Chris’ note: Stocks are taking a bath again today. That’s down to another hawkish speech on rates from Fed chairman Jay Powell. It’s more bad news for buy-and-hold investors. But it’s great news for traders.

As I’ve been showing you, traders look forward to days like today. That’s because they can profit as stocks rise or fall. And they can be in and out of a trade in days.

It’s all in today’s insight from Market Wizard Larry Benedict. He made $95 million for clients of his hedge fund in 2008. And last year, as another bear market raged, he gave subscribers of his One Ticker Trader advisory the chance to close out the year up 240% on cash.

What’s his secret sauce? Read on to find out…

Most folks think you can only profit on stocks in bull markets.

But as I’ve been spreading the word on, that’s not true.

Although buy-and-hold investors need rising stock prices, traders can profit in either direction.

The big gains usually come when stocks drop… And we see more of those drops during bear market conditions like we’re living through today.

For instance, this year I’ve given my subscribers the chance at returns of 39% and 54% closing out trades on a falling Nasdaq.

I know this is new for a lot of people. So today, I’ll show you how I gave my subscribers the chance to close out a 62% gain in just a week as one of the world’s biggest stocks took a dive.

It’s a classic example of the “mean reversion” trades I love to make.

Playing the Snapback

Stocks tend to revert to their long-term average after they make dramatic moves.

So, I look for stocks that have overshot in either direction… and profit when they snap back toward their average.

That’s what happened to blue-chip tech stock Microsoft (MSFT) after it overshot to the upside last month.

Take a look…

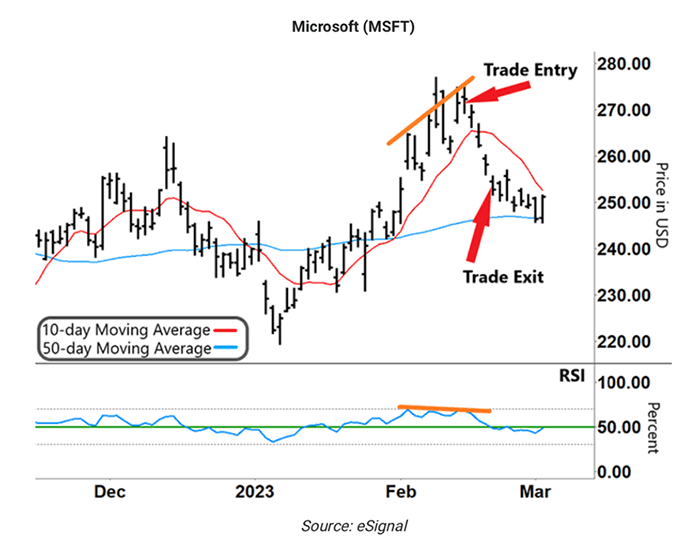

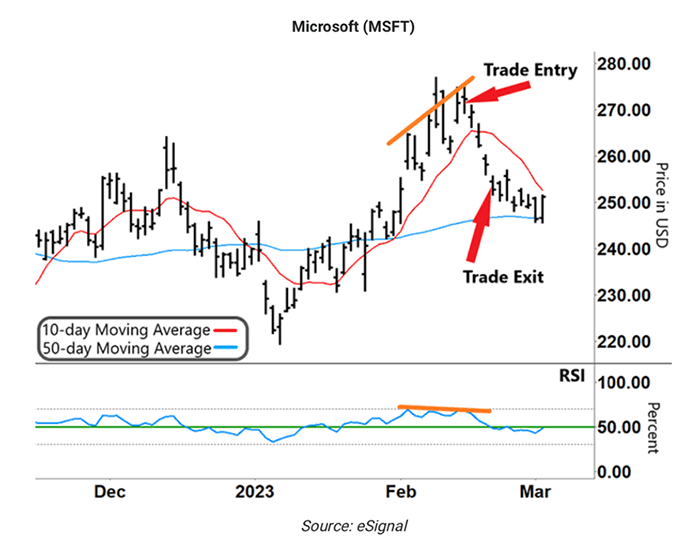

From early January to its peak in February, MSFT rallied 26%. But as it reached a new high (upper orange line on the chart), I could see its momentum had peaked (lower orange line).

That’s thanks to the Relative Strength Index (“RSI”). It compares the strength of a stock’s move on up days versus down days. This points to oversold and overbought conditions.

And when price and momentum diverge, a change of direction is not far away.

MSFT’s chart wasn’t the only reason it was due a fall…

False Narrative

As I’ve been showing my readers, there’s a false narrative that inflation is no longer a problem.

This has led to the hope that the Fed is about to stop hiking rates.

This would be good news for Microsoft and other tech stocks, which tend to perform best in low-rate environments.

But on February 14, the Consumer Price Index (“CPI”) reading for January came in hotter than expected.

This pulled the rug out from under MSFT… and the broader tech market.

That’s bad news if you’re a buy-and-hold investor. But it provided the perfect setup to profit from a fall in Microsoft’s share price – what’s known as a short position.

On Tuesday, February 14, I recommended subscribers of my Opportunistic Trader advisory open a short position on MSFT by buying put options. These are side bets on the movement of stocks that increase in value when the stock falls.

The stock market was closed the following Monday for Presidents’ Day. And when the market opened again on Tuesday, February 21, I sent out an alert to sell that MSFT put option, closing out the trade for a 62% gain.

I didn’t capture the entire move lower. But I’d rather book a profit for my readers and leave some money on the table than let those profits slip away… or turn to losses.

There were two reasons why I closed out that trade…

Extra Oomph From Options

When a blue-chip like Microsoft gaps down like this, bargain hunters start to buy, pushing the stock higher.

By closing out the trade, we avoided the risk of that scenario playing out.

The other reason goes back to the chart I showed you. Here it is again…

My exit point coincided with the RSI testing support (green line). If the RSI had shot higher, it would have sent MSFT higher, too. This would have taken away some of our profits.

It’s important to note that this 62% return was from trading an option contract. Options give you “leverage” – or extra oomph – over the move in the stock price.

If I had directly shorted shares instead, the return would have been lower.

That’s the benefit of using options. You can amplify the returns you make over a short span.

And it’s why I’m so excited about my Shockwave Summit that airs tomorrow.

Circle Your Calendar for March 17

It’s all about a wave of volatility scheduled to slam into the market on March 17.

That’s bad news for many investors.

But if you know how to play these shockwaves as a trader, this volatility is to your benefit.

Just like our MSFT example, we can find points where stocks become oversold or overbought… and profit when they snap back.

To learn more… including my favorite ticker to trade in these market conditions… you can go here to sign up to attend for free.

It kicks off at tomorrow night, March 8, at 8 p.m. ET. So, clear some time in your schedule to come and join me.

That will give you plenty of time to prepare.

You can RSVP with one click right here.

Regards,

Larry Benedict

Editor, The Opportunistic Trader

P.S. At tomorrow’s summit, I’ll show you what this shockwave is… and why it could devastate buy-and-hold investors. Most important, I’ll walk you through the strategy you can use to profit as a trader. Here’s that link again to automatically sign up.