Chris’ note: Daily Cut AM is a new e-letter from Legacy Research. It’s where you’ll find our best ideas – paid or free – about the coronavirus and its impact on your health and wealth.

We’ve been getting a lot of questions lately from your fellow readers about gold and its role in a crisis. So today, I’m sharing with you an important insight from globetrotting geologist and natural resource investing expert Dave Forest.

Dave heads up our International Speculator advisory. He’s studied which metals and commodities offer the best protection during a crisis. And as you’ll see, gold is still the best place to be in a financial crisis.

Make sure to stick around to the end of this morning’s dispatch for more mailbag comments from your fellow readers…

You’ll want to print out today’s essay and keep it close by.

Last year, my team and I conducted a deep-dive analysis in our International Speculator commodities investing newsletter.

We looked at the top natural resources to own leading up to, during, and after a financial crisis.

This information is critical right now. As Chris has been covering in these pages, we find ourselves in the middle of an economic crisis with a looming recession due to the coronavirus pandemic.

This may sound gloomy. But it needs to be part of your strategy for getting through this bear market.

And I’m excited about the opportunities to profit in commodities as a result of a breakdown in the financial system.

I hope you carry that mindset with you as we go through this crisis. It’s the potential for outsized gains that makes a crash like this one a little less frightening.

So how exactly should you protect yourself and profit in a crash?

I’m a commodities guy. And investors have typically sought protection in metals. So let’s look at how different metals have performed in past crises.

My team and I have crunched the numbers on the Japan meltdown (1990-1992), the Asian financial crisis (1997-1998), the dot-com bust (2000-2002), and the Great Financial Crisis (2007-2009).

We looked at all metals where comprehensive historical data is available. These are gold, silver, platinum, palladium, copper, zinc, vanadium, tin, nickel, and aluminum.

Then, we plotted their average performances during the three “acts” of each crisis:

-

One year prior to the crisis

-

The period during the crisis

-

One year after the crisis (the recovery)

This showed us three things…

First, which metals did well in the time just before a crisis.

Second, which metals were the best stores of value during investor panic.

Third, which metals are best to buy at the depths of a crisis in order to profit from the recovery that’s historically taken place the year following a crash.

Below is the average performance for our 10 metals during the last four big crises.

Let’s start with the first five – gold, silver, platinum, palladium, and copper.

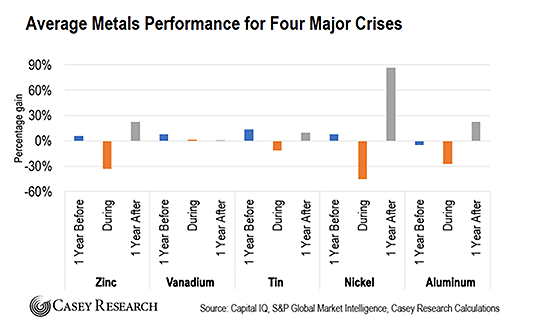

And here are the next five – zinc, vanadium, tin, nickel, and aluminum.

These are unprecedented times. And we’re still in the early stages of this crisis. So it’s too early to predict how each of these metals will hold up today.

But by analyzing their performances during past crises, we can get a firm grasp of which commodities to keep our eye on.

Let’s go through some of the specific takeaways.

Base metals can get hit hard during tough economic times.

The data backs this up. During the last four crashes, the worst-performing metals have been aluminum, copper, zinc, and nickel.

On average, these major base metals fell 25% to 45% during market panics.

This makes sense. These metals are tied to industrial activity. When the economy hits major speed bumps, investors dump these first.

The major base metals are also increasingly traded by speculative investors worldwide. And when markets get wiped out, traders tend to liquidate their most speculative positions in an attempt to cut their exposure to crashing markets.

The major base metals have delivered slight gains before a crash. But they shine afterward.

For example, in the 12 months following major crashes, nickel gained an average of 87%. Copper and zinc showed average one-year gains of 29% and 22%, respectively.

Investment Takeaway: When markets are exposed to a significant correction or crash – like today – be selective with exposure to the major base metals. The best strategy is to buy base metals firms that also hold significant precious metals.

If the markets do correct, adding base metals stocks at the bottom to benefit from the immediate rebound is a time-tested, winning strategy.

One of the most interesting findings from our research: Minor base metals held up surprisingly well.

Both tin and vanadium delivered solid gains in the year prior to crises.

But unlike the major base metals – which fell 25% to 45% – tin dropped an average of 12% during crashes. This was a better performance than precious metals silver, platinum, and palladium.

Vanadium posted a 1% average gain during crashes.

Investment Takeaway: The minor base metals are good bets for the current unsteady market environment. Even as the broad market continues to suffer, these minor base metals retain value.

A major reason they’ve historically held up well in crashes is that there’s been little speculative trading in the minor metals.

But a point of caution: That’s changed in recent years. Financiers have created investment vehicles such as exchange-traded funds (ETFs) to facilitate wider investment in minor metals – especially those related to electric vehicle batteries.

That increasing speculative investment could make minor metals more volatile during crashes than we’ve seen previously.

Our research proves that gold is the way to go during uncertain times.

During the last four major financial crises, gold was the only metal (aside from minor metal vanadium) that increased in value during a crash, gaining an average of 3%.

Gold also delivered gains before and after the crashes. It rose, on average, 4% in the year prior to a crash. And it rose, on average, 10% in the year after.

Interestingly, silver fared much worse during crashes. Silver took a significant hit during the crises, falling an average of 13%… and barely showed any gains in the years leading up to major crashes.

Platinum and palladium performed well in the year after a crash. They rose 20% and more than 40%, respectively.

Investment Takeaway: Gold is the safest place to be in uncertain times – having a history of holding value well and delivering solid gains.

History shows us silver isn’t as reliable. Perhaps because of its industrial uses, silver tends to take a much larger hit during crashes. It does rebound well after the storm clears, so it’s best to wait until a bottom before taking a position.

And although platinum and palladium suffer during a crisis, they have delivered solid gains on either side of one.

Chris here – Each day, we’re putting together a kind of “community center” for you and your fellow readers.

This is where you can share your updates and personal stories about how you’re getting through this crisis. It’s also where you can put your most pressing questions to our analysts.

I’ll get to as many of your emails as I can.

Then I’ll publish answers from Bill Bonner, Doug Casey, Teeka Tiwari, Jeff Brown, E.B. Tucker, Jason Bodner, Dan Denning, Nick Giambruno, Tom Dyson, and Dave Forest in these pages.

Right now, the team is spread all over the world. Bill is in Argentina. So is Nick Giambruno. I’m in Ireland. Teeka is in Puerto Rico. Jeff is in the U.S. And Dan is in Australia.

But we’re all well. And we’re working hard on your behalf remotely. So we’re happy to field your most pressing questions about the markets.

And if you have a personal story to share about how you’re coping with a lockdown… or how you and your family are staying safe… send it on.

We’re also interested in updates on quarantines in your area… stories from frontline medical staff… and the response by the feds.

Let’s make this an alternative to the fearmongering and hysteria in the mainstream news… and the usual BS coming out of Washington.

So send your questions and stories my way. You can reach me and The Daily Cut AM team at [email protected].

Today, I want to focus on the brave men and women in the medical profession who are on the front lines of the fight against COVID-19…

My name is Sammy. I am a registered nurse working in Houston, Texas.

I want to thank you so very much for your daily emails and for the education you’ve given me in what’s going on behind the scenes in the monetary world these past few weeks.

As a nurse working in patient care every day, it has become quite stressful. I have two young boys, and I have become overly cautious in dealing with my patients every day. I feel like my calling is to help those in need, and every day, I go to work with the mindset that it is my ministry.

But my hands are dry and cracked from the constant washing. Our hospital has been great at limiting access to visitors this past week. As I talk to my coworkers, we feel that all we can do is try to be as careful as we can going from room to room… and from patient to patient. The last thing we want to do is infect ourselves or others.

I think the best thing I could ask of you is your prayers. Not only for me… but also for our healthcare workers across the country.

– Sammy C.

Thanks for writing in, Sammy. And thanks for your service. Please keep sending your updates. And stay safe.

Other readers are worried about family members on the front line. Take this short note from grandmother Marilyn G…

My granddaughter is a brand-new nurse. She did her orientation in late January and her first day was February 1. Please pray for her. She is only 22 years old. She loves being a nurse. She loves God, her husband, and her family.

– Marilyn G.

There are also worries about the state of preparedness of U.S. hospitals…

I learned from the news that NYC hospitals will run out of medical supplies in 10 days. How should we react to this desperate situation? Just watch and let our frontline medical staff face all the risks and be helpless?

As a community, should we not do something? Let’s be responsible and generous and do whatever we can to help!

– KC C.

But the sacrifices of doctors and nurses aren’t going unnoticed, as this next reader email makes clear…

My thanks to the hardworking medical community and tireless researchers who are striving to unlock the secrets of this virus.

As an airline pilot, I am watching developments unfold as my airline cancels flight after flight. I was lucky. My vacation started just as the virus became known.

Years ago, I bought a “summer” home in the high desert of New Mexico. My wife and I have been here since March 2. Twice, we have gone to town (30 miles) for provisions. Each time seems surreal. Limiting goods and amount of people allowed into a store, etc.

We have no cable, so our house is not poisoned by the media. If there were any pearls of wisdom, I’d have to say that canceling cable would be on the top of my list. It’s criminal how they incite panic. We realize how important it is to minimize debt and live simply.

– John B.

This resource is for you and your fellow Legacy readers. These are trying times. They will test your mettle. But as I keep hammering on, we’ll get through this together.

So please send us your questions about the market… plus your stories of how you’re coping… along with updates from the front lines… at [email protected].

I’ll publish as many of your emails as I can.

Now, more on the coronavirus outbreak… and why the U.S. is about to become its epicenter…

You’ve been on our minds a lot lately, Dear Reader.

And our top priority right now here at Legacy Research is minimizing the impact of the coronavirus on your health and wealth.

That’s why, nine days ago, we created this new morning edition of The Daily Cut to help you navigate the coronavirus panic.

When we sent you your first Daily Cut AM issue (on Monday, March 16), there were 4,596 confirmed coronavirus cases in the U.S.

Data from Johns Hopkins University reveals that there are now over 55,000 confirmed cases.

That’s a twelvefold surge.

And so far, the virus has killed 802 people.

The U.S. now has more confirmed cases than any other country in the world outside of China and Italy.

And over the coming days, those numbers will go higher.

It’s the grim math of this virus that the U.S. is destined to overtake China and Italy as the country with the highest number of confirmed cases.

That may sound shocking. But that’s how this pandemic works. The rate of infection grows exponentially.

It doubles… then doubles again… then doubles again… until something stops it.

It’s all down to something called the “R-naught” number…

It measures how infectious viruses are. And it’s expressed mathematically as R0.

If a virus has an R0 of 1, it means every infected person infects one other person.

Anything over an R0 of 2 is a problem. It means an exponential spread.

For perspective, research shows that measles has an R0 of between 3.7 and 203.

The Spanish flu pandemic – which killed an estimated 50 million people between January 1918 and December 1920 – had an R0 of between 1.4 and 2.8.

According to the World Health Organization (WHO), the coronavirus has an R0 of between 2.0 and 2.5.

Results of a study of the poorly contained outbreak on the Diamond Princess cruise ship back the WHO’s estimate. It revealed that the coronavirus had an R0 of 2.2.

That’s why I’ve been warning you that this pandemic will get worse before it gets better.

And it’s why I’ve been trying to prepare you for the long haul.

The R0 also reveals why the coronavirus is more dangerous than the seasonal flu.

During the 2017-2018 winter, there were nearly 80,000 deaths from the seasonal flu in the U.S alone. And during the 2018-2019 winter, there were 57,000 seasonal-flu-related deaths.

Those are staggering numbers. But as people rightly point out, we don’t put the economy on ice to stem the spread of the seasonal flu.

And so far, the global death toll for COVID-19 (the disease the coronavirus produces) is just under 19,000.

But the key phrase is “so far.”

The R0 of the seasonal flu is as low as 0.9 and as high as 2.1.

That gives it an average R0 of 1.3… versus an average R0 for the coronavirus of 2.25.

In other words, the coronavirus is roughly twice as infectious as the seasonal flu.

So although the seasonal flu has resulted in more deaths than the coronavirus so far, the coronavirus is likely to surpass that number… and then some.

Of course, nobody wants to be in lockdown. I’m on day seven of self-isolation here in Ireland… and I’m already starting to go a little stir-crazy.

Lockdowns on the scale we’re seeing today will send the economy into recession. It will impact livelihoods. Folks will lose their jobs.

And that is another type of disaster that we all want to avoid.

But according to our tech expert, Jeff Brown, a vaccine is up to 18 months off.

That means the only way to stem the spread of the virus… and allow hospitals to treat the severely ill… is to stem the infection rate and try to pull down that R0 number.

There’s no pain-free option.

On the one hand, turning off the economy will lead to layoffs, economic pain, and even – as President Trump has rightly pointed out – its own grim effects.

We know that suicide rates went up, for example, in the wake of the 2008 financial crisis.

On the other hand, if we don’t stem the spread of the virus, it means overwhelming the health care system and watching older folks… and folks with underlying medical conditions… dying in even greater numbers.

And it’s not pretty. Video footage has emerged from Spain – one of the countries the virus has hit the worst – of patients suffering from COVID-19 piling up in corridors, gasping for breath.

There are no beds for them… no life-saving ventilators… or treatments.

There’s an idea that we can all carry on as normal while our hospitals buckle under the strain of the dead and the dying.

My personal take is that enough people will still be scared of getting the virus… or passing it on to a vulnerable loved one… to keep the economy effectively shuttered.

I’ll have more for you on this in future updates.

But I know this is a controversial subject. So don’t be shy. Write to me with your thoughts, suggestions, and objections at [email protected].

I’ll be back with you later with our regular Daily Cut dispatch. So look out for that in your inbox this evening.

Regards,

|

Chris Lowe

March 25, 2020

County Kilkenny, Ireland

P.S. As cities across the U.S. go into lockdown, here at Legacy, we want to go the extra mile for you. It can be boring being stuck indoors with nothing to do. So we’re unlocking a digital copy of Legacy cofounder Bill Bonner’s latest book for you.

It’s called Win-Win or Lose: A Modest Theory of Civilization. And it’s a Bonner classic. In fact, it’s one of the best insights into how society and the economy really work that I (Chris) have read. And it’s almost diametrically opposed to the mainstream view.

You see, Bill believes government bailouts… quantitative easing (QE)… zero interest-rate policy (ZIRP)… trade wars… and all other Washington boondoggles are win-lose deals. The remedy for the economy is something different entirely. You can access your free copy of Win-Win or Lose here, courtesy of Bill.

Like what you’re reading? Send your thoughts to [email protected].