Another “rubber band” has snapped back…

One way to profit in a bear market is by betting on the rubber band snapping back.

That’s how master trader Jeff Clark describes his core trading strategy.

If you stretch a rubber band too far in one direction, it snaps back. That’s what happens in markets, too. If an asset’s price goes too far away from its average – in either direction – it snaps back.

And we just saw the rubber band in action in the gold market.

Gold got off to a rocky start this year…

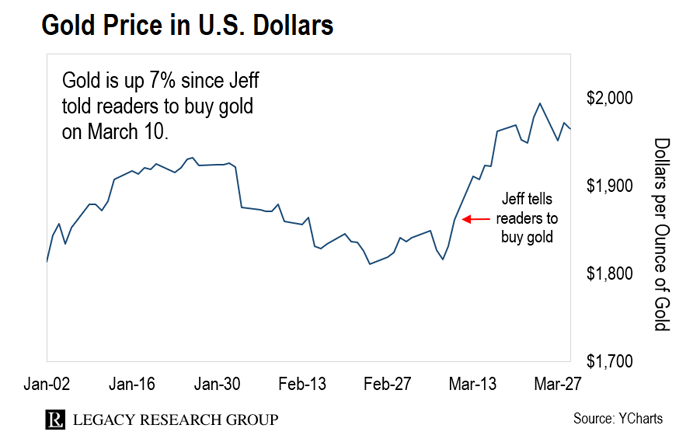

From its peak of $1,930 on January 26, it slid to a low for the year of $1,826 on March 7.

And sentiment on gold was banged up after its lackluster performance last year when inflation was raging.

But on March 10, Jeff penned a bullish alert on gold to readers of his Market Minute e-letter…

Gold bugs – those diehard fans of the precious metal – are once again in the all-too-familiar position of watching gold underperform the stock market.

But that may be about to change…

The recent decline has created a potentially bullish reversal pattern on the chart.

Here’s what happened next…

Gold is up 7% since Jeff’s call. And as you’ll see today, it’s not the only successful call he’s made based on the rubber band effect.

So today, let’s take a closer look at how this works. And why it’s been such a powerful strategy during the recent market turmoil.

First, an important warning…

Most traders talk in jargon…

So, they can be hard to follow – especially if you’ve just started your wealth-building journey.

That’s what I love about Jeff. He keeps it simple.

That’s where the “rubber band” comes into play. A simple way to grasp how stocks move over the short term, he says, is by picturing a rubber band. Jeff…

My trading strategy revolves around finding emotionally overbought and oversold conditions that are ready to reverse – or snap back.

Think of those conditions as a stretched rubber band. We can all tell when a rubber band has been stretched close to the limit. The rubber at the center of the band stretches thin. Its color fades. It even starts to vibrate just a bit. That’s usually when it snaps back.

The same goes for the stock market. Back to Jeff…

When you’re trading stocks, it’s harder to tell when the snapback is coming. But there are clues…

Stock prices stray far away from their long-term averages. The technical indicators I watch on the charts reach extreme conditions. And TV’s talking heads all pile onto the same side. That’s when the logical-thinking trader decides it’s time to bet on the rubber band snapping back.

That doesn’t mean every trade Jeff recommends is a winner. But the rubber band effect puts the odds in his favor.

That’s why Jeff has had some of his best years as a trader when stocks were in a bear market.

During bear markets, volatility tends to spike…

The snapbacks from overbought and oversold conditions tend to be even more dramatic than in bull markets. This amplifies the potential gains traders can make.

It’s what allowed Jeff to nearly double his net worth during the dot-com collapse – with a single trade.

And during the 2007–2009 bear market, he handed his subscribers the chance to make transformative wealth.

At the time, Jeff helmed a trading advisory called The S&A Short Report for newsletter industry legend Porter Stanberry. Here’s what Porter wrote about Jeff’s track record on January 29, 2009…

Jeff’s trading this year in The S&A Short Report was nothing short of heroic. He made 52 recommendations – all of them short-term trades. Out of these, 42 made money. A win rate of more than 80% in options trading is ridiculous. The average return of every trade was a bit more than 31%.

That’s outrageous when you understand the short duration of these trades and the turnover in the portfolio. How outrageous? The cumulative total return was greater than 1,700%.

You may think trading a bear market is risky…

I get that. A lot of rookie traders blow up their accounts due to risky bets.

But Jeff has been a professional trader for more than 40 years.

And as he’s been spreading the word on in the 15 years since he launched his first trading advisory, you can use options contracts to reduce your risk of losses.

Think of options contracts as side bets on stocks.

You don’t have to own the stock itself to profit when it moves. You can buy a call option on that stock if you want to profit as its price rises. And you can buy a put option on a stock if you want to profit as it falls in price.

And you risk less money to control a stock in the options market than you do buying it directly. As Jeff explains it…

Let’s say you want to buy stock in Company X. It trades for $10 a share. So, you could spend $1,000 to buy 100 shares.

But you can control the same number of shares with one call option contract. You can buy that call for, let’s say, $50… and leave the other $950 in your account.

If Company X’s stock goes up, you’ll make money. If the stock goes down, the most you can lose is the $50 you spent to buy the call. That’s a 100% loss. But it’s a lot less in dollar terms than losing, say, 20% of the $1,000 you risked buying the stock. That would set you back $200.

That makes options a low-risk, high-reward way to trade the volatility that kicks up in bear markets.

Jeff sees even more volatility ahead…

He’s predicting a historic market move on par with March 9, 2009 – the bottom of a 60% plunge in the S&P 500.

During similar events in the past, his subscribers had the chance to close out trades for gains of 1,391% in 78 days… 1,263% in 68 days… even 1,285% in just 48 hours.

To help prepare you this time around, he’s hosting an online briefing all about it next Wednesday, April 5, at 8 p.m. ET. He’ll also share a free recommendation you can start trading immediately.

One of the stocks you’ll hear about from Jeff is a gold stock. He’s helped his readers close 30 trades for gains of 100% or more on this stock. So, go here to automatically sign up. It will be worth your time tuning in.

Regards,

|

Chris Lowe

Editor, The Daily Cut