Chris’ note: Last night, 25,997 of your fellow readers tuned in to watch Silicon Valley insider Jeff Brown’s Beyond Exponential summit.

It’s easy to see why it was so popular… Jeff has handed readers the chance to close out gains of 221%, 239%, and even 332% from stocks that harness the power of exponential growth. And after crisscrossing the U.S. during the pandemic, he revealed for the first time his No. 1 way to profit from exponential tech over the next decade.

If you didn’t make it last night, head on over to the free replay here. Then read on below to hear from Jeff on why one of the best hunting grounds for exponential growth plays is artificial intelligence (AI). Its power has been growing at a beyond exponential pace…

In the summer of 1956, John McCarthy was a young assistant professor of mathematics at Dartmouth College.

He met with other scientists to discuss a topic that most people considered science fiction… thinking machines.

That summer, he coined the term “artificial intelligence.”

Within a few years, scientists around the world were teaching computers to play checkers, solve word problems, and speak English.

In 1965, one of McCarthy’s fellow scientists, Herbert Simon, predicted that “Machines will be capable, within 20 years, of doing any work a man can do.”

Simon’s timeline was overoptimistic. But artificial intelligence (AI) has become one of the most cutting-edge technologies of our modern age.

AIs can perceive their environments and act to maximize their chances of achieving certain goals. They can learn, in other words.

We use AI in healthcare, cybersecurity, e-commerce, advertising, agriculture, education, finance, and more. There’s almost no area of society or industry untouched by its influence.

That has major implications for us as investors.

Despite the pervasiveness of AI, few understand how fast this technology is progressing.

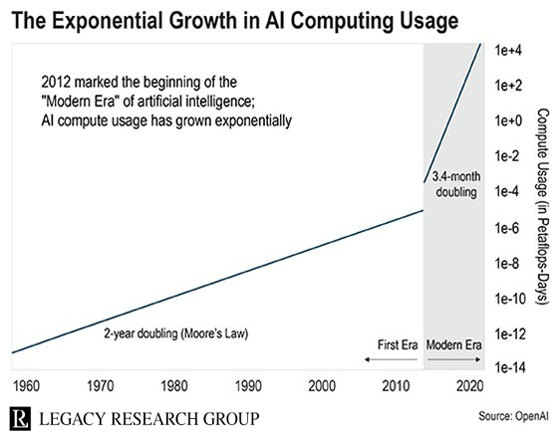

Here’s a chart that can put the progress into perspective.

It shows the amount of computer processing power – in petaflops, a measure of processing speed – behind complex AI.

Until 2012, AI computing power doubled about every two years. This followed Moore’s Law of exponential growth. It states that the number of transistors you can fit on a microchip doubles roughly every two years.

But in 2012, computational power made a bigger jump up. And AI computing power has doubled every 3.4 months since then. That dwarfs Moore’s Law.

This shows how powerful AI is becoming.

Take another look at the chart above… The growth of processing power for AI is so explosive, the chart looks like a hockey stick. AI can now solve problems that were nearly unthinkable just five years ago.

It can now help us treat and even cure disease by analyzing billions of compounds. This allows us to discover potential new drugs and therapies in days instead of months or years.

AI is also enabling autonomous driving technology by helping our cars learn to be safe drivers. This will save millions of lives each year by preventing car crashes… 90% of which are caused by human error.

AI is now even helping the military replace or augment human abilities.

In August, an AI won a dogfight against a human F-16 fighter pilot in the United States Air Force. 4 billion simulations trained the AI to adapt under any circumstance imaginable.

And market research shows adoption of this technology is speeding up at a similar pace…

International Data Corporation, a leading market analysis firm, says companies will spend about $50 billion developing and implementing AI this year alone.

Spending will more than double over the next four years, hitting $110.7 billion in 2024.

That’s a ton of capital flowing into AI projects. And that’s why we should be paying attention as investors…

This will be a major boon for the software companies developing AI technology. This will push up demand for next-generation hardware as well.

The world needs more servers, more processing power, and more application-specific semiconductors designed for AI.

These are the ways we’ll be able to take advantage of the exponential growth of AI. Let me show you just one example…

In May, U.S. chipmaker NVIDIA (NVDA) announced its A100 AI chip.

Talk about horsepower. It has 54 billion transistors on a single chip. It can run at 5 petaflops. That means it can do 5 quadrillion operations per second.

A quadrillion is a thousand trillion. A quadrillion seconds ago was 32 million years ago. It’s an immensely large number.

It’s also 20 times more powerful than NVIDIA’s previous-generation chip, Volta.

Most sequential product releases in the semiconductor industry deliver maybe two to three times the performance of existing chips. To see a 20-times jump like this in a single generation is unheard of.

Allow me to put this in context…

To handle AI training tasks today, you need 600 central processing unit (CPU) systems to handle millions of queries. For this level of processing power, you need about 25 racks of servers – costing $11 million – and 630 kilowatts of power. That’s enough to power an average home for a month.

But with NVIDIA’s new chip, all you need is one server rack – costing $1 million – and 28 kilowatts of power. So NVIDIA’s new product provides the same processing power at one-tenth of the cost and just 4% of the power requirements.

I worked as a technology executive for decades in Silicon Valley and in Asia. It’s not often that a breakthrough really stuns me.

What we’re talking about here isn’t even exponential growth. It’s a quantum leap. And it’s these kinds of bleeding-edge chips that are going to fuel the continued growth of AI.

This chip’s cost makes it accessible to all corporations and government agencies. I expect Amazon’s cloud computing arm, Amazon Web Services, to buy this tech and make it available on demand in the cloud. When that happens, even early stage companies will “rent” advanced AI computing power without any upfront costs.

That will put it in the hands of any researcher or data scientist who wants to experiment with the world’s most advanced AI hardware.

I first publicly recommended NVIDIA in early 2016 at a meeting of a small group of wealthy investors organized by Legacy Research cofounder Bill Bonner.

Some of them thought I was crazy. But NVIDIA ended up being the top-performing S&P 500 stock that year. And since that meeting, it’s up more than 1,800%.

And the gains for AI-related investments are just getting started…

The next 30 years are going to bring technological developments that will make it difficult to recognize the world we find ourselves in.

It’s going to be an amazing journey. And this multiyear boom will overflow with investment opportunities like NVIDIA back in 2016.

In fact, I’ve already found the perfect way to profit from this boom…

I revealed all last night in my free investing summit, Jeff Brown: Beyond Exponential. Including how everyday investors can build a multimillion-dollar tech portfolio – from scratch – in today’s market.

So if you missed that, make sure to catch up here. You’ll even get the name of the top company I believe could rival NVIDIA with its gains.

Regards,

Jeff Brown

Editor, Exponential Tech Investor