“I didn’t ever try to commit fraud on anyone…”

That’s FTX founder and former CEO Sam Bankman-Fried (“SBF”) speaking to New York Times financial columnist Andrew Ross Sorkin.

And it was amazing to see the 30-year-old former crypto boss bat away questions on the billions of dollars of customer funds that left his cryptocurrency exchange FTX and wound up at his crypto trading firm, Alameda Research.

In other words, after years of hamming it up as a crypto savant… SBF is now claiming he was too dumb to know what was going inside his businesses.

Reading between the lines, SBF’s message now seems to be, “I didn’t mean to steal customer money. It was just a silly accident to do with poorly labeled accounts. Who knew risk management could be so hard?”

Welcome to your Friday mailbag edition of The Daily Cut.

This week, we’re turning our attention back to the turmoil in the crypto market… and the fallout from FTX’s collapse.

In case you missed it, last month, FTX – once the world’s third-largest cryptocurrency exchange – crashed in a spectacular way.

That’s why today, you’ll hear from renowned crypto expert Teeka Tiwari on why there’s no reason for long-term crypto investors to go into panic mode.

You’ll also hear from former Wall Street insider and investigative journalist Nomi Prins on how owning bitcoin differs from keeping deposits at a bank.

But first, we turn to our tech and digital assets expert Jeff Brown.

Jeff believes crypto and blockchain technology will transform everything. From how we save and spend money… to how we trade and invest… to how we interact online.

A lot of folks in the mainstream press now say that dream is dead. And all crypto is going to zero because of the FTX blowup.

But as Jeff reminds his readers, FTX was not part of the blockchain industry. It was a different beast entirely…

Reader question: FTX has fallen. What do you think about the blockchain industry now? Should we trust other cryptocurrency exchanges such as Binance?

– Fredrik H.

Jeff’s response: Hi, Fredrik. I’m glad you asked. I’m sure many subscribers are wondering how the FTX collapse will impact the blockchain industry.

My team and I have been closely tracking the developments and updating subscribers at our digital assets advisories, Unchained Profits and Neural Net Profits.

Through a mix of incompetence and fraud, SBF and other FTX insiders lost billions of dollars of customer funds. And it’s looking unlikely that these folks will be made whole again.

The new CEO of FTX – an insolvency expert called John Jay Ray – put it perfectly…

Never in my career have I seen such a complete failure of corporate controls and such a complete absence of trustworthy financial information as has occurred here. From compromised systems integrity and faulty regulatory oversight abroad, to the concentration of control in the hands of a very small group of inexperienced, unsophisticated, and potentially compromised individuals, this situation is unprecedented.

And we should know that Ray was the man behind the restructuring of Enron after it was revealed executives there had been fudging the books.

So, he’s saying that the FTX debacle is worse than Enron.

Does this change my view of the blockchain industry?

No, it doesn’t.

It’s important we distinguish the actions of FTX and its executives from the wider industry and the asset class.

FTX reminds me of the bankruptcy of MF Global in 2011. It was a derivatives brokerage headed up by the former governor of New Jersey at the time, Jon Corzine.

The firm lost money on bets on sovereign debt. And it used customer funds to meet capital requirements. This led to a liquidity crunch. And MF Global imploded in the same way that FTX did.

SBF never cared about the blockchain industry… or what it stood for. In an interview with Forbes last year, he said he would happily switch to trading orange juice futures if it meant he could make more money. This is not a mission-driven person.

SBF was focused on building a highly centralized exchange. He was also an active lobbyist in Washington, D.C. And he was working with the government to implement regulation that would benefit FTX… and hurt the rest of the industry.

This is the opposite of what the blockchain industry stands for.

Many in the blockchain industry are committed to building a more open, free, decentralized, and transparent version of the internet. That ideal is still in its infancy. But it’s worth fighting for.

And the FTX debacle could have been avoided entirely if the company had used blockchain technology. A public blockchain, after all, is transparent and permissionless. That means anyone can audit it. This would have shed light on dodgy transactions because they would have been visible on a blockchain.

It was only by centralizing control and hiding its operations that SBF got away with this for as long as he did. Again, this is the opposite of what the industry stands for.

My biggest concern right now is the government response.

We now know SBF was holding private meetings with Gary Gensler – the head the Securities and Exchange Commission (“SEC”). He had access to a key regulator that others in the industry lacked.

Is there a larger game at play here? Is this the excuse Washington will use to impose stricter regulations on the crypto industry so it can control digital assets and implement its plans for a fully digital dollar – aka a central bank digital currency (CBDC)?

I hope not. Washington will likely implement its digital dollar next year. And after that, I expect it will issue more regulatory clarity for other digital assets.

With the right regulations, this will be a good thing for the industry. And there’s enough support for crypto on Wall Street and in Silicon Valley to make sure the regulators don’t put an end to the next generation of internet and financial services technologies.

As to your question about whether we should trust other centralized cryptocurrency exchanges such as Binance, I recently shared three ways to safeguard your digital assets…

Be your own bank – Instead of leaving your funds in a centralized finance exchange, self-custody your crypto assets. I suggest a hardware wallet such as Ledger or Trezor. These are devices that resemble a USB memory stick that allow you to store your crypto offline. This protects you from hacks or malware.

Hire a custodian – Custodians such as Coinbase Prime and Fireblocks specialize in safeguarding assets for institutional clients. This is a good option if you have a large exposure to crypto.

Be selective with your exchanges – Some popular exchanges such as KuCoin, Bitfinex, and OKX are based offshore like FTX was. Others such as Kraken, Gemini, and Coinbase are regulated in the U.S. The safest of them is probably Coinbase. It’s publicly traded. So, it’s required to regularly publish audited accounts.

I hope that answers your question. I’ll have more to say about FTX in the days and weeks ahead.

Jeff is not the only Legacy Research analyst who’s been answering questions about FTX and crypto from worried readers. So has Nomi Prins.

As you know, Nomi is a PhD economist and former global investment banker. She spent 15 years on Wall Street.

But in 2002, she walked away from her seven-figure career to expose the rot at the heart of corporate America.

Now, she uses her decades of experience to empower subscribers and help them gain an edge in the markets.

She heads up our Distortion Report advisory. And she writes a free daily e-letter, Insider Wall Street With Nomi Prins.

And Nomi is bullish on bitcoin, despite the FTX trainwreck. She agrees the sector needs stronger regulation. But she sees bitcoin as a way for you to directly control your money… without having to rely on big banks.

But not all her readers are on board with this view…

Reader comment: Bitcoin is just a better disguised Ponzi scheme. If I put $100,000 in Bank of America, and the bank gets robbed, it is the bank that lost the money, not me. My money is still there, all $100,000.

If I put $100,000 in Bitcoin, and someone steals it, I lose my $100,000. How can people be so stupid as to play a rigged game!

– David F.

Nomi’s response: Thanks for writing in, David. Bitcoin is designed so that you’re responsible for safekeeping your funds. That’s what cryptocurrency wallet apps are for. They allow you self-custody your bitcoin.

The only way someone can steal your funds is if they steal your private cryptographic key associate with the wallet. As long as it’s safe, nobody else can access your bitcoin. There are no banks involved.

And if you’re worried about hacks, you can store your crypto offline in what’s known as a “cold storage.” This stops bad actors from trying to break into an online wallet.

But as you rightly point out, many crypto investors have outsourced this responsibility. Instead of holding their bitcoin in a wallet, they’ve let centralized crypto exchanges such as FTX and Binance custody their coins on their behalf.

In that case, what’s really happening is you’re leaving your coins in a wallet that gives the exchange control. It has the private cryptographic key that can access these funds. So, you don’t need to worry about funds becoming unrecoverable just because you lost your key.

That’s what makes this option suitable for investors who aren’t tech-savvy. And by storing your bitcoin this way, you can even earn interest on bitcoin.

But this option comes with a set of risks.

For one, your funds are at risk from hacking. Crypto exchanges use wallets that are protected by military-grade security. But still, that risk is real.

Also, crypto’s history is littered with examples of centralized crypto platforms going under and taking customers’ funds with them. In June, for example, crypto lender Celsius halted user withdrawals and transfers, citing “extreme market conditions.”

This happened just days after it assured customers it was financially stable. Celsius filed for Chapter 11 bankruptcy protection one month later.

Or, as we saw more recently, with the collapse of crypto exchange FTX. Just last month, it was revealed its founder, Sam Bankman-Fried, used customer funds at FTX to prop up his crypto trading firm, Alameda Research.

So I recommend you avoid third-party custodial services for the bulk of your long-term holding. But if you decide to go that route, two easy options are PayPal or Cash App. You can start your bitcoin portfolio on these platforms for as little as $1.

Just keep in mind that bitcoin is a new technology. And it’s still in a highly speculative phase of its development. I believe it has a bright future. Sure, there needs to be some oversight to protect bitcoin users from losing their tokens to fraud and bad actors in the sector…

But I believe bitcoin – and the blockchain technology behind it – could completely transform the financial system in the future.

Of course, like with any other disruptive technology, there are no guarantees. That’s why I recommend taking only a small, speculative position in bitcoin.

Finally, we turn to world renowned crypto investing expert Teeka Tiwari.

He’s been recommending crypto to our Palm Beach Letter and Palm Beach Confidential readers since April 2016 (when bitcoin was trading at $428).

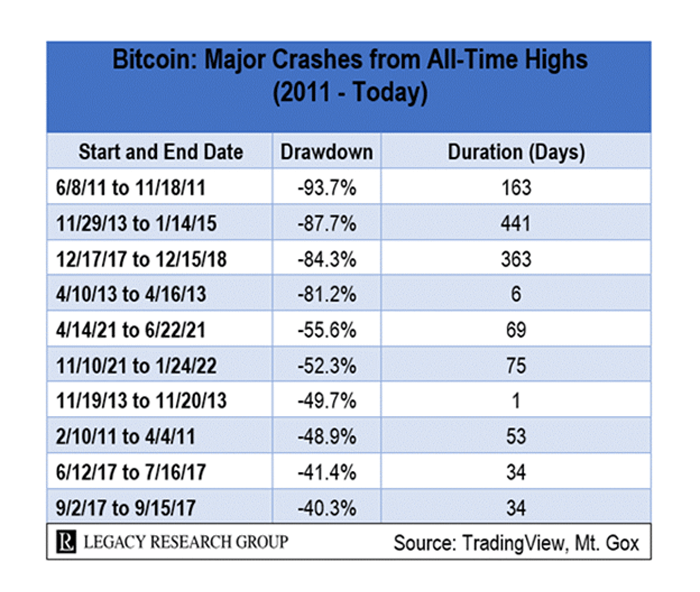

And over that time, he’s had to endure 11 crypto bear markets, including the one we’re in today.

But despite these bone-crunching plunges… readers who acted on recommendations are sitting on gains of 1,600%… 4,500%… 5,400%… 14,100%… and even 15,500%.

He sent a video update to his Palm Beach Confidential readers last week. And he showed them why the FTX collapse is long-term bullish for the industry because it will flush the toilet on bad actors. (Paid-up Teeka subscribers can read that here).

And at the end of it, he addressed the most important question for investors right now: What’s next for the crypto market?

Over to Teeka…

So where does the FTX debacle leave us? It leaves us dealing with an enormous amount of volatility. If we see further bankruptcies hit the industry, bitcoin could drop from it’s current $17,000 down to $10,000. That wouldn’t surprise me one bit.

I know that’s hard to hear. But I’m not going to tell you it’s rainbows and unicorns outside when it’s fire and brimstone, and the devil’s riding on horseback across the landscape. Because that’s where we are right now. It’s horrible. It sucks.

And it’s not over…

So what should you do about it if you own crypto?

Get your coins off the exchanges and self-custody them in a wallet instead – I’ve been saying that forever.

I’m continuing to dollar-cost average into bitcoin. In other words, I’m buying a fixed dollar amount on a regular basis… no matter where the price is at. This allows me to buy at the bargain prices the bear market has put on offer.

If we see bitcoin fall below $12,000, I’ll buy more. But that’s me. If you’re not comfortable doing that, you don’t have to. Just make sure you’re holding the coins you already own securely… and wait it out.

Bitcoin will survive this hellscape, just like it survived when the Mt. Gox exchange went under in 2014. At the time, it was housing something like 70% of all bitcoins in circulation. So, it was worse than what we’re going through right now.

That’s all for this week.

If you have a question or comment for Teeka, Jeff, or anyone on the Legacy Research team, you can let us know at [email protected].

Have a great weekend,

|

Chris Lowe

Editor, The Daily Cut