Jay Powell has twisted himself into a pretzel…

Since last March, the Fed boss has been on a mission to smash inflation by jacking up interest rates.

And to prove he means business he’s sent the Fed on the most aggressive rate hike cycle in history.

This has paid off. The annual inflation rate is down from its June peak of 9.1% to 6% today. But it’s also come with some serious collateral damage…

As we’ve seen over the past couple of weeks, it’s triggered a panic in the banking system.

Higher rates have torpedoed the value of the long-term bonds banks have been holding to back deposits. This brought on the collapses of three U.S. banks. And regional bank shares are getting clobbered.

We’re not in 2008 territory… yet. But investors’ minds are going there. And they’ve been pummeling regional bank stocks… and yanking their deposits out for the relative safety of the bigger banks.

This has the Fed between a rock and a hard place. It can either keep raising rates and further hurt the banks… Or it can take its foot off the gas and risk letting inflation run higher.

And today, it chose the rock of hurting the banks over the hard place of letting inflation spiral out of control.

The Fed raised rates by a quarter of a point…

And it didn’t pull any punches about what that means. This is from a Fed statement about the banking crisis…

Recent developments are likely to result in tighter credit conditions for households and businesses and will weigh on economic activity, hiring, and inflation.

What he didn’t say is that raising rates higher… and imposing losses on banks… risks crashing the banking system.

So, it’s critical you keep some of your cash outside of the banking system.

The Fed clearly thinks it can kill inflation without crushing the banks. But it was asleep at the switch ahead of the current banking panic. And it could be, once again, underestimating the damage further rate hikes could cause.

Your first escape route is gold…

On Monday, gold hit $2,014 an ounce.

That’s just 3% below the all-time high of $2,075 it reached in August 2020.

And the reason investors are loading up on the yellow metal goes back to the Fed’s dilemma.

We’re looking at an inflationary spiral or a roiling banking crisis. And either outcome is good for gold.

Gold is a “hard asset.” It’s hard to produce more of it relative to its existing supply. That makes it resistant to inflation.

It’s also a “chaos hedge.” It tends to go up along with panic levels in the market.

A lot of folks expected more from gold during the pandemic, your editor here included. After all, it brought panic and inflation in its wake.

But since the start of 2020, it’s up 29%.

That’s a lot better than seeing the worst inflation in 40 years eat into your U.S. dollar savings.

Even better, gold is nobody’s liability…

It doesn’t matter who goes bust, it still holds its value.

That makes it different from a bank deposit. A lot of people don’t fully grasp this. But when you put money on deposit in the bank, you’re making an unsecured loan to the bank.

Your bank doesn’t keep a pile of cash in a vault in case you come looking for it. Instead, it’s free to use your deposits to gamble on long-term bonds and other investments that lose value as interest rates rise.

That’s what brought down Silicon Valley Bank. It’s the California-based lender that went under earlier this month.

The question now is… how many other midsize banks did the same thing? And what does that mean as deposits continue to flee the banking system?

Your second escape route is bitcoin…

As we looked at in these pages last week, the cryptocurrency is the brainchild of a pseudonymous developer called Satoshi Nakamoto.

Satoshi launched bitcoin in the wake of the 2008 financial crisis as an alternative to banks.

Like gold, a bitcoin is nobody else’s liability. As long as you custody it in a digital wallet app, there’s no counterparty risk.

It’s also impossible to dilute bitcoin’s value. There can only ever be 21 million bitcoins. And new supply tapers off over time.

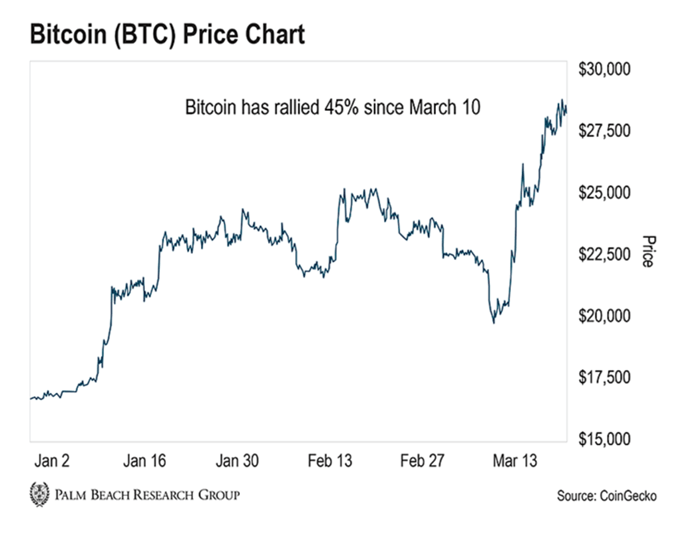

And as you can see, that’s been to bitcoin’s benefit as the banking crisis has played out.

The cryptocurrency up 45% since its March 10 low.

Like I said, the Fed’s hardly inspiring confidence right now…

First, it failed to see inflation was a problem and did nothing. You’ll recall it started off calling inflation “transitory” when it first started to become a problem two years ago. And it was slow to start raising rates.

The it hiked rates so aggressively it buckled the banking system.

And today, it showed it’s prepared to keep the pressure up on banks in its battle against inflation.

This will continue to make gold and bitcoin attractive alternatives.

Here’s colleague Teeka Tiwari, our resident crypto investing expert, with more…

With bank runs happening across the globe, many people are turning to bitcoin as an alternative.

Over the past few weeks, I’ve spoken to a lot of wealthy folks. And they tell me they’re starting to move some of their money from banks to crypto.

That’s because, as long as you custody your bitcoin, it’s free of counterparty risk. Sure, bitcoin is volatile. We’ve seen double-digit dips on a regular basis.

But bitcoin always comes roaring back, like we’re seeing now. And folks are realizing it’s better to deal with volatility than the chaos of the banking system. That’s why I believe bitcoin will continue rising from here.

Teeka’s got an impressive track record with his crypto predictions…

He called the 2018 Crypto Winter and the 2020 Covid crash. Subscribers who followed him through those upheavals had the chance to make peak gains of 3,955%, 12,193%, and 76,034% on cryptos he recommended.

Now, he’s issuing the most important warning of his career. An unprecedented event is guaranteed to hit the crypto market as early as by the end of this month… And it will trigger a historic panic.

It will catch millions of Americans off-guard.

That’s why Teeka is holding an urgent briefing tonight at 8 p.m. ET.

It’s called The Crypto Panic of 2023.

He’ll explain just what this event is… and how you can potentially make life-changing, generational wealth on small stakes… all while getting paid month after month.

He’ll even share one of his top picks for profiting when the panic hits. And according to Teeka, only a small corner of the crypto market will benefit from this panic… so you won’t want to miss tonight’s event.

So, go here to automatically reserve your spot. And if you upgrade to VIP, you’ll get access to a collection of Teeka’s tutorials on navigating the crypto market… and an exclusive report he’s put together called Teeka’s Secret to 10,000% Gains.

Here’s that sign-up link again.

Regards,

|

Chris Lowe

Editor, The Daily Cut