Chris’ note: The buildout of the crypto economy is one of the most profitable investment themes we track here at The Daily Cut. And it’s one we want to make sure is front and center on your radar.

So today, we’re passing along an insight from Greg Wilson. Greg works closely with world-renowned crypto expert Teeka Tiwari.

As Greg shows below, gold is a good way to diversify your wealth away from stocks. But an even better strategy is to own some gold and some bitcoin. As you’ll see, putting even 1% of your wealth in bitcoin can dramatically boost your returns… with limited downside.

When I walked into the conference room, the first thing I saw was a Plinko board.

The game operator was offering prizes. And the gimmick worked… So I headed over to the booth.

Now, you may know Plinko from the long-running game show The Price Is Right. It’s a fan favorite.

Contestants are given flat chips to drop down the board’s maze. You aim for the prize you want, release a chip, and watch it bounce down the slots until it reaches a prize.

But this wasn’t The Price Is Right. And Bob Barker wasn’t bellowing, “Come on down!”

Instead, I was at Consensus 2019 in New York. It’s the biggest crypto conference of the year. With over 7,500 attendees, 250-plus speakers, and hundreds of sponsors, it brings the crypto industry together.

The game operator was Grayscale Investments. It’s one of the world’s largest crypto asset managers. It has $2.7 billion in assets under management.

I won a pair of cool socks. But what really caught my eye was Grayscale’s message on the board: “Drop Gold.”

|

An ad for Grayscale’s “Drop Gold” campaign

Frankly, I was a bit taken aback. Gold has been used as money for 5,000 years. And it’s a good hedge against the world’s fiat currency system collapsing.

But today, I’ll share why the Plinko board was right – and why you should consider reallocating some of your gold position to bitcoin…

At the Palm Beach Research Group, we recommend holding up to a 5% allocation of precious metals – including gold.

If society breaks down, that 5% allocation could end up becoming more valuable than the other 95% of your investment assets.

Now, if you’re convinced gold is going significantly higher, we don’t disagree with you. But we’d also encourage you to set aside part of your gold allocation to bitcoin. And Grayscale agrees…

The firm believes gold has maintained its status as scarce, fungible, and recognizable back from the past. But our world is different now. So gold’s status as the ultimate store-of-value asset needs to be questioned.

Here’s Grayscale’s reasoning:

-

Gold is the past… President Nixon dropped the gold standard in the 1970s. Gold is heavy (25.7 pounds for a standard bar). It’s not easy to move around – and you have to worry about storage.

-

Bitcoin is the future… It’s electronic, fraud-resistant, and accessible to everyone. It’s borderless and secure. And it can be sent around as easily as a text message.

You may be thinking Grayscale is just talking its own book. But the numbers back it up, too…

Bitcoin is up about 175% since the start of the year – despite all its volatility. Gold, on the other hand, is up about 18%.

More important, allocating even just a small amount of your portfolio to bitcoin can significantly increase your returns.

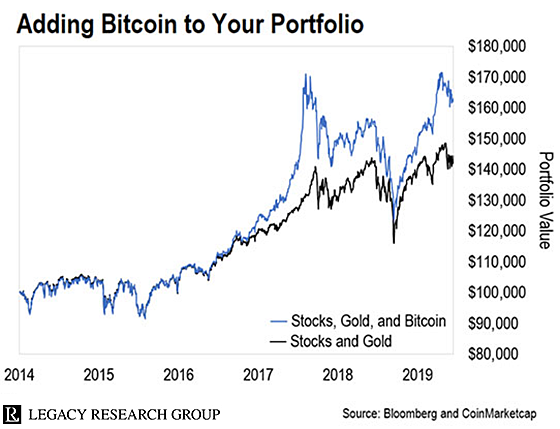

Let’s compare a portfolio of 95% stocks and 5% gold to one with 95% stocks and a split of 4% gold and 1% bitcoin, going back to 2014. The starting portfolio value is $100,000.

As you can see in the chart below, the portfolio with bitcoin would have made you nearly $20,000 more over the past five years.

With these results, it’s hard to argue against selling some of your gold and adding some bitcoin.

Now, Grayscale recommends its clients add bitcoin exposure through its Grayscale Bitcoin Trust (GBTC). But that’s not an ideal solution. Here’s why…

It comes down to one question: Would you pay $10 for a $5 meal?

Well, neither would we. And that’s the problem with GBTC. It always trades at a premium (often of 100% or more) to its net asset value…

Let’s say GBTC is trading at $12 with a 100% premium built in. This means buyers are getting only $6 worth of bitcoin for each $12 share. So you’re starting off with a 50% loss.

No matter how well an asset performs, you won’t do well by paying 100% premiums for it.

That’s why we have a better way: Buy bitcoin (BTC) yourself on an online exchange and learn how to store it in a digital wallet. You’ll avoid premiums and essentially be your own bank.

If you don’t know how to get started, don’t worry. We put together a simple, one-page guide.

It shows you three exchanges where you can buy bitcoin… four secure digital “wallets” to store your bitcoin… and where you can trade bitcoin for other cryptos.

Regards,

|

Greg Wilson

Editor, Crypto Income Quarterly

P.S. On Wednesday, September 18, world-renowned cryptocurrency expert Teeka Tiwari is offering a free, weeklong crypto training series. It’s available to anyone who registers for his live crypto webinar.

During the event, Teeka will reveal a little-known phenomenon that’ll boost the entire crypto market in the coming months. And he’ll share details about five cryptos he believes will profit most. Teeka will even give away the name of his new No. 1 crypto pick of 2019 live during the webinar. Don’t miss out on the chance to become a crypto millionaire…