It began with a 31% plunge in the oil price ahead of the opening bell in Asia.

And as I type, the benchmark for U.S. prices – West Texas Intermediate (WTI) is down 24%.

That’s its worst single-day percentage drop for a barrel of crude oil since 1991.

Traders are betting the coronavirus will send the global economy into a recession. And the failure of the OPEC oil cartel to cut supply to prop up prices caused a wave of sellers to all rush for the exits at once.

Then came cascading losses for world stock markets.

The Asia Dow closed the day down 4.8%. And the EuroStoxx 600 (Europe’s version of the S&P 500) plunged 7.4%.

Stocks in Italy – where the virus has infected the highest number of Europeans – did even worse. The Milan stock exchange plummeted by over 11%.

The wave of panic selling hit U.S. markets, too. The S&P 500 ended the day down 7.6%. That’s its biggest single-day percentage loss since 2008.

Jim Cramer captured the mood perfectly when he tweeted that the U.S. was facing an “imminent recession.”

There was even talk on CNBC of reinstituting the uptick rule. This would put restrictions on short-sellers making bets that stocks will fall.

At one point, the New York Stock Exchange’s “circuit breakers” halted trading for 15 minutes to try to stem the bleeding.

It’s days like today that test your mettle as an investor. I know. My parents back in Ireland have a retirement account and some exposure to stocks. And I was on the phone with them for nearly an hour today reassuring them about their portfolio.

This is NOT a reason to panic and dump all your stocks.

It’s never pleasant when stocks get slammed like they did today. But they call the stock market a roller coaster for a reason. It can be a scary ride.

So it’s natural to feel fearful from time to time.

The key is putting yourself in a position to survive these kinds of swings – no matter what the trigger.

That’s why I’ve been stressing the importance of playing defense as well as offense in your portfolio and loading up on bear-market protection in the form of cash and gold.

It’s my job to pass along the best ideas, insights, and recommendations for your wealth from Teeka Tiwari, Jeff Brown, E.B. Tucker, and the rest of the Legacy Research team.

And that includes ideas on how to protect your wealth when markets are in turmoil.

So today, I’m going to lay out the defensive steps you need to take to protect your wealth from the severe market turbulence we’re seeing right now.

I know I’m always banging on about them in this newsletter. But there’s a reason for that. If you follow these steps, you’ll no longer let stock drops keep you awake at night.

You’ll still want to keep an eye on the markets. But you won’t mind if you don’t check in on your investments more than once a month.

You’ll still feel anxious when stocks go down. That feeling never fully goes away. But you’ll know you’re not going to suffer a “ruinous loss.”

As Legacy Research cofounder Bill Bonner likes to remind his followers, that’s the kind of loss you don’t recover from. So it’s hugely important you have a plan in place to make sure that never happens.

Following a simple asset allocation plan.

Simply put, you want to put your eggs in different baskets… rather than just one.

This is critical to your long-term wealth.

Studies show that your asset allocation decisions – not the stocks you pick – account for more than 90% of a portfolio’s long-term returns.

It’s why I’ve spilled so much ink on why you need to put asset allocation front and center on your radar.

The mainstream version is to divide your portfolio 60/40 between stocks and bonds.

But as colleague and former hedge fund manager Teeka Tiwari showed in these pages last Wednesday, that model is now outdated.

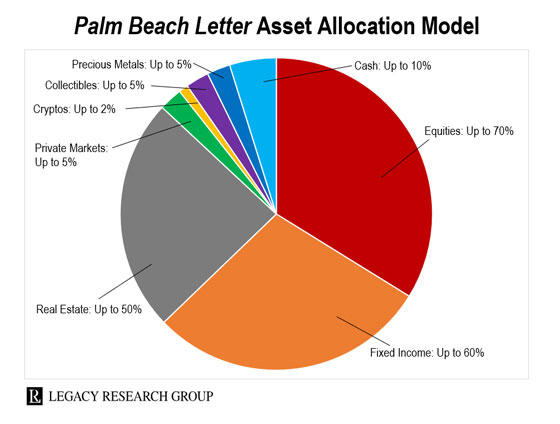

Teeka says it’s better to include a wider range of assets. Here’s the recommended model he and his team put together for our Palm Beach Letter folks…

Teeka includes eight different allocations: equities (stocks), fixed income (bonds), real estate, private markets, cryptos, precious metals, collectibles, and cash.

Teeka says it’s the reason for the success of The Palm Beach Letter model portfolio.

The Palm Beach Letter launched on April 13, 2011. And through June 30, 2019, the model portfolio averaged annual returns of 129.7% (which Teeka had verified through a third-party verification service).

Over the same time, the average annual return for the S&P 500 was 11.6%. So you would have done more than 10 times better with Teeka’s diversified approach.

That’s because everyone is different. Exactly how you split your wealth is up to you.

If you’re a younger investor, with a higher appetite for risk… you might want to max out your stock and private market allocations. If you’re more conservative, you might opt for more real estate, cash, and bonds…

What’s important is that you follow an asset allocation plan of some sort. If you don’t like the one above… no problem.

Our editorial director at Legacy, Kris Sayce, dropped me a note today about the simple diversification strategy he follows.

He splits his portfolio three ways, among stocks, cash, and gold. And he says it’s a huge weight off his mind…

I know from looking at my portfolio my stocks are getting whacked. And they could continue to get whacked. But I’ve got only a third of my portfolio in stocks. The other two thirds is split evenly between cash and gold.

My stocks are down 15% or so from the peak. But it’s not a big deal. My gold has gone up. My cash hasn’t budged. So I’m not so worried. A 15% drawdown in my stocks translates into just a 5% drawdown in my portfolio. And I can live with that.

Regular readers will know that the best way to think of physical gold – bars and coins – is as “disaster insurance.”

It’s what investors turn toward when there is panic in the air.

Gold doesn’t produce any income like a bond. It doesn’t produce any earnings like a stock. But it doesn’t carry what Wall Street types call “counterparty risk.”

In other words, unlike a stock or a bond, its value doesn’t depend on someone else’s promise to pay.

And so it’s been recognized as bedrock wealth for millennia. So people turn to it as a safe haven in times of distress.

Just look at gold’s returns after the last really serious stock market meltdown in 2008.

Gold sold off a bit at first. Then, it rallied 182% to a peak of $1,921 an ounce in September 2011.

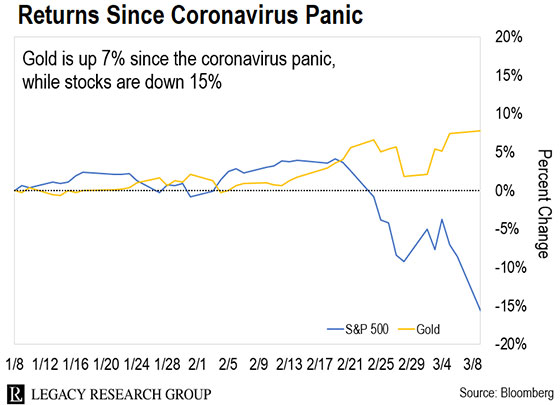

Now, take a look at this next chart…

Since the coronavirus panic first hit the front pages in the U.S. on January 8, gold is up 7.7%.

That compares with a 15.6% loss for the S&P 500.

That means you could’ve done nearly 22% better in gold than in stocks.

But as you can see, it wasn’t a straight shot higher for gold. It dipped first. Then, it recovered and went higher.

And I expect gold will keep moving in the opposite direction of stocks. (For more on why, check out colleague Tom Dyson’s research here.)

Ballast keeps a ship steady in a storm.

Likewise, when stocks are tanking, cash will keep your portfolio steady.

Cash also gives you the ability to buy beaten-down stocks at bargain-basement prices.

In other words, cash gives you the ability to buy low and sell high. And that’s how you make real money as an investor.

You want to play defense as well as offense… not instead of offense.

That’s where asymmetric bets come in.

As I’ve been showing you, asymmetric bets are bets where the upside potential greatly outweighs the downside risk.

That means you need to put only a small amount down to see payoffs that can really move the dial on your wealth.

Teeka recommends Palm Beach Letter readers put up to 2% of their wealth in cryptos… and up to another 10% in private markets (tiny stocks that have yet to go public).

As he’s been showing his readers, these kinds of high-upside, low-downside bets allow you to make huge gains with just small grubstakes.

For instance, during the 2017 crypto boom, cryptos Teeka recommended at our Palm Beach Confidential advisory went up as much as 44,902%… 48,870%… 143,058%… and 147,735%.

And he believes gains like these are on offer again in five tiny cryptos he believes could turn each $500 invested into $5 million.

No one knows if stocks are going lower or higher from here.

What’s important is being prepared before any more damage gets done… not when it’s too late.

It’s why we put together the Ultimate Crisis Playbook for you. It’s a compilation of the best wealth-protection insights from Bill, Teeka, Doug Casey, E.B. Tucker, Dan Denning, Jason Bodner, Dave Forest, Nick Giambruno, and the rest of the team.

It’s 109 pages filled with tips from our investors, speculators, and traders across Legacy Research.

You’ll learn about the five asset classes you should consider to make your portfolio crash-resistant… how to make money as stocks fall… even a proven commodities system you can use to avoid having your wealth wiped out in the next crisis.

And as a Daily Cut reader, you can access it for free here.

Regards,

|

Chris Lowe

March 9, 2020

Barcelona, Spain