It’s the Holy Grail of investing…

A market-beating return is great. But if it comes with bone-crunching volatility, that rules it out for a lot of people.

Dramatic price swings may be okay for younger investors who have a while to recoup any losses before they retire.

But folks closing in on retirement – or who are already retired – need something steadier and more reliable.

That’s why you ideally want investments that can outpace the market and have below-average volatility.

And thankfully, these investments aren’t hard to find. There are hundreds you can buy today through your broker.

And history shows they can turn stakes of $10,000 into millions of dollars… if you have the patience to stay with them for the long run.

I’m talking about an elite kind of dividend paying stock…

Bonds aren’t the only source of income you can tap into as an investor.

Some companies pay shareholders regular cash distributions from their earnings in the form of dividends.

And some of these companies have steadily raised their dividends every year… often for decades.

There are 65 stocks on the S&P 500 known as “Dividend Aristocrats.” They’ve raised their dividend payments every year for 25 years.

That impressive… But it pales in comparison with the “Dividend Kings.”

These elite firms have raised their dividends every year for at least 50 years…

That brings us back to 1972.

Over that time, there have been seven recessions… eight bear markets… and three crashes (the dot-com bust, the 2008 crisis, and the pandemic-induced crash in 2020).

But none of these shocks stopped these firms from rewarding their shareholders with dividend increases.

They’ve been able to keep growing… and stay profitable… while also paying out a rising dividend.

It’s an exclusive club…

Right now, there are only 48 Dividend Kings.

And 13 of them have streaks of raising dividends going back 60 years or more.

Focusing on these and other dividend raisers can make a huge difference to your wealth over time.

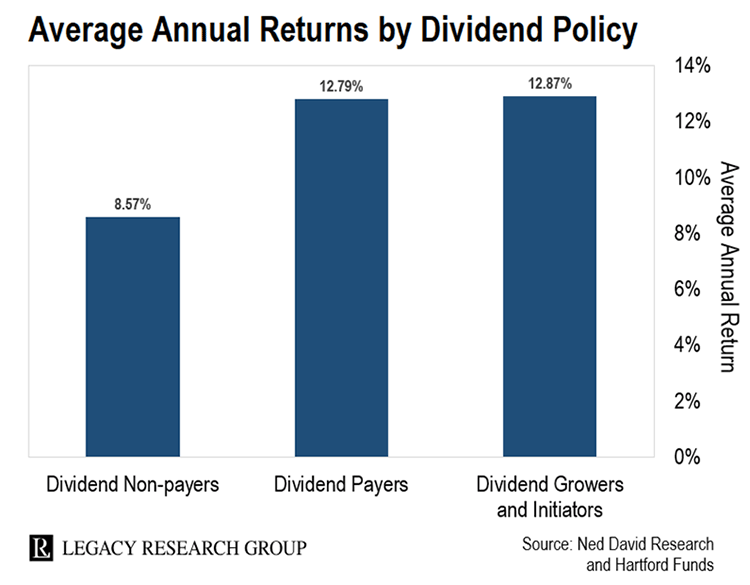

It’s all in this next chart…

It’s by way of Ned Davis Research and Hartford Funds.

They gathered roughly a half-century of S&P 500 history (from 3/31/72 to 12/31/19).

They then looked at the difference in performance between three groups – stocks that paid no dividends, stocks that paid a dividend, and stocks that raised existing dividends or paid a new dividend.

As you can see, the dividend growers and initiators had the highest return. And the difference between this group and the stocks that paid no dividend was about four percentage points.

Over time, that can mean millions of dollars more in profit…

Let’s look at what would have happened if you’d invested a $10,000 stake at the start of this study in each of these two groups.

A $10,000 investment over that time in the stocks that paid no dividend would be worth $500,000 today.

That’s not bad…

But the same amount in the dividend raisers and initiators would be worth $3.24 million today.

And as I mentioned up top, superior returns are not the only advantage these stocks bring.

Dividend growers are also less volatile than the average stock…

The next chart looks at the performance of the S&P 500 versus the Vanguard Dividend Appreciation ETF (VIG).

It tracks stocks that have raised their dividends for at least 10 straight years. And for extra safety, it excludes the top 25% highest yielders.

As you can see, VIG has cushioned the blow from the bear market this year…

VIG is down about 9% so far this year. But that compares with a roughly 16% year-to-date loss for the S&P 500.

And as you can see, VIG reliably put in a higher low than the S&P 500 all year.

That makes dividend growers great to own in bear markets…

There are two sources of returns for stock market investors – capital gains as the share price goes up and dividend income.

Together, they give you your total return.

And while a company’s share price may plunge in a bear market… its dividend payments tend to be more stable.

So, your total returns are more stable, too.

Dividend growers also tend to be larger companies with mature businesses and strong balance sheets. This adds further stability during rocky markets.

Brad Thomas calls these dividend raisers “SWAN” stocks…

That’s because they help you sleep well at night.

Regular readers will know Brad already. But if you’re just joining us, he started out as a real estate developer.

He made millions from collecting rent checks from commercial tenants.

But 14 years ago, those checks dried up. And that’s when he discovered the power of SWAN investing. Brad…

The reason I’m 100% focused on following the SWAN blueprint is because of the losses I suffered when I didn’t. I was a real estate developer with a booming empire. I made a fortune. But in 2008, trusting in the wrong people… and a global financial crisis… sent me back to square one.

Building back my finances was a long and painful journey. But I’m happy to say I’ve made back my millions – and then some. Even more important, I came back wiser. And I now make safety the bedrock of my strategy.

Uncertainty is the name of the game when it comes to managing money in the stock market. But you can feel safe about your investment portfolio if you focus on generating reliable streams of rising income.

That’s why Brad launched his Intelligent Income Investor advisory. It’s where he shares a model portfolio of his favorite SWAN stocks with his readers.

A great example of a SWAN stock is Altria (MO)…

It’s the 190-year-old tobacco company behind the Marlboro cigarette brands.

Back to Brad…

SWAN stocks are strong businesses that can support sustainable dividend growth. That’s why I like Altria so much. If you’re not interested in owning a tobacco stock for moral reasons, I understand. But from an income perspective, it doesn’t get much better than Altria.

The company has raised its dividend every year for 53 years running. It currently yields an inflation-beating 7.9%. And it plans to grow that dividend by about 5% a year.

There’s no guarantee it will meet this target. But Altria is a Dividend King for a reason. Throughout all the antismoking press it’s received, it continues to churn out earnings per share – a key measure of profitability.

In fact, Altria has produced negative year-over-year earnings growth in only 1 of the last 20 years. That’s the essence of SWAN investing. We’re backing reliable stocks with proven records of delivering steadily rising income streams to shareholders.

Brad recommended Altria to his subscribers on March 9, 2020.

That was just 14 days before the bottom of the pandemic-induced crash. (The S&P 500 ended a 34% peak-to-trough descent on March 23.)

Since then, it’s up 45% from the share price rise alone.

And that’s not even the highest gainer of the SWAN stocks Brad has recommended.

Stocks he’s recommended are up 52%… 75%… 81%… 117%… 190%… and 208%.

And the average yield on the 30 stocks in the model portfolio is roughly 3%.

So, if you’re not already following Brad’s recommendations, check out how to get access here.

Regards,

Chris Lowe

Editor, The Daily Cut