Remember when bitcoin was “going to zero”?…

This was last November…

Sam Bankman-Fried’s cryptocurrency exchange, FTX, had just collapsed. This triggered bankruptcies at a bunch of crypto lenders and hedge funds.

And the usual naysayers piped up.

The Black Swan author Nassim Taleb claimed that bitcoin’s value was “exactly zero.” “Dr. Doom” economist Nouriel Roubini said the “fundamental value of bitcoin is zero.” And Peter Schiff, a well-known precious metals dealer, talked about the cryptocurrency’s “ride to zero.”

Here at the Cut, we took a different view.

We showed you how these were centralized businesses going bust, not decentralized cryptocurrencies such as bitcoin.

And in our January 4 dispatch we even identified three catalysts for a new bitcoin rally.

Here’s what happened next…

Instead of going to zero, bitcoin surged 59% year to date. That makes it one of the best-performing assets of the year.

And as you’ll see in today’s dispatch, a new catalyst means the bitcoin surge is far from over.

We’ll get to this fourth catalyst in a moment. First, a quick recap on the three catalysts we identified at the start of the year with the help of our crypto investing expert, Teeka Tiwari

First, Wall Street is getting involved in crypto…

Take Fidelity. It’s one of the world’s largest asset managers. It has about $4.5 trillion in assets under management.

Last November, it launched a way for investors to invest directly in crypto in their 401(k) plans.

Or look at BlackRock. It manages more than $10 trillion in assets. That makes it the world’s largest asset manager.

Last August, it partnered with publicly traded crypto exchange Coinbase. This will give BlackRock’s institutional clients access to crypto.

Second, the bitcoin “halving” is on the horizon…

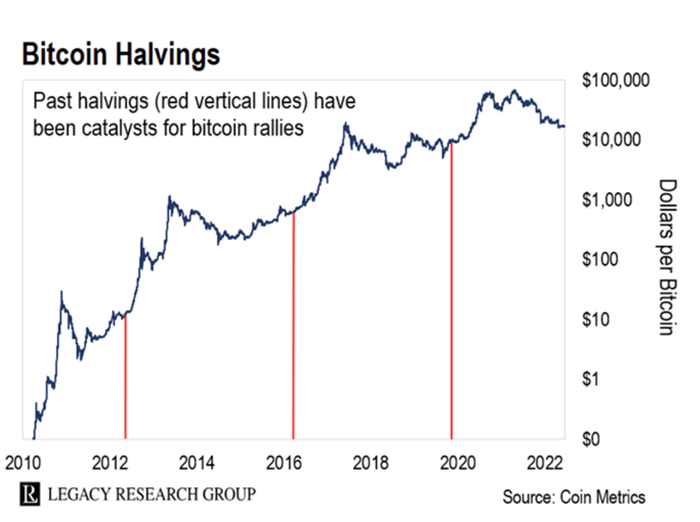

If you’ve been with us for some time, you’ll know that the supply of new bitcoin halves roughly every four years.

In the past, these events (red lines on the chart below) have led to a sharp rise in bitcoin’s price.

The next bitcoin halving happens next year. That makes this year a great time to buy ahead of the next halving.

The third catalyst is shifting demographics…

The deVere Group is one of the world’s largest independent financial advisories. It reports that more than two-thirds of millennials prefer bitcoin over gold.

That’s a huge deal when you consider that millennials – folks born between 1981 and 1996 – make up about 22% of the population.

And Gen Z – folks born between 1997 and 2012 – makes up another 20% of the population.

Together, that’s roughly double the 21% of baby boomer Americans.

As these younger folks head toward midlife… and their peak earning and savings potential… most of them will choose bitcoin over gold in their portfolios.

Remember, like gold, bitcoin is a “hard asset”…

It’s hard to produce more of relative to its existing supply.

The new supply of bitcoin is governed by code and operates on a pre-existing schedule. And once bitcoin hits a total supply of 21 million coins, no more new coins can be minted.

That’s not where the similarities with gold end.

Unlike bank accounts and Treasury bonds, bitcoin’s value doesn’t rely on someone else’s promise to pay. So, it doesn’t matter who goes bust, your bitcoins aren’t at risk.

It’s the digital version of having gold in a safe in your home. Your bitcoins are yours to keep, even in the worst kind of financial crisis.

That brings us to the fourth catalyst for bitcoin as we head into the second half of 2023.

Politicians are playing a game of chicken over the debt ceiling…

Depending on who you vote for, you’ll think the clash over the debt ceiling is either a necessary intervention… or a reckless gambit.

That’s up to you…

My mission here at the Cut is to bring you ideas about how to grow your wealth… and make sure you’re aware of threats on the horizon.

And although most folks see the debt ceiling clash being resolved before the government runs out of cash… and is forced into default… I’m not so sure.

You don’t have to be a Beltway insider to know what I mean.

Team Biden hates House leader Kevin McCarthy’s guts… along with the Freedom Caucus that lifted him to power in Congress.

The feeling is mutual. As far as a lot of Republicans in Congress are concerned Biden is not even the lawful president.

There are all sorts of ways things could go wrong…

In past debt ceiling fights, GOP House Speakers could push through a vote at the eleventh hour. There are real questions about whether McCarthy can.

In January, it took him 15 votes just to get the gavel. That’s the longest speakership battle since 1859.

And at his CNN townhall last week, the frontrunner to be the Republican presidential nominee – Donald Trump – weighed in. He said…

I say to the Republicans out there – congressmen, senators – if they don’t give you massive cuts, you’re going to have to do a default.

And when CNN anchor Kaitlan Collins pushed him to clarify his remarks, he said…

Well, you might as well do it now, because you’ll do it later. Because we have to save this country.

That makes it even harder for McCarthy and other Republicans in Congress to back down.

There’s $24 trillion in outstanding U.S. Treasury debt…

Hitting the debt ceiling means defaulting on those bonds. The Treasury won’t have money in its account to pay the interest income it owes.

If that happens, folks holding some of the so-called safest assets out there will get burned.

We’re talking about panic selling in bond funds… money market funds… and contagion from the resulting losses spreading through financial markets.

And most folks are underappreciating how likely this scenario is. It’s not an 80% or 90% chance. It may not even be 50% or 60% chance.

But even if it’s a 20% or 30% chance you should be concerned. A default on U.S. Treasury debt would make the chaos unleashed by the collapse of Lehman Brothers in 2008 look tame.

Back then, folks rushed into Treasury bonds as a haven. This time, Treasury bonds will be the toxic assets.

There’s no way of knowing how investors will react to a default…

That’s because Uncle Sam hasn’t defaulted before.

But bitcoin shot up after the collapse of Silicon Valley Bank in March.

And that’s after the blowup of a midsize bank most folks had never heard of.

Imagine what kind of reaction they’ll have if they get news that the debt ceiling didn’t get raised in time and the country is in default.

Together, the first three catalysts are enough to push bitcoin significantly higher from here. Teeka has a long-term price target of $500,000 as bitcoin market grows.

If the folks in Washington wind up triggering a debt default, we could get there a lot quicker than even Teeka has been expecting.

The Treasury Department said in a statement Friday that it had just $88 billion remaining as of May 10 to help pay the government’s bills.

And it’s projecting its account will dry up as soon as June 1… just 17 days from now.

Regards,

|

Chris Lowe

Editor, The Daily Cut