Chris’ note: In 1987, one man called the crash arguably better than anyone else…

In December 1986, Mason Sexton warned of a “giant stock market boom early in 1987 [followed by] a calamitous collapse.”

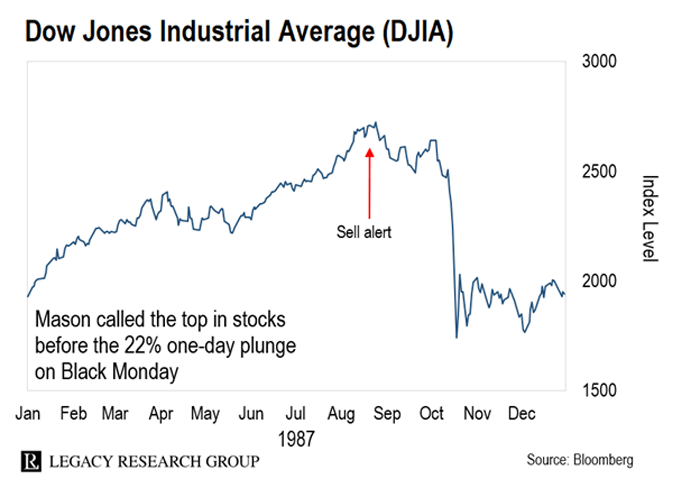

On October 8, 1987 – 11 days before the notorious Black Monday crash – he recommended people get out of the market… and even bet against it. (A move that earned legendary trader Paul Tudor Jones $100 million.)

Since then, he’s kept up his run of uncanny predictions. They include calling the bottom of the 2009 crash… the exact top of the market last year… as well as the 10 worst days in the stock market over the past three years.

But what he believes is coming is unlike anything he’s ever seen. “I often shudder when I think of what’s coming for Americans,” says Mason.

This morning, he revealed his full, ominous forecast… Including the calamitous event on the horizon, and the exact date it will strike. If you missed it, that’s okay… You can still catch Mason’s prediction this evening at 8 p.m. ET.

Don’t wait to sign up. If Mason’s forecast is correct, there isn’t much time to prepare for what’s coming. In fact, it could be just weeks away.

So, make sure you go here to catch Mason’s event. Then read on below for my Q&A with him about what he sees ahead.

Chris Lowe: Mason, you’re presenting an important market call just three hours from now. You’ll release the details of the strange and ominous forecast you see ahead for America over the next three years.

But for the past 30 years or so, you’ve been flying under the radar, so to speak. You’ve been selling your market timing research to hedge funds and other wealthy clients. Why share this forecast now with everyday investors?

Mason Sexton: My specialty is calling major changes in market paradigms. I did that most famously in 1987. I called the top in stocks before the Black Monday crash to the day.

I also called the top of the stock market before the Covid panic… and told my clients to sell at the exact peak in 2022.

And I believe we’re in the middle of a major paradigm shift that’s just too important to ignore. And it is critical that folks know about it. If I’m right, it will bring profound changes not only to the market… but also to the economy and to society in general.

Chris: What do you mean by a paradigm shift?

Mason: A paradigm is a set of rules that govern our perception of reality. It’s a framework for understanding the world. And that can be a problem. Because − despite what we may want to believe − paradigms change. When they do, everything we believe, everything we think we know, is proven wrong.

Chris: Can you give an example of what you mean?

Mason: Sure. I started my Wall Street career at Morgan Stanley in the spring of 1972. That was right around the peak of the stock market boom of the late 1960s and early 1970s. This was the time of the so-called Nifty Fifty. These were roughly 50 large-cap stocks on the New York Stock Exchange that were responsible for the lion’s share of the gains in that boom.

Most of them were the tech stocks of the time – for instance, Kodak, Polaroid, Xerox, and IBM.

Today’s version of the Nifty Fifty is the FAANG group of stocks – Facebook, Apple, Amazon, Netflix, and Google. They’ve been responsible for the lion’s share of gains over the past several years. But that can change… fast. And that’s when we usually see a major shift.

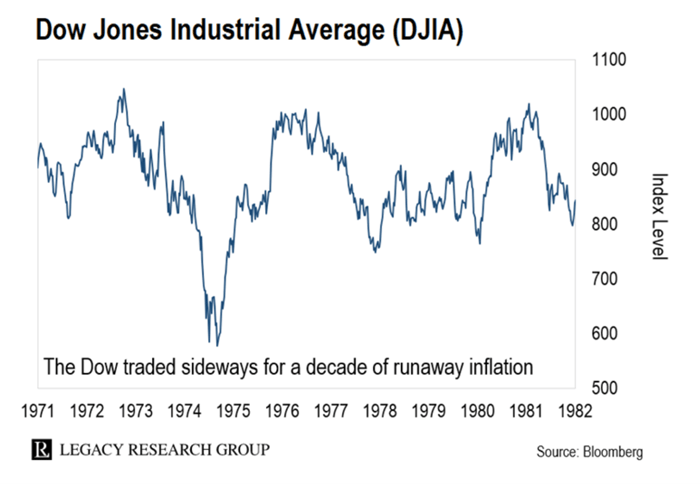

I was at Morgan Stanley for only six or seven months before that boom peaked in January 1973. Then, suddenly, there was this dramatic plunge. Between January and December 1973, the market fell by about 46%.

You can imagine what that did to people’s portfolios… and their moods. The Dow topped in January 1973 at just under 1000 points. In August 1982, almost 10 years later, it was at the same level.

But on a real-inflation-adjusted basis, you were down more like 50%.

And there’s another parallel between the 1970s and today. Back then, Fed chairman Paul Volcker was also jacking up interest rates to combat inflation. He pushed rates up to more than 20% at the peak of that cycle.

Jerome Powell, who now runs the Fed, hasn’t pushed it that far. But in both cases, higher rates have been a major headwind for stocks.

Chris: The 1970s are forever associated with high inflation. By 1973, it was running an annual pace of more than 8%. And it didn’t peak until the end of the decade… when it was into double digits. Do you see a repeat of that this time around?

Mason: The most important thing for folks to recognize is that once inflation takes hold of investors’ psyches it’s very hard to get rid of it. Psychology is the culprit. And slaying that culprit is extremely challenging.

I think we’re facing the same kind of “stagflationary” economy we faced in the 1970s. In other words, I see a mix of stubbornly high inflation and low economic growth.

The Fed will do everything it can to soften the blow, especially as it’s an election year next year. But rates will have to stay much higher than most people realize.

The one thing the Fed can’t do is let inflation go unchallenged. So, it will err on the side of caution. It may not rapidly raise rates. But I don’t think they’re going to lower. That means we’re stuck with 5% to 5.5% interest rates.

Chris: A lot of people on Wall Street disagree with you. How can you be so sure the Fed won’t relent?

Mason: I’ll be getting into this in more detail during my special briefing tonight. But my thesis is we’re going to face some difficult crop growing conditions. In fact, there’s a good probability of a drought this year. It may even follow some flooding, like we saw in the Central Valley in California this year.

As you may know, ocean temperatures are now about as high as they’ve ever been. El Niño – a warming of surface waters in the Pacific Ocean – is unusually strong this year. This means heavier rainfall and more risk of flooding.

I mention it because food is the most sensitive category of the Consumer Price Index (“CPI”). And Americans are paying at least two times – maybe three times – what they used to pay for eggs, butter, milk, bread. And thanks to changes in the climate, food inflation is going to be higher for longer than most folks realize.

That’s going to be the bugaboo for the Fed. It’s powerless over the weather and over crop growing conditions. So, I’m expecting higher inflation in certain areas no matter what the Fed does with rates.

Meantime, it will soon be clear that we’re in a recession. Which is why I’ve been warning about a return of 1970s-style stagflation.

Chris: You’ve been putting out market timing research for nearly four decades now. You have all the money you’ll ever need. But you’re launching a new business, New Paradigm Research, where you’ll be sharing your marketing timing insights. That’s an unusual thing to do at your stage in life.

Mason: I’m 75 years old. Some people may think I’m in the twilight of my career. But I’m just starting the third or fourth quarter of the game. I’m inspired by super investor Warren Buffett. He’s 91. And he says he’s never been more productive or incisive. When I’m 91, I want to be running the top-rated financial newsletter in America.

And like I said, Chris, I believe this mission is critical right now. We’re facing dire times over the next 10 to 15 years. And I feel a responsibility to help folks through this time.

I’ve been very lucky in just about every way you can think of. I’ve been married for 46 years. And I have an amazing family. You may know my son Buck has the largest radio program in the country. My other boys are also extremely successful. And my daughter’s a great lawyer. I now also have a grandson.

I’m starting to think more about my legacy for the next generation. I’m able to help people. And I think people are going to need a lot of help.

My research shows that’s what coming now is unlike anything I’ve ever seen. In fact, I often shudder when I think of what’s coming for Americans. It’s going to be very tough for some… especially for folks who are unprepared.

That’s why I hope folks reading this will tune into my briefing tonight at 8 p.m. ET. I’ll be on camera along with my son Buck to reveal my full forecast. I’ll give details of a calamitous event on the horizon… as well as the exact date I believe it will strike.

Chris: Thanks, Mason. I’ll provide that link again for folks who still haven’t signed up. [To secure your spot, RSVP here.]

Mason: Thanks, Chris. I appreciate you helping me get the message out.