Are you feeling stressed out?

Are you checking on your portfolio several times a day?

Do you feel queasy every time you switch on the financial news?

In January, we saw the worst stock market plunge since the pandemic-induced crash in March 2020.

Last month, the tech-heavy Nasdaq dropped 14%.

The once high-flying biotech sector plunged 17% to start the year – putting it in official bear market territory.

And our favorite cryptocurrency, bitcoin, plummeted to less than half its November 2021 all-time high.

| Recommended Link | |||

|

|||

| — |

But as you’ll see, there’s no need to panic.

There are two simple moves you can make to sleep easy… while building lasting wealth as an investor.

It’s all in this week’s video update with me and Weekly Pulse host Tom Beal at the top of the page.

Regards,

Chris Lowe

Editor, The Daily Cut and Legacy Inner Circle

Regards,

Chris Lowe

Editor, The Daily Cut and Legacy Inner Circle

| Click here to access the Legacy Inner Circle archive |

| Not yet a Legacy Inner Circle member? Join here. |

Transcript

Tom Beal: Some wise advice from the Legacy Research Group experts on what to do during highly volatile times…

My name is Tom Beal, host of The Weekly Pulse, where we break down the biggest wealth-growth story of the week.

I’m here today with the editor of Legacy Inner Circle, Chris Lowe.

Chris, how do we kick off today’s conversation?

Chris Lowe: Tom, this week, I want to talk to folks about the volatility that has been in the headlines a lot lately.

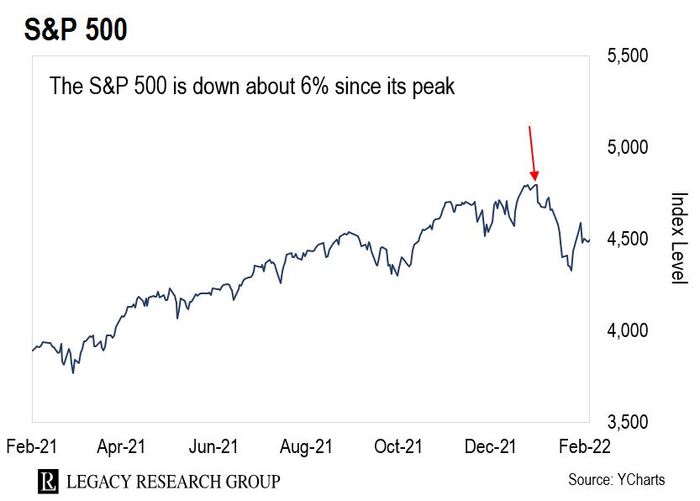

It’s affecting assets across the board. As we speak, the S&P 500 is down about 6% from its peak last December.

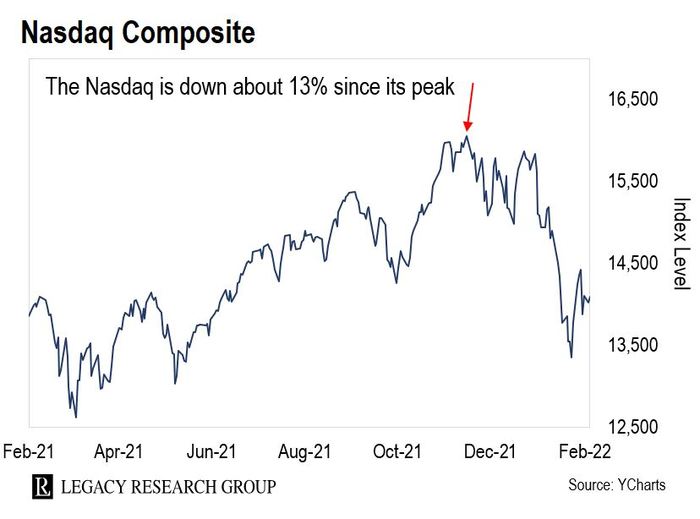

The tech-heavy Nasdaq is down about 13% from its peak last November.

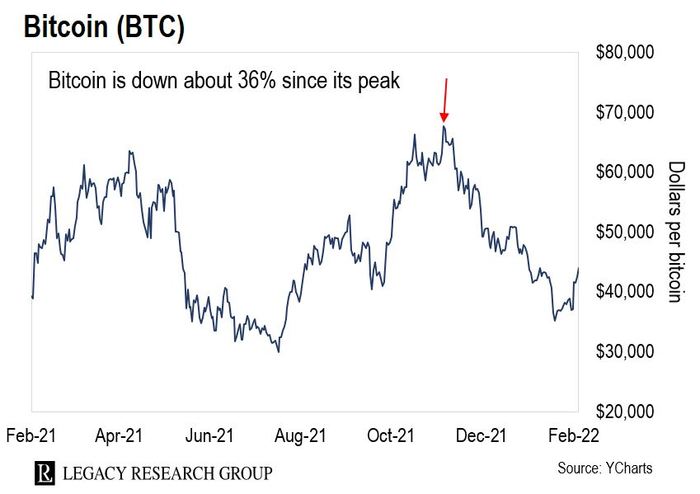

And bitcoin, our favorite cryptocurrency, is down about 36% from its peak last November.

This week, I want to pass on some insights into how to deal with that volatility… so that folks can get the maximum gains in their investments over the long run.

Tom: The thing that’s given me peace amongst all this is the Legacy Research guidance here in The Weekly Pulse, and more so in Legacy Inner Circle.

Our experts and their teams have decades of experience of weathering storms like this.

Being part of Legacy Inner Circle, I get my confidence and guidance from those experts.

You, Chris, are like the curator who brings the best of each of the experts to us every single week, in The Weekly Pulse and inside Legacy Inner Circle.

I was late to the game of financial literacy.

Now, I outsource my “emotional stability” to the experts. I trust their and their teams’ expertise.

Literally, it’s like having a team that’s worth hundreds of thousands of dollars – and they’re on my team, helping me remain calm among the storm.

So the volatility doesn’t affect me now as much as it used to, before being plugged into the experts’ guidance here at Legacy Research. I hope that’s how the other members feel as well.

Chris: I hope so, too, Tom. And you’re right. One of the things we do here at Legacy Research is we pass on ideas about how to really move the needle on your wealth.

That’s why we talk so much about cryptos… NFTs… tech stocks… and early-stage investing.

But that’s only one of the things we do.

Because you can be in all the best ideas in the market. You can time those things perfectly…

But if you get shaken out of your positions every time volatility kicks up, it’s not going to do you any good.

As we go through tougher times, we get on air and try to reassure people… to show them how to get through those tough times.

I mentioned two things that people can do.

These really are very simple… if you internalize them and put them in place in your portfolio.

If you don’t have these things in place, life is going to be tough for you as an investor.

Even if you’re in the right things to begin with… even if you bought bitcoin at the right time… you got into the right tech stocks at the right time… if you get shaken out, it’s not going to do you any good.

In heightened volatility, like we’re going through now, the first thing to learn is to sit and do nothing.

Jeff Brown, our tech expert, recorded a video in the middle of the pandemic-induced stock market selloff.

It was Paddy’s Day – I’m Irish, so I remember the date – March 17, 2020. That was the worst of the selling. The pandemic hit. The lockdowns were coming onstream. Everyone was panicking.

And Jeff Brown said to his readers, “Sit through this. Stay strong. Don’t panic-sell. Sit and do nothing. Just let this volatility wash over you.”

Since Jeff made that call, the NASDAQ – a good proxy for tech stocks – is up about 96%. I wrote about it in The Daily Cut on Monday.

The call was really simple: “Sit there and do nothing.”

Jeff is back beating that same drum again. Teeka Tiwari is beating that same drum again.

You have to learn to sit there and do nothing.

I don’t know about your experience of dealing with times like this, Tom. But have you been able to sit there and do nothing?

Tom: Oh, my goodness. Being late to the game of financial literacy, I’m so thankful I’m plugged into the Legacy Research Group.

I was a ship at sea, getting battered around wherever the waves were pushing me. I was an emotional rollercoaster. Some other viewers may say, “Yeah, I’ve been there.”

You mentioned that advice Jeff gave in the midst of the pandemic.

His experience, his calmness, his ability to weather the storms and persevere… it gives confidence to that little boat out there, feeling alone and getting caught up in the news, then washed ashore, an emotional wreck.

You can gain some stability through the experts’ guidance – because they’ve been through so much chaos and adversity.

When that expert tells you, “Just remain calm. This, too, shall pass,” it can give you emotional stability… so you don’t panic-sell.

If you recognize it’s an emotional journey, you can become more emotionally stable – in many cases, just by borrowing that stability from the experts.

Just trust and know that this, too, shall pass. Being plugged into the guidance from you and the experts here at Legacy Inner Circle has helped me immensely.

I’m hoping that’s exactly what other members are feeling, because it’s crazy out there. Everybody knows we’re living in times where change happens so fast.

I would encourage everyone who’s watching this to get out of the news –the negative energy without substance – and stay focused here, where you have the expertise guiding you to grow and protect your wealth.

It’s a great place to be. Just embrace it and remain confident that the Legacy experts are leading you to the right destination.

Chris: That’s right, Tom. You used a very good phrase there, “emotional stability.” That really is what’s needed.

It can be incredibly nerve-wracking to go through a 36% dive in bitcoin. And it was down more than that before – it was down about 50%. The NASDAQ was down about 15%. That’s not so bad. But it’s still pretty tough.

Apart from having the emotional stability, you also need to do a bit of planning. And the planning will help you have that stability.

That brings us to the second insight I want to put in front of our viewers today: Always be diversified.

The more diversified you are, the less one event can affect your wealth.

Right now, there are worries in the market about the Federal Reserve hiking interest rates. I’m not going to get too deep into the weeds. We’ve covered it in previous episodes. You can find those in the archives. [Click here and here].

This is something that the market goes through quite often…

As the Fed changes rates, it changes the financial landscape. People start to reprice assets like crypto and stocks, based on where interest rates are going to be.

But with a diversified portfolio, you’re not going to be so exposed to the storms when they come. That means you don’t just own stocks and crypto. You have cash in your portfolio… some real estate… maybe some collectibles… maybe a little bit of gold.

It’s like having ballast on board a ship. It keeps it stable.

If you are 100% invested in high-flying tech stocks, and the market drops 30%, your portfolio is going to go down 30%. You’ll experience the full brunt of that shift in your portfolio.

But if you only have 10% or 20% of your portfolio in those tech stocks – and you have those other assets mixed in – it’ll be much easier to absorb those blows.

That’s because it’s going to be a much smaller drop in the value of your overall portfolio. It’s something I recommend anyone watching this to keep in mind.

We get very excited about the opportunities in crypto and bleeding-edge technology stocks. But we never, ever recommend that people put all their wealth into those asset classes.

That’s because people are not psychologically prepared for the storms when they come. And if you’re 100% exposed to those assets and the storm comes – as it will – that’s going to be very difficult.

But if you’ve diversified your portfolio… if you have a smaller amount in each bucket in that portfolio… it’s going to be much easier to have the emotional stability that you mentioned earlier on.

So first, learn to sit and do nothing. Having that diversification in your portfolio will help you learn to do that.

That way, you’ll never be fully exposed to a risky asset class like crypto or bleeding-edge tech stocks. Those asset classes give you immense returns on the upside, but the volatility can be huge.

You need to have that ballast in your portfolio through diversification.

Tom: As Teeka Tiwari has said, in order to get those big returns, you have to weather the intense volatility and not freak out… and also, have the long-term vision to know where it’s going.

The research from our experts and their teams shows what the long-term vision is. If you can step back from being caught up in the moment of the storm… and see where this is actually heading on a grander scale… it does help you handle the volatility.

When you have that bigger picture, you don’t freak out. You aren’t even paying attention to the ups and the downs of the day.

That’s because you know where that long vision is leading, based on our experts’ guidance… on their thousands of hours of research… and on their experience of weathering so much in the markets.

As a member of Legacy Inner Circle, it’s incredible to have this many resources available for such a minimal investment. It’s the equivalent of having your own research team, worth hundreds of thousands of dollars.

There’s only so much we can do ourselves. But when you have that team of experts guiding you, you’ll have that stability and trust… knowing that they’re leading you to the right destination.

Chris: That’s right, Tom. I’ll share one tip for how I deal with volatility, particularly in crypto.

I have an eToro account. It’s a brokerage over in Europe. It asks you for your password whenever you log in. So I haven’t logged in for a while. I’m just not checking.

When you keep checking, you see it bleeding red… and you tend to make the wrong decision.

It’s something as simple as that – just stop checking your portfolio.

If you have made the right decisions… and you’ve followed the advice of our experts, as we’ve been talking about here on The Weekly Pulse… it’s not going to help to check your portfolio.

All it’s going to do is increase your level of anxiety. Personally, I haven’t checked my crypto portfolio in a couple of weeks.

I know it’s bad. But I also know I’m in it for the long run. I’m talking many years, not months or weeks. That’s why I’m just not going to check.

Tom: Super-wise advice. Whether it’s E-Trade… whether it’s Coinbase… whether it’s the various things that I can log in to and see… I am like you; I don’t pay any attention to that.

It doesn’t matter to me because I, too, have that longer vision.

That’s not where I was a few months ago, prior to getting the Legacy experts’ guidance. I was logging in many times a day.

During that volatility, I actually started thinking, “Man, with these big daily moves, I could probably do some day trading.”

And I realized that was a bad idea. I realized the hard way that was a really ridiculous assumption.

It sounds simple: “Buy low and sell high.” But none of us can time it. Day trading is for the very few, to say the least.

Chris: You’re absolutely right, Tom. The phrase that springs to mind is something the old-timers on Wall Street say: “It’s not timing the markets that counts. It’s time in the markets.”

That’s a pretty simple thing. But it really is the essence of successful investing.

If you’re going to time the markets, you have to figure out in advance what’s going to cause the markets to fall…

And you’re going to have to figure out when exactly they’re going to fall…

Then, you’re going to have to figure out when to buy in again… And that’s completely impossible.

We should let folks who are watching this know that Legacy Inner Circle – which you referred to – is our deep-dive service, where we go into the ideas in greater detail. It’s a monthly membership service.

And if folks are interested in the ideas we share with them here and in The Daily Cut, Legacy Inner Circle is where they can go deeper into those ideas.

We have interviews with Teeka, Jeff, and the rest of the Legacy Research team. We also interview folks from outside.

If people enjoy the ideas from the Legacy team in The Daily Cut, Legacy Inner Circle is a great next step.

That’s because they can go deeper inside those ideas. We spend a little longer talking through them, and we often have interviews like this on Zoom.

It’s a great way to take that next step and get more familiar with the ideas I write about in The Daily Cut.

[If you would like to become a member of Legacy Inner Circle, just click here.]

Tom: 100%. I think the main lesson of all this is, sit tight. This, too, shall pass. That ancient wisdom stands true today.

And follow the guidance of the experts that resonate with you.

Here at The Weekly Pulse and Legacy Inner Circle, we’ve got the elite experts who know how to guide you to grow and protect your wealth, regardless of market storms.

By following their guidance, you can tap into the unique opportunities for exponential growth.

You’re in the right place. Trust the experts. Borrow some of their confidence. Borrow some of their emotional stability. And borrow their research and recommendations, do your due diligence, and make the proper moves to grow and protect your wealth.

Chris, thank you once again for helping us all to have that emotional stability.

Chris: Thanks, Tom.

| Not yet a Legacy Inner Circle member? Join here. |