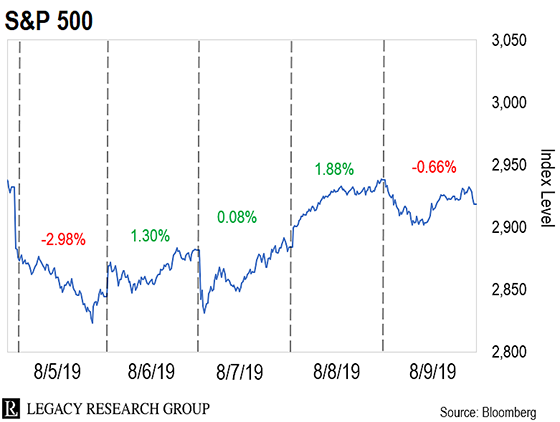

Wall Street types call it “volatility.” But for folks with money in stocks, it can seem more like a roller coaster.

Last Monday, the S&P 500 suffered its worst one-day rout so far this year.

And the index (our regular stand-in for the U.S. stock market) ended in the red on Friday.

But sandwiched in between was the biggest three-day rally in two months.

Take a look…

But not subscribers of our master trader Jeff Clark.

In an alert he sent out Monday night, Jeff urged paid-up subscribers of his Delta Direct trading blog to stay calm.

Here’s what he wrote…

Folks… I know it’s hard to hold onto positions here when it looks like the financial world is melting down. But selling stocks here is the wrong thing to do. Conditions are too oversold. We’re due for at least a reflex rally to relieve those oversold conditions.

You’ll likely do better waiting to sell into that bounce rather than selling into the current decline.

Jeff was able to make that call thanks to a key insight about how stocks move at the extremes. It’s what he calls the “rubber band effect.”

Understanding this won’t just protect your wealth from turmoil in the stock market. It will also allow you to profit in a bear market… as those around you get slaughtered.

In fact, as you’ll see in today’s dispatch, the more volatile stocks become, the bigger the payoff.

Traders tend to talk in complex jargon. But Jeff prefers to keep things simple.

As a trader, he’s interested in short-term market moves. And a simple way to grasp how stocks move over the short term, he says, is by thinking of a rubber band. Jeff…

My trading strategy revolves around finding emotionally overbought and oversold conditions that are ready to reverse, or snap back. Think of those overbought or oversold conditions as a stretched rubber band.

We can all tell when a rubber band has been stretched close to the limit. The rubber at the center of the band stretches thin. Its color fades. It even starts to vibrate just a bit. That’s usually when it snaps back.

And the same goes for the stock market. It’s a little harder to tell when the snapback is coming. But there are clues…

Stock prices stray far away from their averages. The technical indicators I watch on the charts reach extreme conditions. And TV’s talking heads all pile onto the same side. That’s when the logical-thinking trader decides it’s time to bet on the rubber band snapping back.

And the more volatile stocks become… the bigger the opportunities to profit.

Here at the Cut, we’re spending the time now to make sure you’re prepared for the next bear market. (Catch up here, here, and here.)

Foresight is never 20/20. But our base case scenario is that the 10-year bull market on Wall Street will be over within 12 months… along with the economic expansion on Main Street.

That means more of the bone-crunching volatility we saw last week.

And as Jeff reminds his readers, “Higher volatility leads to more extreme conditions. More extreme conditions means more opportunities to profit.”

It’s what allowed Jeff to have one of the best years of his career in 2008…

As most investors were losing their shirts, Jeff booked an annual gain of more than 1,000%. And his subscribers had the chance to book more than 100% gains 10 different times.

As you’ll recall, the 2007-09 bear market was the second-worst market crisis in history (after the 1929 crash).

But it wasn’t the only dark time for stocks when knowing about the rubber band paid off.

Christmas cheer (and end-of-year bonus checks) usually make the holiday season a happy time on Wall Street.

Stocks tend to rise in what the press dubs the “Santa Claus Rally.”

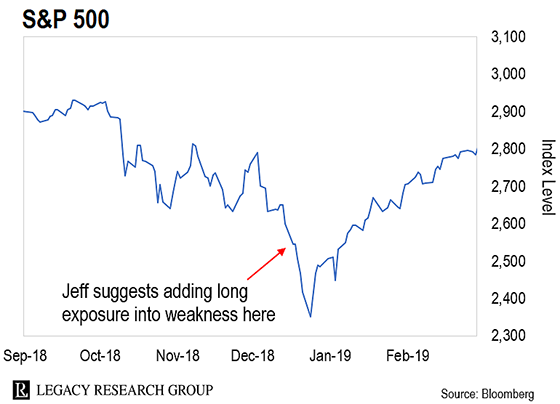

But last year, Wall Street was on track for its most dismal December since 1931, during the Great Depression.

The S&P 500 was already down nearly 18% from its peak on September 20. Then we got the Christmas Eve Massacre.

All told, the S&P 500 collapsed from 2931 to 2351… nearly 20%. It was its worst decline since the financial crisis.

It’s not easy going against the crowd. In fact, it’s one of the hardest things an investor can do.

But Jeff has been at this for more than 30 years. He doesn’t care what the opinion writers at The Wall Street Journal… or the anchors on CNBC… say.

He knew the rubber band was stretching. And he knew that meant it was about to snap back and send stocks shooting higher.

So right before Christmas, as the S&P 500 was cascading lower, he wrote to his subscribers. And he pointed to three levels he was willing to buy at – 2600, 2525, and 2450.

As you can see, one week after Christmas, the S&P 500 had shot back to 2500. Two weeks after Christmas, it was at 2600. And by the end of January, the S&P 500 had hit 2700.

As he’s been telling his readers, there’s a good chance the July 26, 2019 peak of 3025 for the S&P 500 marks the high of the 10-year bull run for stocks.

And he expects the S&P 500 will be lower, not higher, by the end of the year.

But that’s not a reason to panic. For long-term investors, Jeff says it can simply mean raising your cash levels…

The most important thing you can understand about bear markets is they put quality assets on sale. So I’d encourage folks to look at the coming bear market with optimism… and to hold plenty of cash.

With the right strategy, a bear market is just a Black Friday sale for stocks. If you’re a long-term investor with plenty of cash on board, you get to buy quality stocks at dirt-cheap prices.

It also means considering setting aside a portion of your portfolio to trade the snapback rallies that are the hallmark of bear markets.

But as Jeff loves to remind his readers, he’s a very, very conservative guy.

Jeff goes after big wins. But he trades with only 10% of his liquid wealth. The rest he keeps in extremely conservative assets such as cash and gold.

That makes a lot of sense. With only 10% of your wealth on the line you won’t suffer a ruinous loss.

And if you have long-term positions in stocks in your portfolio, having 10% set aside to profit from the extra volatility a bear market brings can help you offset other losses.

Regards,

|

Chris Lowe

August 12, 2019

Dublin, Ireland