All is not well in the market for U.S. Treasury bonds…

That’s according to credit ratings agency Fitch Ratings.

Yesterday, it placed the U.S. government’s AAA rating on watch.

That’s a big deal…

Credit ratings agencies do this when they see rising default risk and are thinking about a downgrade.

Mostly, markets are calm over the prospect that the U.S. may be forced into default as of June 1.

It’s the so-called X-day when the Treasury Department’s account at the Fed runs dry, and the federal government can no longer pay its bills.

But as I’ve been showing you in these pages, even if there’s a 20-30% chance that dysfunction in Washington triggers a default, it’s worth taking steps now to make sure your portfolio is protected.

That’s what the pros are doing…

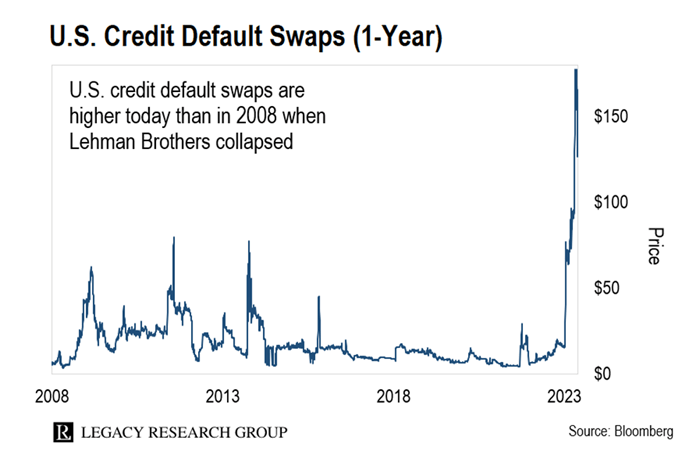

We know this because the cost of credit default swaps (“CDS”) has skyrocketed.

A CDS allows you to swap the default risk on a bond with another investor. The higher the risk of default, the more it costs to buy a CDS.

It’s all in this chart. It shows the cost of insuring against a U.S. government default over the following 12 months in the CDS market.

As you can see, the cost of insuring against default is now more than double the level it reached during the first major debt ceiling crisis in 2011.

Basically, investors see the risk of default as being twice as high this time around.

And it’s not the only sign that investors have the jitters over the prospect of a default.

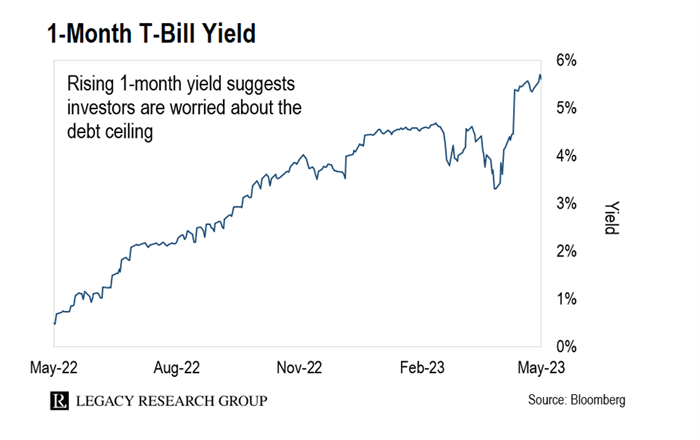

Meantime, Treasury bills are trading like junk bonds…

That’s the message of this next chart.

It’s of the yield on the 1-month Treasury bill. It’s supposedly one of the world’s safest places to park your cash.

Bond yields move in the opposite direction to prices. So, the spiking yield on the chart above means plunging prices.

Investors know if X-day arrives… and Congress still hasn’t raised the debt ceiling… these T-bills could become worthless. And demand for them is plunging.

Normally, when a T-bill matures, the Treasury pays the bondholder back in U.S. dollar cash. It can’t do that under current law if it has no money in its account.

Bond investors are right to be worried…

House Speaker Kevin McCarthy says he’s upbeat about the prospect of a deal with President Biden to break the deadlock.

Yesterday, he had a four-hour meeting with White House negotiators. And after it, he said, “I still think we have time to get an agreement and get it done.”

But here’s the problem… Neither McCarthy nor President Biden can raise the debt ceiling. Only Congress can.

Even if McCarthy and Biden strike a last-minute deal, McCarthy needs House Republicans to get onboard.

And with Donald Trump backing a default… that’s far from a sure thing.

He’s the head of the party. And he has the loyalty of the 45-member Freedom Caucus.

That’s only one of the way things could go haywire…

After the midterms, McCarthy had to sit through 14 failed votes before he won the speakership.

And he didn’t get the top job without making some serious concessions to the Freedom Caucus holdouts.

One of them was a rule change that affects how Congress can oust him as speaker.

Now any member of Congress can bring a motion that forces a vote on him remaining speaker.

If House Republicans don’t like McCarthy’s deal, they can get rid of him.

That would leave the House without a speaker… and plunge the nation into chaos.

Is there wiggle room if Congress can’t pass a fresh debt limit?

There’s talk that the Treasury could mint a platinum coin… give it a high dollar value… and generate revenue for the government by way of “seigniorage.”

It’s the difference in between the cost of minting a coin and its value.

Title 31 of United States Code allows the Treasury Department to “mint and issue platinum bullion coins” in any denominations the Secretary of the Treasury may choose.

Right now, that’s Janet Yellen. So technically, she could give the platinum coin a value of $1 trillion.

Another idea is to issue “consols”…

These are interest-only bonds with a face value of zero. So under the law, they don’t add to the debt.

But this is the type of thing that takes planning. And it doesn’t seem like Team Biden has laid the necessary groundwork.

There are also rumors that the president might try to leverage the 14th Amendment.

But there’s a problem there, too…

It forces the federal government to honor its debts. But it doesn’t force Congress to raise the debt ceiling.

It means the president must find a way to service the country’s debts… even if Congress doesn’t raise the debt ceiling.

That leaves something called “prioritization” …

If Congress doesn’t raise the debt ceiling, it’s up to President Biden to stop other payments and free up enough cash to pay bondholders.

That could mean pausing Social Security payments… not paying government workers’ salaries… and leaving federal contractors in the lurch.

And that can only go on so long before the inevitable happens… and the Treasury department is unable to make payments to bondholders.

At that point… the U.S. will default. And all hell will break loose.

That’s why I’ve been spilling so much ink on this topic lately. It’s also why I’ve been recommending you add some gold to your portfolio.

Gold will be the “last man standing” in a chaotic debt default…

Regular readers will be sick of me saying this. But gold carries no counterparty risk.

That’s just a fancy way of saying it doesn’t rely on another party to remain creditworthy for it to have value.

And that’s not the case with Treasury bonds. These are IOUs from Uncle Sam. If the government is no longer solvent… these IOUs have no value.

Only a solvent government can pay the interest owed on them. And only a solvent government can convert them back to cash once they mature.

It’s why folks who are building generational wealth rely heavily on gold. They know that, over a long enough time frame, no government is completely creditworthy.

By owning gold, they get rid of default risk.

Gold has been a great place to be of late…

Since its low in September last year, it’s up 20%.

If the folks in Washington don’t resolve the debt ceiling issue in time… it could easily rise another 20%.

And if Congress raises the debt ceiling in time, that’s fine, too. You’ll simply have more gold in your portfolio than you did before.

And gold is a great way to diversify outside of stocks and bonds.

Take last year, for example. We saw the S&P 500 fall 25%. Bonds had their worst year on record. And crypto and other more speculative assets got smashed.

Gold, on the other hand, held its value.

The price of gold dropped just $5 in 2022 – a welcome haven given the damage done in stock and bond markets.

That’s what diversification is all about…

Gold tends to underperform when investors are optimistic about the future.

But it comes into its own when fear takes over as the dominant emotion.

So even if it doesn’t come in handy this time around, it serves as portfolio insurance for the next time disaster strikes.

A good option is the Sprott Physical Gold Trust (PHYS). You can buy shares in this exchange-traded trust through your regular broker. It stores gold bars allocated in your name in vaults at the Royal Canadian Mint.

That’s your takeaway for today. I hope you act on it.

I’ll be back with more on the unfolding drama in Washington next week.

Regards,

|

Chris Lowe

Editor, The Daily Cut