Chris’ note: If you lived through the 2008 financial crisis, you may be having déjà vu. This month, three U.S. banks have collapsed… and many more have seen their stocks crushed.

Then, over the weekend, Swiss investment banking giant UBS bought Credit Suisse for pennies on the dollar. This came after shares in Credit Suisse – the world’s seventh largest investment bank – cratered last week.

But as all hell is breaking loose in the banking system, bitcoin has been soaring. It’s up 37% over the past 11 days. And as you’ll hear today from world-renowned crypto investing expert Teeka Tiwari, it’s only going higher as more people shift their money out of banks and into bitcoin.

The last time I felt this anxious about the markets was nearly 16 years ago…

It was a devastating time. It was so terrible, folks wondered if we’d ever come through to the other side.

I’m talking about the Great Financial Crisis of 2007–2009.

In October 2007, the S&P 500 hit an all-time high. This came after a 101% rally off its dot-com-bust lows.

But as the subprime mortgage market went sour, the blue-chip index plunged as much as 57% before bottoming in March 2009.

The first domino to fall was global investment bank Bear Stearns.

At the start of 2007, it was the country’s fifth largest investment bank. And it traded for $171 a share. That March, it narrowly avoided bankruptcy when JPMorgan Chase swooped in and bought it for $10 a share.

At the time, I was running my own hedge fund. And I remember thinking, “This isn’t over. Bear Stearns is massive. There’s no way more dominoes won’t fall.”

It took some time, but that’s what happened…

In September 2008, the fourth largest investment bank in the U.S., Lehman Brothers, went bust.

Then came a string of bank failures. Washington Mutual… then Wachovia… then National City Bank.

Here’s why I’m telling you this…

We’re seeing a similar crisis unfold today. But unlike in 2008, there’s a new type of asset that allows you to not only protect your wealth in these times, but also grow it.

First Domino to Fall

The dominoes began to fall on March 8.

That’s when Silvergate Bank announced it was winding down operations.

This triggered runs on two other U.S. banks – Silicon Valley Bank and Signature Bank.

And last Thursday, California-based First Republic Bank – which operates in 11 U.S. states – almost went under. Its shares plunged as much as 73% in one week.

A group of 11 large banks deposited $30 billion into First Republic to help reverse the bank run.

But despite the lifeline, the New York Stock Exchange was forced to halt trading of First Republic’s shares to stem outflows. And when trading resumed, First Republic Bank’s shares continued to crumble.

Then last weekend, Credit Suisse narrowly avoided collapse after management admitted “material weakness” in its financial reporting.

In an echo of the Bear Stearns deal, another Swiss investment bank, UBS, said it would buy Credit Suisse for $3.2 million. That’s roughly 10% of Credit Suisse’s market value at the start of the year.

It’s been a rough time for folks with money in the bank.

But throughout the turmoil, bitcoin has continued to work without a hitch. And it has soared in value versus the U.S. dollar.

Why Bitcoin Is Rallying

As banks go belly up… or require rescues… more and more folks are turning to bitcoin as an alternative way to store their savings.

Bitcoin is up 37% since its March 10 low. And it’s no surprise…

Over the past few weeks, I’ve spoken to a lot of wealthy folks. And they told me they’re starting to move some of their savings from banks to bitcoin.

The beauty of bitcoin is it’s not someone else’s liability. As long as you custody your coins in a digital wallet app, there’s no counterparty risk.

It’s also impossible to dilute bitcoin’s value. There can only ever be 21 million bitcoins. And new supply tapers off over time.

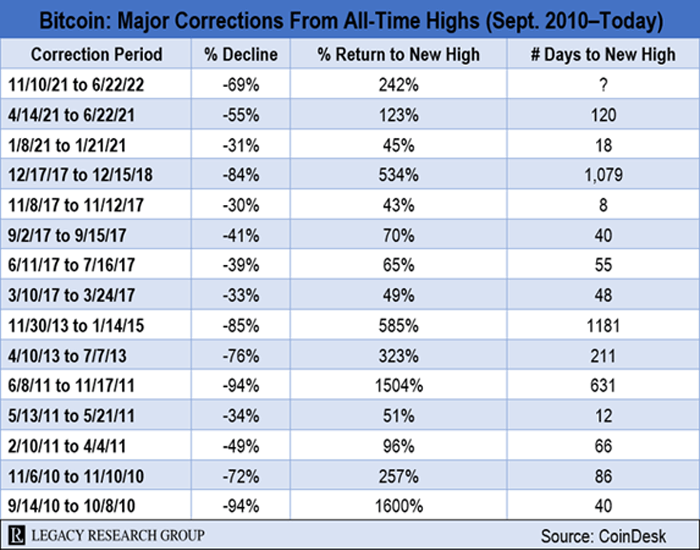

Sure, bitcoin is volatile. You may wake up one morning and see it down double digits versus the dollar.

But as we’re seeing now, after every crash, it powers back to all-time highs.

People are realizing it’s better to deal with volatility than risk losing everything. That’s why bitcoin will continue to rise from here.

$1 Trillion Could Flow Into Bitcoin

In particular, the world’s wealthy are scared.

They’re rediscovering that there are no safe havens in the banking system. Logic and self-preservation dictate they look outside of it to preserve their wealth.

And if they put a small percentage of their net worth to bitcoin – say 1% or 2% – that could send more than $1 trillion into bitcoin.

Right now, bitcoin has a market value of just over $540 billion. So, that would imply a bitcoin price of $84,000… and a 200% gain for folks who buy now.

Sure, the Federal Deposit Insurance Corporation (“FDIC”) insures bank accounts up to $250,000. But high-net-worth individuals often have millions of dollars in their accounts.

They’re asking themselves, “What happens if my bank collapses, and the government doesn’t come to the rescue? So what about taking 1% of my net worth and hedging against that risk by buying bitcoin?”

Remember, deposits are liabilities on a bank’s balance sheet. When we say we have $1,000 “in the bank,” what we’re really saying is the bank owes us $1,000.

If it can’t pay its debts, our deposits go up in smoke.

So ask yourself this: Would you rather take an IOU from the bank and wait in line while the feds try to recover your savings? Or would you prefer an asset you can self-custody?

I know what I’d prefer. And wealthy people are waking up to this reality, too.

Remember, if only a tiny fraction of these folks’ net worth goes into bitcoin, it will send it to new highs.

That’s why I’m so bullish on bitcoin right now.

But as I’ve been hammering on, now is NOT the right time to buy into the broad crypto market.

From Banking Panic to Crypto Panic

There’s a panic coming to crypto like we’ve never seen before.

In fact, this could be the biggest crypto panic I’ve seen in my seven years following this sector.

This warning is based on my research.

I’ve met the crypto billionaire who will trigger it. His developers have confirmed this could happen as early as by the end of this month.

And unfortunately, it will catch millions of Americans by surprise. By the time they realize what’s happening, it will be too late.

You see, folks are using this rally to speculate in meme coins and a bunch of other fraudulent projects. And a coming panic will wipe them out…

But not in a way you’ve ever seen before.

The mistake everyone is making is they think the entire crypto market will have an explosive rally… And they’re horribly wrong.

My research shows that just a tiny fraction of the crypto market will benefit. If you don’t own these coins, you’ll get crushed, while a small group of better-informed investors will make a killing.

To prepare you for this coming panic, I’ve put together a special briefing on Wednesday at 8 p.m. ET. It’s called The Crypto Panic of 2023.

I’ll explain exactly what will cause this panic… and how you could potentially turn $1,000 into an entire nest egg… all while getting paid each month.

And as a bonus for those who attend, I’ll give away my top pick to play the coming panic. And you should know my past free picks have seen an average peak gain of more than 1,300%.

So, if you haven’t already, automatically RSVP here.

It’s critical you do. We’re seeing the biggest banking panic since the 2008 financial crisis. If you make the wrong move, it could be among the worst financial mistakes of your life.

Let the Game Come to You!

|

Teeka Tiwari

Editor, Palm Beach Daily

P.S. My team and I have put together a special report to help you brace for the coming Crypto Panic.

It offers insight into how I’ve taken crises like this to give my subscribers the chance to make fortunes in crypto off of small stakes.

It’s called Teeka’s Secret to 10,000% Gains. And it’s available to you if you sign up for my event and upgrade to VIP. You’ll even get exclusive access to my video series guiding you through investing in crypto when you sign up.