It was about as welcome as a skunk at a lawn party…

Yesterday, Fed boss Jay Powell testified before the Senate Banking Committee.

And he used the occasion to knock over any doubts that the Fed was about to “pivot” on interest rate hikes.

Don’t worry if you didn’t tune in.

Listening to a central banker drone on in front of grandstanding politicians isn’t my idea of a good time, either. But it’s part of my job to be your eyes and ears for market moving news… and help you figure out how to play it.

Here’s a key line from Powell’s testimony…

The latest economic data has come in stronger than expected, which suggests that the ultimate level of interest rates is likely to be higher than previously anticipated. If the totality of the data were to indicate that faster tightening is warranted, we would be prepared to increase the pace of rate hikes.

That’s a bearish double whammy for stocks. Not only did Powell say he’s ready to jack up rates higher than expected… he’s also ready to raise them at a faster pace.

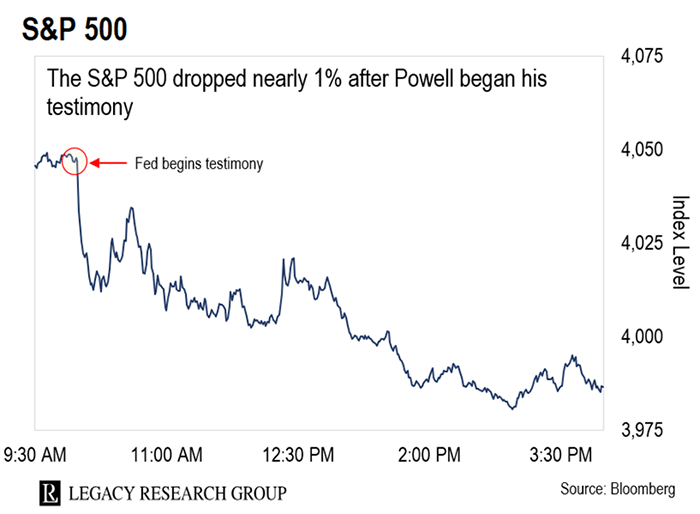

Investors immediately hit the “sell” button. It’s as clear as day in the chart below.

It’s part of the rollercoaster ride we’ve been on during this bear market.

But we’re not giving up on our mission to help you really move the needle on your wealth.

The traders we feature in these pages have been racking up some of their biggest wins. And readers who’ve followed their recommendations have had the chance to do the same.

Take the 11 triple-digit gains Larry Benedict scored in February…

As regular readers know, he’s one of the “wizards” featured in Jack Schwager’s 2012 book on the world’s best hedge fund managers, Hedge Fund Market Wizards.

That’s because Larry had one of the world’s longest winning streaks as a trader. He didn’t have a single losing year between 1990 and 2010.

Larry now runs three trading advisories – S&P Trader, One Ticker Trader, and The Opportunistic Trader.

And he’s been knocking it out of the park at all three.

Last month, he issued 13 trade alerts at S&P Trader. He closed out 11 of those for returns of 100% or higher… all in just one week.

It’s a strong start coming out of a rough year for buy-and-hold investors. The S&P 500 entered a bear market last January. But all three of Larry’s trading advisories ended the year in the green.

At One Ticker Trader, he issued 11 trade alerts last year. All of them were winners. This gave his subscribers the chance to close out the year up 240%.

And Larry scored a 60% win rate at The Opportunistic Trader last year.

That was enough to generate a 155% cumulative return on cash – all while the stock market slid deep into the red.

Imagine the difference this could have made to your wealth last year… You’d have suffered losses on your long-term stock holdings. But you’d have offset those losses with the gains in your trading account.

And Larry hasn’t just been accurate with his trades. He’s also been right about the big picture.

He’s been warning that the Fed “pivot” is a mirage…

Here’s what he told his One Ticker Trader subscribers last Thursday…

Just the slightest hint of a slowdown in inflation has the bulls frothing that the Fed will pivot and go easy on rates. That would push tech stocks up to fresh highs.

But as we’ve seen time and again, this false narrative has sucked investors into the market right before it has rolled over and headed down…

This may sound like bad news. But it’s actually good news for a trader like Larry.

The uncertainty over the Fed’s next move has triggered a surge in volatility. That gives traders lots of chances to piggyback off these moves. Larry again…

It’s tempting to stay on the sidelines in cash when the stock market is chopping back and forth. And if you’re okay with inflation eating into your savings at a rate of 6.4% a year, that’s fine. But I’d rather trade stock market volatility for profits.

I can’t tell you if the stock market will be higher or lower a year from now. All I know is that it does a whole lot of moving around. And as a trader, that’s the kind of market I crave.

I can profit in both directions – up and down. And I can be in and out of trades in as little as a day. When stocks are as choppy as they are now, this vastly increases my chances of making money. I have more opportunities to trade. I can also capture bigger moves.

This cuts both ways, of course. A lot of chop means higher risk. But I’ve developed a reputation for being ruthless about managing my risk. So, I’m not too worried about losing a lot of money.

At Legacy, we call this an asymmetric bet. If you follow Larry’s risk management advice, the upside far outweighs the downside.

And one of the biggest opportunities of the year is coming up less than two weeks from now.

On March 17, Larry says a “shockwave” will slam the market…

Most folks don’t know it… But Wall Street engineers an event that guarantees a shockwave of volatility on a specific day.

The next is due on March 17. It could be bad news for buy-and-hold investors. But Larry uses a special trading strategy to profit on these shockwave days.

Since he started recommending trades to his subscribers using this strategy in December 2019, he’s had a 91% win rate.

If you followed each of those trades, you’d be sitting on a total 255% gain through the end of last year.

Larry will be getting into the details tonight, at 8 p.m. ET, during his Shockwave Summit event. He’ll show you show what the shockwave is… why it’s great news for traders… and his top ticker to play it.

I won’t steal his thunder. But billions of dollars pass through this ticker on these shockwave days. This gives you the chance to profit in less than a week – usually just a day or two.

Tonight’s event is free to attend. And it will be a masterclass on trading this market from one of the world’s most prolific moneymakers.

So, if you haven’t already, RSVP with one click here.

Regards,

|

Chris Lowe

Editor, The Daily Cut