“We have the setup for a recession unfolding…”

That’s Ken Griffin. He’s the founder and CEO of Miami-based hedge fund Citadel.

During last year’s bear market, it booked gross trading profits of $28 billion. That’s the largest haul for a hedge fund in a single year in history.

And as he told Bloomberg at an event in Palm Beach, Florida, on Tuesday, he worries that an overly aggressive Fed is setting up to crash the economy.

And there’s strong evidence from history to say he’s right.

So today, we’ll look at an indicator with a 100% track record of predicting recessions over the past 50 years… and the warning it’s flashing today.

I’ll also pass on an idea for how to play defense in your portfolio. It’s a way of collecting steady income checks from one of the most recession-proof landlords in the U.S. through the stock market.

The “yield curve” says a recession is inevitable…

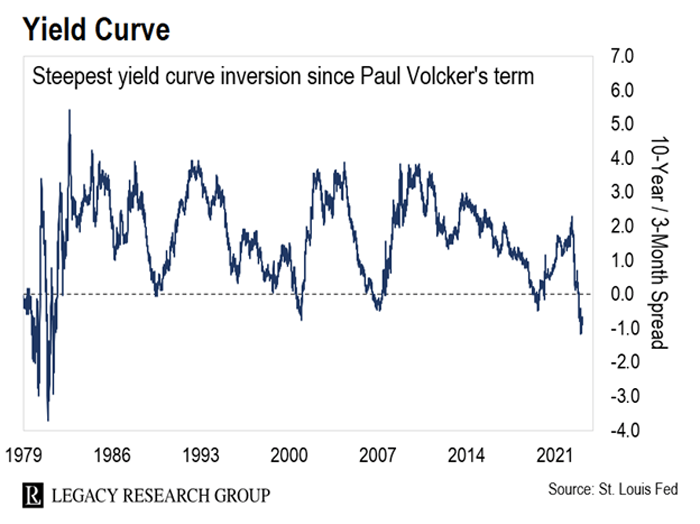

It looks at the difference between yields on short-term and long-term Treasury bonds.

Think of the yield curve simply as an economic barometer.

The curve tends to slope up when investors are optimistic about future economic growth. It slopes down – and eventually inverts or goes below zero – when they see slowing growth ahead.

And as you can see in the chart below, the yield curve hasn’t been so steeply inverted since Paul Volcker was running the Fed more than four decades ago.

He’s remembered as the guy who slayed the inflation of the 1970s by jacking up interest rates into double digits. But he also triggered the “double-dip” recessions of the early 1980s.

This has predicted past recessions with staggering accuracy…

It’s all in this next chart from Credit Suisse. It shows how each yield curve inversion (readings below 0) has preceded a recession (gray shaded areas).

There’s a lag between the extreme inversion readings (red circles) and the recessions that follow.

But like clockwork, after every inversion, the economy has hit the skids.

That’s why I’ve been spotlighting “SWAN” stocks lately…

That stands for “sleep well at night.” These are stocks with wide competitive moats, fortress balance sheets, and histories of churning out income. And they’re the focus of friend of the Cut Brad Thomas.

As regular readers will know, Brad built a $30 million real estate empire from scratch after he left college. Then he lost it all in the 2008 crash.

And he built back his millions using this tried-and-tested approach.

I know what you’re thinking… “Chris, you’ve just told me a recession is coming. Why would I be buying stocks?”

Because the best SWAN stocks are also recession-proof.

One SWAN stock Brad likes a lot is Sun Communities (SUI)…

It owns a wide range of income-producing properties – including marinas, RV parks, and manufactured homes.

And because it’s classed as a real estate investment trust (“REIT”), it pays at least 90% of that rental income to shareholders.

What makes Sun Communities recession-proof?

First, there’s a shortage of marinas in the U.S. Even if boat ownership dips in a recession, there’s still a shortage of berths. Over to Brad for more…

The boating industry is economically sensitive. People tend to buy yachts when times are good, not when we’re sliding into a recession. But marinas stay busy even during recessions.

It’s down to the imbalance between supply and demand. There are roughly 12 million registered boats in the U.S. And there’s only about 1 million wet slips for on-water storage.

Plus, there’s a trend of redeveloping waterfront properties for other purposes. This has lead to a shrinking supply of marinas. Sun Communities reports that 85% of its marinas have a waitlist of customers looking for a berth to become free.

Marinas are just a small part of the portfolio for Sun Communities. There’s also its manufacturing housing business. Back to Brad…

It’s hard to bring on new supply of manufactured housing communities. Although they’re built to high standards, people complain that they bring down property values in their area.

This has led to restrictive zoning and onerous regulations. So, there’s been hardly any new manufactured housing communities over the past decade. That allows owners of existing manufactured housing communities to regularly increase their rents in line with inflation.

And that’s what Sun Communities is doing. It’s had positive income growth for 20 years. That includes during the 2008 financial crisis and the COVID-19 pandemic.

And there are other recession-resistant REITs that Brad recommends you buy now.

They’re in the model portfolio at his Intelligent Income Investor advisory. It’s where he and his team focus on safe dividends to create a growing income stream that will passively support your lifestyle with stress-free investments.

To get access to Brad’s SWAN stock portfolio… as well as special reports on his favorite dividend-payers… follow this link.

Let us know at [email protected].

Regards,

|

Chris Lowe

Editor, The Daily Cut