Chris’ note: Our mission here at Legacy Research is to bring you ideas you won’t hear about in the mainstream press. Ideas about how to really move the needle on your wealth.

That’s why, all week, I’ve been featuring insights from one of the newest members of the Legacy Research team, Phil Anderson.

Over his 34-year career, he’s called all the major market turns – including the housing crash in 2007… the 2008 stock market crash… and the bottom of that crash in March 2009.

And last night he went live with what could be the biggest prediction of his career. Phil says we’re entering a melt-up phase for stocks that will last until at least 2025. We’re talking about a rally so powerful that commentators will call it the “biggest boom ever.”

If you missed Phil’s event, you can catch the replay here. Then read the Q&A with him below for more on why the next couple of years will make or break your retirement.

Q&A With Phil Anderson, Editor, Cycles Trading With Phil Anderson

Chris: Yesterday, you went on air with a stock market prediction you call The Eleventh Hour – Last Chance. And you had a very bullish message for attendees. We’re getting close to what commentators will describe as the “biggest boom ever.”

More than 2,400 people tuned in. But for folks who missed it, what is the Eleventh Hour? How does it fit into the economic cycles research you use to predict – and trade – markets?

Phil: I don’t call what I do “predicting.” I call it “remembering the future.” I’ve learned over my 34 years as a market timer that the question “What comes next?” is best answered by looking at the past.

For my latest call – which I first made at the end of March – I looked back 20 years to 2003. This was after the dot-com crash that began in 2000. The tech-heavy Nasdaq was down about 78% from its high. But in 2003, it rocketed about 50% higher.

Then I looked at 1983. That was right after 1982 – another bearish year. But 1983 was a big up year for stocks.

Same goes for 1963. After the Cuban Missile Crisis in October 1962, there were a lot of scary headlines about nuclear annihilation. But 1963 was another big up year.

And this cycle repeats…

We got a major bearish year in 2022. So, going by the cycle, we were going to get an major bullish year in 2023. A melt-up, in other words.

We talked about it in the interview we did at the beginning of April. That was in the wake of the regional bank collapses in the U.S. Few commentators were suggesting a recovery, let alone a melt-up.

It was a ballsy call. Things looked grim in March. Silicon Valley Bank went bust. Then Signature Bank. Then First Republic Bank. It was the worst string of bank runs since the 1930s.

I don’t blame people for feeling nervous. But because I know that history repeats, I could see that March would likely be the start of a big move higher for stocks.

And here we are, four months after I first aired my prediction. And lo and behold, 2023 is looking like 2003. The Nasdaq was up 29% in 2003. So far this year, it’s up 35%.

Chris: So, what should you do instead of tuning into the “experts” on CNBC and on social media?

Phil: Watch the replay of yesterday’s Eleventh Hour – Last Chance event. I went into more detail on where we are in the cycles I track… and how you can learn to track them yourself.

Also, pay attention to stock market history. Few investors understand this. But it’s the key to understanding what’s to come.

Chris: Since I talked with you and we had some time to hang out in Florida, I have changed how I see the stock market. Correct me if I’m wrong, but you look for a top in the real estate market before a top in the stock market.

Phil: That’s right. Like what happened in 2008, the real estate market will peak before the stock market. But first, we’ll get our Eleventh Hour melt-up, which is just history repeating.

Chris: On April 11, you recommended a homebuilder stock to subscribers of your cycles trading advisory, The Signal. It’s up 53% since then. So, you’re not talking about these cycles in the abstract. You’re connecting the cycles you track with stock recommendations. What was your thinking behind that?

Phil: My mantra is, “Buy the right stock at the right time.” That was an example of this mantra in action. The market was betting on a fall in the housing market. Thanks to my knowledge of the cycle, I knew they were likely wrong.

Chris: For folks who missed the run-up you predicted for 2023, what do you see heading into the rest of the year, next year, and beyond?

Phil: I call it the Eleventh Hour for a reason. It’s the wild bull market at the end of the cycle. It’s the point in the cycle when most assets go up, beginning with land and real estate.

When land and real estate start declining at a massive scale, only then can I say the end is near.

Here’s something your readers need to understand: The end of the cycle will be an event of global proportions. It will be more significant and more visible than a recession in any one country.

There was a similarly bullish pattern between 1963 and 1966. You can see it the chart of the Dow below.

…and again between 1983 and 1986…

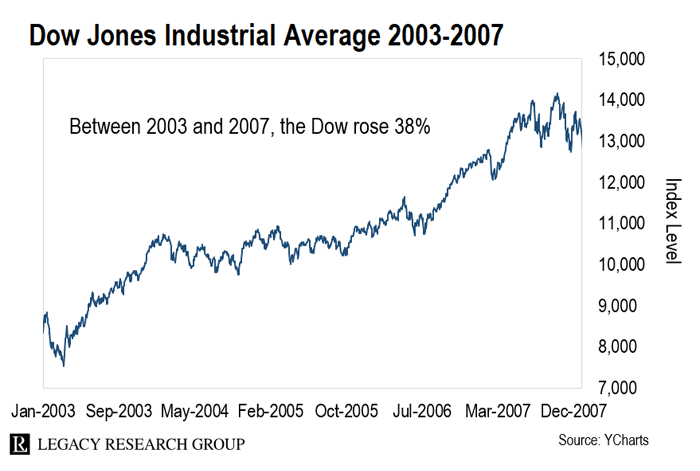

And history repeated once again between 2003 and 2007…

I know it will sound odd to many of your readers. But if you want to know what’s in store for stocks over the next few years, it’s all in these three charts.

In 1962, we had the Cuban Missile Crisis and a bear market in stocks…

In 1982, we saw interest rates as high as 15% and inflation as high as 8%.

In 2002, the U.S. was building up to its invasion of Iraq… We’d just been through the Enron scandal… Then the WorldCom scandal came to light.

WorldCom was the second largest long-distance telephone company in the U.S. And its CEO, Bernie Ebbers, had inflated profits by about $4 billion using fraudulent accounting.

To say investors were bearish in 1962… 1982… and 2002 is an understatement. These were bleak years. But the stock market recovered in 1963… 1983… and 2003.

And each time, we went on to see what commentators described as the biggest boom ever… until it collapsed in a land-price-led recession.

That will happen this cycle, too. Over the next two to three years, we’ll go from the Eleventh Hour we’re in now to a new top for stocks. Then we’ll get a fall in land and real estate prices, followed by a major downturn in stocks.

I got into all the details last night at my Eleventh Hour – Last Chance event.

If your readers missed it, they can still catch the replay.

Chris: Sounds great, Phil. Thanks for your time.

Phil: Anytime, Chris.