Stocks are back.

But did they ever leave?

Yesterday, the S&P 500 rose nearly 2%. The Nasdaq added 2.4%. And the Russell 2000 index of smaller stocks gained over 5%.

Why?

Inflation is tamed…

Or so they tell us. But regardless of what we think of that, if the market wants to be bullish, we darn well better not get in the way.

Because if markets believe the inflation problem is over, there’s no telling how high this market could go.

Besides, maybe it really is over. That’s another reason not to protest too much.

So, we’ll take a closer look at that story. But first, let’s check in on what the markets did today…

Market Data

The S&P 500 closed up .16% to end the day at 4,502.88… the Nasdaq gained .06%, to close at 14,103.84.

For individual stocks, Microsoft closed up .04% to $369.67… Apple ended higher by 0.3% at $188.01… and Tesla ended the day at $242.84, a 2.3% gain.

In commodities, West Texas Intermediate crude oil trades at $76.50… gold is $1,941.70 per troy ounce… and bitcoin is $37,664.

And now, back to our story…

Inflation Is Over. Really?

Yesterday morning, the Bureau of Labor Statistics released the latest inflation data.

It showed that “core” inflation, as measured by the Consumer Price Index, was the same as last month. No change.

Compared to this time last year, price inflation was still up 3.2%.

Considering it wasn’t so long ago – June 2022, to be precise – that price inflation was 9.1%, we can see why markets would be happy.

The question is, does the Federal Reserve have inflation licked?

According to our Director of Research, Jack Kasprzak, the answer could be a big “yes.”

We checked in on some research Jack had shared ahead of this week’s inflation data.

As Jack noted:

A look at the Global Supply Chain Pressure Index (GSCPI) indicates inflation is set to fall.

Unprecedented supply chain disruptions during COVID-19 contributed to the surge in inflation in recent quarters. This situation was quite unusual.

The GSCPI is produced by the Federal Reserve Bank of New York. It measures global supply chain pressures and their impact on economic outcomes.

The main finding of the New York Fed was that global supply factors are very strongly associated with recent producer price index (PPI) inflation and consumer price index (CPI) goods inflation.

Monetary policy is aimed at demand. Higher interest rates are used to dampen demand and cool the economy thus lowering inflation.

Given the disruptions are on the supply side, monetary policy would only have a limited effect on the recent rise in inflation.

So, are supply chain disruptions getting worse or easing? How will this impact the inflation outlook?

Here is the latest GSCPI chart:

Since the late 1990s, supply chain disruptions have been orderly, staying near average, or the zero line on the chart.

During Covid, the level of supply chain disruption erupted. On the chart, you see a spike to more than four, or four standard deviations above average. How rare is this type of event? Mathematically, you would expect this to occur once every 31,560 days, or about one trading day every 126 years.

Now the spike in supply chain disruptions from Covid has completely reversed. And inflation will follow.

His comment on it today? “I told you so.”

Although to be fair, Jack is far too humble to take a victory lap just yet.

But if Jack’s interpretation of the CPI and GSCPI are correct, it suggests the fears of higher interest rates, and therefore potentially falling stock prices are over… at least for now.

It’s Still a Trader’s Market

That explains yesterday’s market reaction on top of the strong rally over the past two weeks.

Tech stocks in particular put on a show. Big winners were stocks like Tesla Inc. (TSLA) up 6.1% and Meta Platforms Inc. (META) up 2.2%. Even one of the superstars of the pandemic, Peloton Interactive Inc. (PTON) had a great day, gaining 16%.

Now, whether this is a sustainable rally or a knee-jerk rebound is anyone’s guess. We won’t know for sure until several months from now.

But if we look at a couple of charts, there could be an argument for either way.

First, check out the Nasdaq chart. It shows the index going back five years:

You can see the November 2021 peak, which marked the end of the pandemic-fueled bull market. And then zooming ahead, you can see the 2022 bear market low, followed by the rally through July of this year.

The recent drop hardly seems worth mentioning when compared to the bigger picture.

Importantly, the markets have made a big deal about the market’s seven biggest stocks – Amazon (AMZN), Apple (AAPL), Alphabet (GOOG), Meta, Nvidia (NVDA), Tesla, and Microsoft (MSFT).

Folks have noted how these seven big stocks – dubbed the “magnificent seven” – led the market higher… and then led it lower.

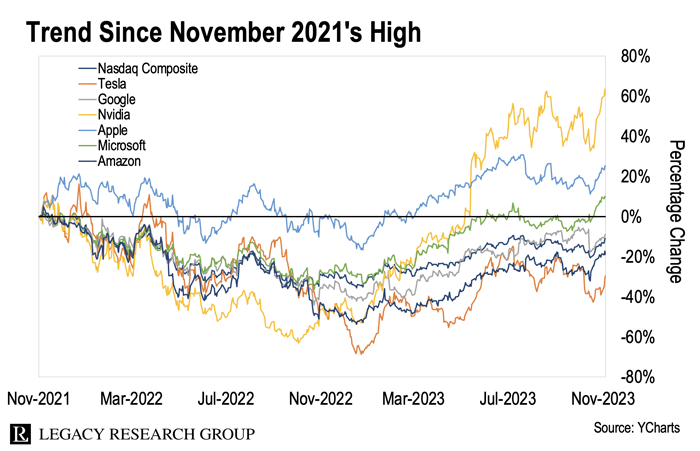

You can see how that played out for each of the seven stocks in the chart below.

It’s a busy chart, with all the lines (although not as busy as one of Mason Sexton’s charts. You can catch up on the presentation he gave last night, and his take on the market’s future right here), but the trend is clear.

The important thing to note isn’t so much the individual stocks themselves, but rather the clear trends since the November 2021 high and last year’s low.

It’s especially worth noting that three of the seven stocks have already surpassed the November 2021 high. The remaining four are down between 11% and 35%.

And given the lightning speed with which tech stocks can move, it would surprise no one if all seven were at new all-time highs within months.

That would mean the Nasdaq reaching a new all-time high too.

How plausible is this? Can the market really spin on a dime this quickly?

Remember, it was barely four weeks ago the markets were worried about all sorts of pain points – inflation, higher interest rates, slowing economic growth, rising unemployment, and so on.

Now one inflation number, following on from the Fed’s decision not to raise rates at its last meeting, and stocks are heading up again.

It’s enough to put an investor in a bind.

But this bull-bear-bull-bear market also explains a lot of things.

For starters, it explains why Legacy’s trading experts and partners have produced some of the most popular content this year.

Guys like Mason Sexton and Phil Anderson with their cycles-trading ideas. And Jeff Clark and Larry Benedict with their more traditional approach of trading these market swings with options – both calls and puts.

It makes sense. Unless you’re making small asymmetric bets (more on this in a moment), investors just don’t want to take the risk of tying up capital longer than necessary.

For all four of the traders just mentioned, you can measure their holding periods in weeks, rather than months.

As an optimist (yes, your editor is an optimist, despite how we may sound sometimes), we’d love to think that the days of buying and holding on for months or years on end have returned.

But based on the evidence, even with lower inflation, and a pause in interest rate rises, it seems more likely that the market will continue to whipsaw up and down for the foreseeable future.

And that’s why trading ideas are likely to remain the most popular among our subscribers, and the most profitable… at least for now.

The Best Asymmetric Bet in Town

We just mentioned asymmetric bets.

Legacy Research’s king of asymmetric bets is Teeka Tiwari.

And the king investment for asymmetric bets is cryptocurrencies.

For most of the past eight years, Teeka has been Legacy’s crypto guy.

He was the first in our industry to pound the table on cryptos like bitcoin and Ethereum. At current prices, readers could be up as much as 9,801% on bitcoin, and 21,976% on Ethereum had they acted on Teeka’s recommendation back in 2016.

Cryptos really have taken over from small-cap stocks in terms of market rebound speculations.

The tiny investment amounts along with the big potential gains mean that you can put up as little as $100 or $200 and still have the chance for a meaningful, life-changing return.

But what’s next for crypto, and bitcoin in particular?

For many, it has overtaken gold as the hedge-against-uncertainty trade. That – along with the prospect of an SEC-approved bitcoin ETF – saw bitcoin move from $26,000 to $38,000 over the past few weeks.

After yesterday’s CPI number, Bitcoin today trades at nearly $38,000.

As for the smaller cryptos, they’re down too. But don’t lose sight of the bigger picture. As Grayscale Bitcoin Trust CEO, Michael Sonnenshein tweeted yesterday on his X.com account:

[I]t’s been a ten-year dress rehearsal. [W]e’re ready for the main event.

Does he know something the rest of the market doesn’t know?

We’re sure we’ll find out soon enough.

Unconnected Dots

Our main task at The Daily Cut is to try to “connect the dots.” That is, we help you figure out what events are about, what makes them important, their consequences, and what it all means for you.

But sometimes, we see the individual “dots,” but can’t yet figure out how they connect to anything. Maybe they never will connect to anything.

Regardless, if those unconnected dots feel as though they could be important, we’ll mention them here. And we’ll let you draw your own conclusions.

Today’s unconnected dots…

-

More proof supporting Teeka’s view that bitcoin and cryptocurrencies are heading towards total mainstream acceptance.

This from Bloomberg:

Commerzbank AG has received a crypto custody license, providing more evidence that European banks are growing warmer toward the asset class.

The license will allow the bank to ‘build up a broad range of digital asset services, with particular emphasis on crypto assets,’ the Frankfurt-based bank said in a statement on Wednesday. It’s the ‘first German full-service bank’ to get the license, it said.

It’s just like Teeka’s always said… bitcoin will survive and thrive no matter what happens in the short term.

Despite the crypto naysayers who have claimed from the start that bitcoin is nothing more than the digital equivalent of Monopoly Money… crypto adoption has climbed steadily higher.

So, as it continues to find its way into the traditional financial system… and with a bitcoin ETF on the horizon… now is a great time to get into crypto before it goes fully mainstream.

As always, we’ll keep you posted on any developments.

More Markets

Today’s top gaining ETFs…

-

Amplify Transformational Data Sharing ETF +3.8%

-

Siren Nasdaq NexGen Economy ETF +3.4%

-

KraneShares MSCI China Clean Technology ETF +2.1%

-

Global X MSCI China Consumer Discretionary ETF +1.9%

-

Invesco S&P Ultra Dividend Revenue ETF 1.6%

Today’s biggest losing ETFs…

-

ProShares High Yield – Interest Rate Hedged -1.8%

-

iShares MSCI Japan Value ETF -1.8%

-

Invesco KBW Property & Casualty Insurance ETF -1.0%

-

Cambria Foreign Shareholder Yield ETF -0.9%

-

Goldman Sachs ActiveBeta Japan Equity ETF -0.9%

Mailbag

If you have any questions or comments for our experts here at Legacy Research, we’d love to hear from you.

Write to us at [email protected] and just type “Daily Cut mailbag” in the subject line.

Cheers,

|

Kris Sayce

Editor, The Daily Cut