

A margin call is when your bank or broker demands you put up more money as collateral for your loans.

And you typically get that collateral by selling some of your stocks and raising cash.

This selling then feeds on itself, triggering more margin calls. It causes mainstream investors to panic – and they start dumping stocks, too. That triggers even more margin calls.

Next thing you know, you’re in the middle of a full-blown crash…

The major drivers behind yesterday’s market panic were the plunge in crude oil prices and the spread of panic over the coronavirus.

Yes, the virus outbreak is a big deal. And yes, oil falling off a cliff will hurt U.S. shale oil producers.

But none of this poses the type of financial Armageddon risk the 2008 financial crisis did.

It’s true. Banks will get hurt on bad oil loans. They’ll also get hurt on their lending operations, since U.S. rates are probably going negative.

But banks were in worse shape in 2008… and the banking system survived.

The coronavirus will smash the hospitality and airline sectors. There’s no doubt we’ll see some bankruptcies and consolidation. But again, these sectors were hit harder by the 2008 recession… and the 9/11 terrorist attacks.

Will the coronavirus panic be painful?

Yes, it will.

My personal stock account is in the millions – and it’s getting clobbered.

Am I worried?

No, I’m not. In fact, I’ve been putting hundreds of thousands of dollars to work.

My 31 years in the markets as a professional have given me the ability to look through today’s horrible headlines and see where we’ll likely be 18 months from now…

And chances are, by then, the market will be near – or will have already made – new all-time highs.

In addition to having questions about stocks, you may be wondering why gold hasn’t boomed much higher.

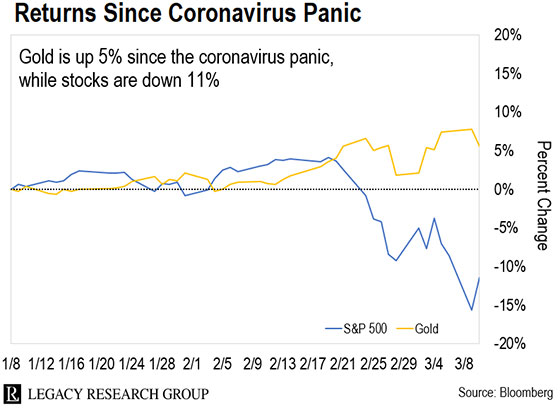

It’s up by about 5% since the coronavirus made front-page news in the U.S. in early January.

That compares with a fall of about 11% for the S&P 500 (a good stand-in for the U.S. stock market).

But as you can see from the chart above, gold dipped before rising higher. And that’s got some folks worried.

Let me be clear… I’m bullish on gold. I believe gold prices will double over the next few years. You can’t have negative interest rates and not have gold go up. People will be desperate to get out of fiat currencies.

But what I learned from 2008 is that, in a crisis, everyone flocks to the most liquid, least hated asset.

In this case, that’s U.S. Treasury bonds.

In the bond market, yields move in the opposite direction of prices. That’s why yields have dropped as much as they have on the benchmark 10-year Treasury note. Bond prices are surging.

Yields are below 1% for the first time in history… meaning bond prices are at record highs.

That’s always Phase I. But as my colleague Chris Lowe has been showing you in these pages, in Phase II, we’ll see a massive policy response from the government and the Fed.

And that’s when we’ll see gold boom.

If we look at 2008, gold initially dropped by as much as 10%. And the price of long-term Treasury bonds – as measured by the iShares 20+ Year Treasury Bond ETF (TLT) – rallied 31%.

But by November 2008, investors realized that we were going to see unprecedented central-bank money-printing.

And gold started an epic run from a low of $682 in 2008 to a high of $1,921 in 2011. That’s a 182% gain.

Now, we’re already seeing central banks around the world cut rates and promise more stimulus measures.

Since stocks started to fall on coronavirus fears, the Fed has slashed rates. So have central banks in China, Hong Kong, Canada, Australia, Brazil, Argentina, Russia, the Philippines, Saudi Arabia, and Thailand.

It’s my belief you’ll make a lot of money in gold. So don’t sweat it.

Now, let’s turn to bitcoin…

One of the most prized attributes of bitcoin – and crypto in general – is it doesn’t give two hoots about what’s happening with coronavirus… the stock market… or oil.

Yesterday, bitcoin was down about 9% in 24 hours.

So you may be wondering, “Why in the world is crypto down?”

There are two factors at work…

One is what I call the post-Golden-Cross dip. As Chris wrote about here, the Golden Cross is a bullish chart pattern that recently flashed a buy signal for bitcoin.

But as he highlighted, every time bitcoin has seen this setup, it’s dipped first – by as much as 28%. Then, it’s gone on to rally an average of 3,123%.

The second factor hitting crypto right now has to do with a multimillion-dollar fraud by Chinese scammers.

They conned people out of millions of dollars’ worth of bitcoin. And they’ve been hammering the market to get away with their ill-gotten loot.

Every trading desk knows these scammers will dump their bitcoin at any price. So they’re “walking down” their bids to get as much bitcoin as they can… as cheap as they can.

That’s causing the bitcoin price to sag. But that’s just good business. You’d do the same thing if you knew a massive seller in the market had to sell at any price.

All in, the scammers attracted more than 180,000 bitcoin (worth about $1.4 billion at current prices) and 6.4 million ether ($1.3 billion). They still control an estimated 20,000 bitcoin ($157 million) and 790,000 ether ($158 million).

Until that overhang is worked off, crypto prices will stay weak.

Long story short, the crypto market remains in its own sphere, unaffected by global events. But here’s the thing… This weakness couldn’t have happened at a better time for us.

As I’ve been showing my readers, we’re at the doorstep of another boom in crypto like the one we saw in 2017.

From the start of 2017 to the peak for the crypto market in December of that year, bitcoin surged 1,870%. Smaller cryptos surged as high as 3,200%… 17,000%… even 123,000%…

During that boom, many of my subscribers became overnight millionaires.

I want to give you all the details why this is about to happen again… but I’m running out of time in this article.

So what I want you to do is come join me for a free educational event I’m hosting on Wednesday, March 18, at 8 p.m. ET.

During this event, I’ll have the time to lay out all the facts on two forces coming together that can turn a handful of $500 investments into as much as $5 million.

I know that sounds outrageous. That’s why I had to go to extreme lengths for you to take me seriously.

I chartered a jet and brought a film crew with me so I could prove to you what’s about to happen in crypto could change your life forever.

So come join me on March 18… I’ll show you how I think a portfolio of five coins I’m calling the “Final Five” could make you as much as $5 million.

It happened before… and I believe it will happen again.

Go here to reserve your seat. Then you can see for yourself how a few hundred dollars in the right names could give you a level of wealth you could never attain from your job or the stock market.

Let the Game Come to You!

Teeka Tiwari

Editor, The Palm Beach Letter