Chris’ note: Bitcoin is up 61% in 2023. And for cycles trading expert Phil Anderson, it’s only the start of an even bigger rally.

Most bitcoiners see the cryptocurrency as an alternative form of money. They think this gives it value. But Phil says bitcoin isn’t money. Instead, it’s more like land. And like land, it’s prone to bouts of frenzied speculation.

Phil says it wouldn’t be weird to see bitcoin at $200,000… or higher… before the boom peaks.

Bitcoin is up 61% since the start of the year.

You can’t ignore price moves like that.

But what’s driving bitcoin higher?

Most bitcoiners will tell you it’s because it’s an alternative form of money.

But bitcoin, as you’ll see today, doesn’t meet the definition of money. So that can’t be it…

Instead, it’s due to a more obscure phenomenon…

It also causes speculative frenzies around land prices. And as I’ll show you today, it explains bitcoin’s roller-coaster volatility.

Is Bitcoin Money?

Bitcoiners have bought into an idea…

They say the cryptocurrency derives its value from being a borderless form of money.

But for something to be money, it must be a generally accepted means of settling credit balances.

Let me show you what I mean with a concrete example…

As I write these words, I’m providing a service to my publisher.

Since I’m not getting paid for a few days, my work has generated a positive credit balance.

At some point, my publisher will settle this balance. It will instruct its bank to mark up my account and mark down its account by the same amount.

Taken on its own, this positive balance is useless to me. It’s just numbers on a screen.

It’s what I can do with it, out there in the real world, that counts…

Means of Exchange

Here’s what I mean…

My cleaning lady comes to my apartment for a couple of hours every week. When she’s done, I tell my bank to pass some of the balance my publisher sent me to her account.

I could also go to an ATM… convert some of my account balance to cash… and settle with her that way.

In both cases, I’ve taken the credits my publisher gave me for something it wanted (my writing). And I exchanged those credits for something I wanted (cleaning services).

The role of money is to facilitate these exchanges so two people can swap their labor efficiently.

And for this to happen money needs to be widely accepted. Otherwise, people won’t use it.

Some people will accept bitcoin in exchange for goods and labor. But it’s still not widely accepted enough to truly be money.

So, what does give it value?

Fixed Supply

Bitcoin’s supply is limited to 21 million coins.

The supply schedule is baked into bitcoin’s code. So, there’s no way of minting more new bitcoins as prices go up.

And when excess demand acts on limited supply, you get a highly speculative asset.

It’s like land. It’s another asset with a fixed supply that’s prone speculation.

This is why the price of bitcoin has been on an upward trajectory, albeit a highly volatile one.

It comes down to an idea that’s even more misunderstood than the nature of money – economic rent.

Key Concept

Economic rent is the profit you get from owning an asset rather than operating a business.

It plays a key role in economics.

For instance, you might own land in an area where a large community springs up. There’s only so much land there. People want to build homes, schools, malls, and so on. So, without doing anything with your land, its value rises.

There are no limits to how high a rent-based asset can go up in price. Because unlike with goods or services, higher prices don’t bring forward new supply.

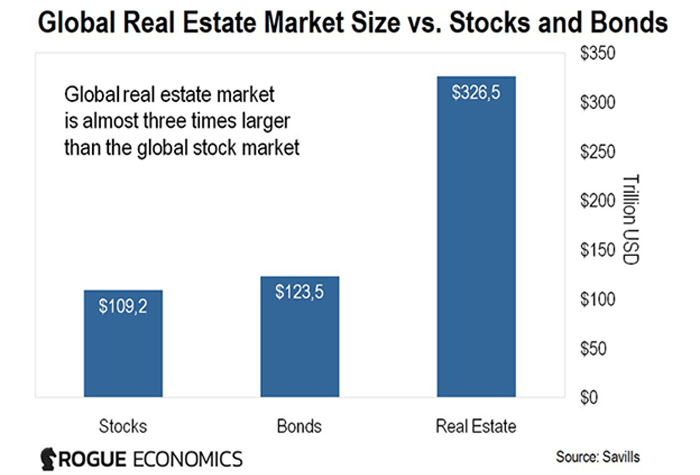

This is what makes real estate the most valuable asset class of all.

In 2020, the global real estate market was almost three times the size of the global stock market.

And economic rent doesn’t apply only to land. It also applies to bitcoin and other digital assets.

The cost of mining bitcoin is much lower than its traded price. This difference is economic rent. It’s the profit you earn by simply owning bitcoin.

This is one of the reasons for the hype surrounding bitcoin and the wild surges in its price. Assets that generate rent often become the focus of intense speculation.

This seems like a new phenomenon because bitcoin is a new type of asset. But it follows a well-worn historical pattern.

Nothing New Under the Sun

By the 1820s, canals were a huge source economic rent in Britain. There was a speculative frenzy around canal stocks.

Then it was the railways. And we got a railway boom.

And of course, we’ve seen many land price and real estate booms – most recently in the lead-up to the 2008 crisis.

These booms can be hugely profitable. But you need to know when a boom is peaking. Because at that stage you want to get out.

This is where knowledge of the 18.6-year cycle is so valuable. It’s the time it takes, on average, for a full boom-bust real estate cycle.

You can use this cycle to spot when the most speculation is taking place. Because for all the attention we give to a new technology such as bitcoin, the greatest booms are always real estate related.

I’m on record as saying that we’re now in the most profitable part of the current real estate cycle. This won’t end until midway through this decade.

I expect bitcoin will ride the vanguard of that boom. Because this part of the cycle is marked by investors chasing economic rent.

It may seem crazy. But bitcoin at $200,000 – or whatever price people are predicting these days – is not impossible.

Just remember that after every boom there’s a bust. And the bigger the boom, the bigger the bust.

So, keep an eye on the real estate cycle. As it turns lower, so will bitcoin and other rent-chasing speculations.

Regards,

|

Phil Anderson

Editor, The Signal