Chris’ note: Tonight at 8 p.m. ET, former global investment banker Nomi Prins will unveil a proprietary new strategy she’s been developing and perfecting for the last two years.

It’s based on the same type of strategy that big banks paid her millions to develop during her 15 years on Wall Street.

It can help you 10x your money – whether the markets go up or down. And with markets plunging since the start of the year, it’s especially important for you to tune in.

There’s still time for you to secure a spot at Nomi’s special briefing here. Then read on below to learn how well her strategy held up at the height of the COVID-19 pandemic…

What I’m showing you today is disturbing…

But it’s something I think every American deserves to know.

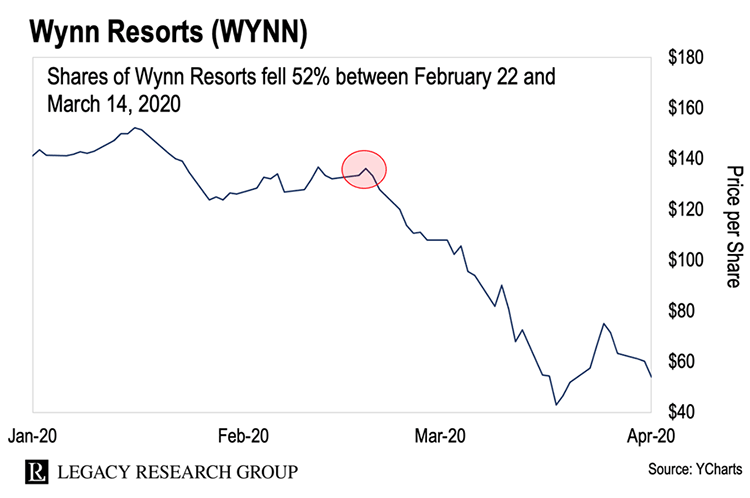

First, look at this chart. It shows shares of Las Vegas casino operator Wynn Resorts (WYNN) in early 2020.

Shares climbed fairly steadily during the first half of January. But in mid-February 2020, I got what I call a “distortion signal” (the red circle on the chart).

It told me that big players on Wall Street and Washington were likely moving cash out of the stock.

This was right before the COVID-19 pandemic took off in the U.S. At the time, most people weren’t worried.

But this distortion signal said it was time to get out of Wynn Resorts.

Then, once everyone realized we were dealing with a pandemic that would shut down the whole world, Wynn Resort shares collapsed.

In just three weeks, they fell more than 50%.

Months later, news broke that four senators had dumped stocks while they got daily briefings about COVID – but before markets began sinking.

They managed to move millions of dollars out of stocks before the markets plunged more than 30%.

That’s shocking. But it’s nothing compared to what happened after the COVID crash…

New Signals

Many distortion signals appeared in April 2020. Especially in tech stocks like Google (GOOG), Amazon (AMZN), Apple (AAPL), and chipmaker Nvidia (NVDA).

But this time, the signals weren’t telling us to get out. They were telling us to get in – because money was about to flow heavily into these stocks.

For example, from February 20 to March 23, Google fell 34%.

But on April 6, my system flashed a distortion signal (the red circle on the chart below). It said money was about to flow into Google. Over the next five months, shares shot up 45%…

About a year later, Fortune broke this story:

House Speaker Nancy Pelosi’s husband cashed in on Big Tech just as Congress was set to pounce.

Around the same time the distortion signal appeared on Google, Nancy Pelosi’s husband was betting big on tech stocks.

He bought shares of Google after the crash. From that trade alone, he made $5.3 million.

These examples I’ve shown you have one key thing in common…

By the time the rest of America knew what was going on, it was too late to profit.

But it doesn’t have to be that way anymore…

Leveling the Field

For the past two years, I’ve been testing a new strategy based on these distortion signals.

It can help you get ahead of these big market moves… and 10x your money, sometimes in just a few weeks.

If you’re skeptical about that in 2022, I don’t blame you.

This week, the S&P 500 officially entered bear market territory – a peak-to-trough fall of 20% or more. It’s down about 22% year to date.

The Dow is down 17%. And the tech-heavy Nasdaq is down nearly 31%.

But my strategy works even when markets are down overall.

I tested it with a small group of readers in 2020, in the middle of the COVID crash. It was the fastest crash in history.

While most people were losing their shirts… those readers had a chance to 8x their money in less than a month on a play on Wynn Resorts.

That’s a 700% gain – while U.S. markets were plummeting more than 30%.

These readers also had a shot at gains of 181%, 200%, and 468% – sometimes in just a few weeks – using my strategy during the COVID crash.

Of course, not every distortion signal will result in similar gains. But the 2020 data tells me this strategy works ideally in choppy markets like today’s.

To be clear, my goal with this system isn’t to expose the political elite.

My main aim is to help everyday folks level the playing field.

And that’s crucial in these distorted times if you want to get ahead…

Great Distortion in Overdrive

The examples I showed you above are symptoms of The Great Distortion I’ve been warning you about in the Cut this week.

It’s the massive disconnect between the markets and the real economy.

In 2008, the Federal Reserve started creating trillions of dollars out of thin air. In the final three months of that year, it created $1.3 trillion.

Nobody had fabricated so much money so quickly before. Some people thought the Fed had gone mad.

But it was nothing compared to what happened in the aftermath of COVID.

In 2020, the Fed threw out its last semblance of monetary sanity. From mid-March 2020 to mid-June 2020, it churned out $2.8 trillion.

That’s about $31 billion coming out of thin air every day for three months.

And in the two years since then, the Fed has created another $1.7 trillion.

This has sent The Great Distortion into overdrive.

Consider this…

In the U.S. alone, billionaires’ combined wealth has risen over $1.7 trillion since the pandemic started in 2020.

Meanwhile, middle-class folks got crushed. Sixty percent of U.S. small businesses that had to close during the COVID lockdowns never recovered.

This is exactly what I mean when I talk about The Great Distortion.

And all those trillions of dollars the Fed created are still in circulation… contributing to today’s market volatility.

But I’m afraid things are about to get a lot worse.

An event in August could trigger the next chapter of The Great Distortion… and create a $4 trillion market shock.

Most of that money will go to those at the top of the financial and political food chains – just like we saw during the pandemic.

But if you know what to do, you could wind up with plenty in your pocket, too.

To show you how, I’m holding a special briefing tonight at 8 p.m. ET.

I’ll reveal the strategy I’ve been perfecting for the past two years.

It’s the same type that big banks paid me millions to develop during my 15 years on Wall Street.

And it can help you grow your wealth whether the markets go up or down.

I can’t guarantee a win or a triple-digit gain similar to our 2020 results each time. But I can help make today’s choppy markets work for you, not against you.

For all the details on how my strategy works… and how we’ll use it to level the playing field amid all this distortion… I encourage you to join me later.

To thank you for attending, I’m giving away a free recommendation. It’s one my strategy is flashing a “buy” on today… and with the potential to double your money.

To make sure you don’t miss my briefing, go here to reserve your spot. I’ll see you there.

Happy investing,

|

Nomi Prins

Editor, Inside Wall Street With Nomi Prins

Chris’ note: The Fed just announced an interest rate hike of 0.75%. In tomorrow’s dispatch, you’ll hear more from Nomi on what that means for inflation… markets… and your wealth.