If you’re new to markets, you may not know how lucky you are.

For decades, there were two separate markets…

One for the rich, powerful, and well-connected.

The other for the “little guy.”

It’s not that the little guy didn’t make any profits. But the wealthy insiders made sure they took the lion’s share.

As you’ll see today, that’s finally changing.

Thanks to two key innovations, power is shifting away from Wall Street and other big-money elites… toward regular investors like you.

And it’s creating new opportunities for you to profit from traditional stocks and bonds.

So today, I’m going to skip over Joe Biden’s inauguration. You’ll find wall-to-wall coverage of that in the mainstream media and on Twitter.

Instead, I’m shining the spotlight on two opportunities that tip the playing field in your favor… and away from wealthy elites.

Together, they prove it’s never been a better time to be an everyday investor.

I know you’ve heard from me a lot on this subject. But it’s not every day a brand-new asset class open to everyone emerges from a white paper.

But that’s what happened after somebody (or a group of people) using the pseudonym Satoshi Nakamoto published a white paper in October 2009.

It was about a “purely peer-to-peer version of electronic cash [that] would allow online payments to be sent directly from one party to another without going through a financial institution.”

Bitcoin – the online cash system the white paper gave birth to – was the world’s first cryptocurrency. It was worth $0 back then.

Today, one bitcoin will set you back $35,000. And the bitcoin market cap – the sum value of all the bitcoins in circulation – is $650 billion.

That makes bitcoin more valuable than payment network titans such as Visa (V, $444 billion) and Mastercard (MA, $325 billion)… and emerging fintech heavyweights such as PayPal (PYPL, $290 billion) and Square (SQ, $103 billion).

Bitcoin’s network has grown larger than even major banking institutions such as JPMorgan Chase (JPM, $421 billion) and Goldman Sachs (GS, $101 billion).

As colleague and world-renowned crypto investor Teeka Tiwari has been showing his readers, crypto is about a lot more than just currency.

It has the potential to disrupt everything from real estate transactions… to international trade finance… to Wall Street itself.

And here’s the thing… With crypto, you don’t need to go through Wall Street investment banks or brokers to get involved.

Anyone with a bank account can go straight to an online exchange and trade their dollars for crypto. And they can store their crypto in a digital wallet without needing a bank or custodian.

It’s a brand-new asset class that’s blowing away the gains on offer in stocks and bonds.

Just take the top open recommendations in Teeka’s Palm Beach Confidential advisory. It’s focused exclusively on the opportunity in crypto since April 2016, when Teeka first recommended bitcoin.

Since then, bitcoin (BTC) is up nearly 10,000%. And ether (ETH), the world’s second-most valuable crypto asset, is up 15,193% since Teeka added it to the model portfolio in the same month.

That’s not even the highest gainer. NEO (NEO), a Chinese crypto project Teeka recommended in February 2017, is up 21,002%.

That’s enough to turn every $10,000 stake into $2.1 million.

Most rookie investors don’t stop to think about it. I know I didn’t when I was starting out as an analyst 20 years ago in London, England.

But companies issue shares before they list on a public stock exchange such as the New York Stock Exchange or the Nasdaq and become available in your brokerage account.

IPO day is the first day a company’s shares become available on a public stock exchange.

And buying before an IPO can be highly lucrative.

Take some of the highest-profile IPOs of the last 25 years.

Main Street investors made 31% the first day Amazon.com (AMZN) went public in 1997. And investors who bought Google (GOOG) on IPO day in 2004 saw an 18% gain.

But those are table scraps compared with what investors who bought before the IPO earned.

Pre-IPO investors in Amazon gained 9,165%… and Google’s early investors saw a 1,500,000% return on IPO day.

For a more recent example, take ride-hailing company Uber (UBER). Silicon Valley insiders made a 64,200% gain when the company went public on May 10, 2019.

Since then, Main Street investors who bought at the best available price after Uber IPO’d are up just 36%.

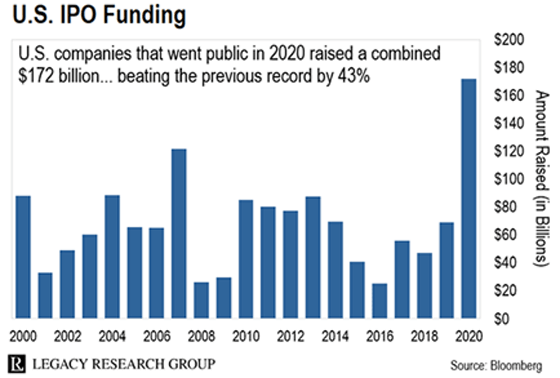

Last year was a record year for IPOs in the U.S.

A total of 552 companies listed on public exchanges. They raised a total of $172 billion. That’s 43% greater than the previous record IPOs set in 2007.

And both Teeka and our tech expert, Jeff Brown, predict a record year for IPOs again in 2021.

Pre-IPO deals have traditionally been the exclusive domain of billionaires and ultra-connected insiders.

Gazillionaires such as early Facebook investor Peter Thiel of Founders Fund… Amazon.com founder Jeff Bezos and his VC firm Bezos Expeditions… or Steve Schwarzman of Blackstone.

And the law explicitly said you couldn’t get in, unless you were an “accredited investor.”

These are folks who’ve made more than $200,000 in annual salary for the past two years… or made $300,000 in joint annual salary over the past two years… or have $1 million in net worth excluding their primary residence.

But in 2012, President Barack Obama signed the Jumpstart Our Business Startups Act (or JOBS Act). This set in motion laws to let everyday investors buy shares in startups.

And since 2015, anyone can buy into early-stage companies through something called Regulation A+ deals.

Regulation A+ deals mean startups can appeal to regular investors to give them cash in return for shares before they list on an exchange.

This is the type of deal Teeka has used at our elite Palm Beach Venture advisory to give his readers the chance to make 174% on a startup cannabis company.

He first recommended the company when it was still in private hands at $0.50 a share in June 2019. It IPO’d at $0.75 a share in November 2020.

At this writing, it’s trading at $1.37 a share.

The fact is many won’t be. Figuring out which companies to back… and which to avoid… means the difference between financial freedom and losing your shirt.

There’s too much to get into here. But you can learn more about how to tell the difference between potential winners and losers in the free training event Teeka is hosting next week.

He says it comes down to knowing which of two IPO paths to follow…

The first path he calls “The Hype Hole” path. This is full of overhyped IPOs you want to steer clear of.

The second path is what Teeka calls “The Blueprint” path. These are the kind of pre-IPO opportunities you want exposure to.

And on Wednesday, January 27 at 8 p.m. ET, he’s hosting his Freedom 2021 event all about it.

Teeka will give you the training you need to be able to tell the difference between an IPO that can financially free you this year… versus a “Hype Hole” IPO that can put your financial freedom on hold for decades.

He’ll also unveil how you can access his next “Blueprint Path” IPO. So make sure you sign up here to attend.

Regards,

|

Chris Lowe

January 20, 2021

Bray, Ireland