It’s the seventh-worst year for the stock market in almost a century…

Our stand-in for the U.S. stock market, the S&P 500, is down 16% so far this year.

If the year ended today, it would be the seventh-worst year for the index going back to 1928 – right before the Great Depression.

Only 1930… 1931… 1937… 1974… 2002… and 2008 saw worse annual losses.

But there’s good news. The average five-year gain after these losing years was 83%.

That’s why I (Chris Lowe) am continuing my campaign to get you to view this pullback not as a reason to panic… but as a buying opportunity.

As you’ll see today, investments in some of the world’s most promising megatrends are now selling at deep discounts.

First, a closer look at what happens after big down years for stocks…

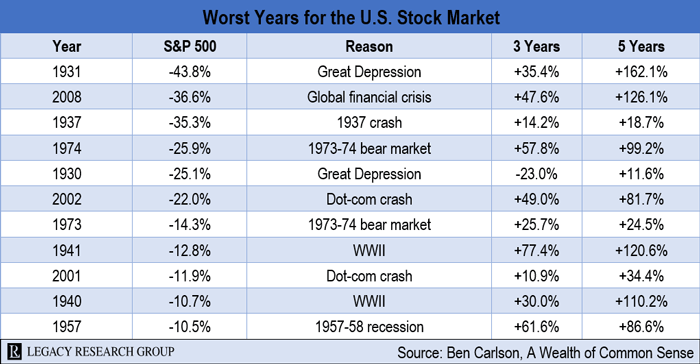

The S&P 500 has suffered double-digit annual losses 11 times since 1928. Take a look…

But as you can see, in all but one of these cases investors were up double digits over the next three years.

The average total return over the following three-year period was 35%.

And in all these cases of double-digit annual losses, the S&P 500 was up double digits over the next five years.

Investors who held the course earned an average total return of 80% over the next five years.

That’s why we’re zeroing in on bargains amid the recent carnage…

Market pullbacks like the one we’re going through today are painful.

But as colleague Teeka Tiwari reminded us in Monday’s dispatch, the stock market is self-healing. So pullbacks are also opportunities to buy into market megatrends at fire-sale prices.

And right now, one prime place to go bargain-hunting is in beaten-down semiconductor stocks.

As you likely know, we’re facing a global semiconductor – aka chip – shortage.

Before COVID-19 struck, the average time between ordering a chip and its delivery – known as the lead time – was 11 to 12 weeks.

By July 2021, the lead time for chips jumped to 20 weeks.

This March, it reached almost 27 weeks.

COVID-19 lockdowns in China are making this situation worse…

It’s something the newest member of the Legacy Research team, Nomi Prins, has been writing about.

If you don’t know her already, she used to work on Wall Street on behalf of ultra-wealthy clients. But she left her seven-digit salary at Goldman Sachs (GS) to help regular investors even the playing field with financial elites.

And she sees the semiconductor shortage as an opportunity to profit. Over to Nomi…

Chinese production accounts for 9% of global chip sales. The country also accounts for about 40% of the world’s chip assembly and testing.

Shanghai is a major hub for chipmakers. It’s been in lockdown since March. Up to 40 other cities are in full or partial lockdown. This led to a 5% drop in Chinese chip production in March and another 12% in April.

There’s talk the authorities will lift some of Shanghai’s restrictions next month. But China is sticking with its zero-COVID policy. So any jump in case numbers will lead the government to bring back lockdowns.

That means even longer lead times for chips.

It’s hard to overstate the size of the problem for our globally interdependent economy. Nomi again…

Semiconductors are key components of many of the devices we use daily – including our smartphones, laptops, tablets. The auto industry also depends on semiconductors. A modern internal-combustion-engine car needs about 1,000 chips. And electric vehicles use roughly three times as many chips as gas guzzlers.

Any shortage or delay in chip delivery means manufacturers can’t get their products to market as quickly as before. This hurts their bottom lines.

Even consumer electronics giant Apple (AAPL) is feeling the effects. It says the global chip shortage could cost it from $4 billion to $8 billion in sales this quarter alone. And many carmakers, including GM (GM) and Toyota (TM), have had to cut production due to the chip shortage.

Meantime, demand for chips is growing…

That’s based on figures from semiconductor market research firm IC Insights. They show that chip sales are on track to hit $680 billion this year.

That’s an 11% increase compared to last year. And it would make 2022 the third straight year of sales growth.

That’s impressive. But there’s a lot more growth to come…

McKinsey & Company is one of the world’s top management consulting firms. It estimates that global chip sales will top $1 trillion by 2030.

That’s a 47% increase from this year’s estimate… and a potential windfall for chipmakers.

Despite this, investors haven’t shown chipmakers much love lately…

As Nomi says, a shortage like this amid rising demand should be great news for the companies supplying the scarce resource.

And chipmakers have taken advantage by increasing prices up to 25%.

You’d expect the shares of these companies to shoot higher as a result.

But not this year. Thanks to record inflation… rising interest rates… and the war in Ukraine, investors are in a bearish mood.

They’ve pushed the tech-heavy Nasdaq down almost 28% from its high last November.

And chipmakers have gotten caught in the rout.

It’s all in this next chart of the Nasdaq versus the iShares Semiconductor ETF (SOXX). It tracks the 30 largest U.S.-listed chipmakers.

And as you can see, SOXX is down 28% year to date… which closely tracks the decline in the Nasdaq.

To Nomi, this is a chance to scoop up a bargain…

The fundamentals for the semiconductor industry are great.

Modern civilization can’t function without them. And chipmakers are raising their prices as demand grows.

But investors are out of love with this sector. So you can get in at a discount.

That’s why Nomi recommends picking up some shares in SOXX…

SOXX is a straightforward investment you can access with a brokerage account. It manages about $7.3 billion of assets. And its 30 stock holdings include leading chipmakers Nvidia (NVDA), Advanced Micro Devices (AMD), and Intel (INTC).

Though I still expect some choppy times ahead for this sector and the overall market, I think we’re currently at an attractive entry point for a longer-term investment in the semiconductor industry.

Just remember to hold on to this investment for the long run. And as always, never bet the farm on a single idea.

Nomi isn’t the only Legacy analyst to recommend SOXX…

In April 2019, our “billion-dollar trader,” Jason Bodner, recommended SOXX in these pages.

This was before the COVID-19 pandemic. Jason was bullish on semiconductors because they were crucial for rolling out 5G wireless networks. You can catch up on Jason’s write-up here.

If you bought SOXX on his recommendation and held on until today, congratulations.

Even after the recent plunge, you’re up 88%. And you can look forward to higher gains as semiconductor supply struggles to keep up with rising demand.

Until tomorrow,

|

Chris Lowe

May 25, 2022