It’s almost as though the Fed wants to torch the banks…

Since it started hiking interest rates last March, depositors have yanked $600 billion out of smaller and mid-size U.S. banks.

That’s the fastest outflow deposits from U.S. banks on record.

As a result, banks have had to scramble for cash… or risk triggering runs on deposits. This is what caused Silicon Valley Bank and Signature Bank to collapse earlier this month.

But that’s not the only way the Fed has hurt the banks.

Basic bond math means that higher rates lead to lower bond prices. Banks hold trillions of dollars in rate-sensitive bonds on their books. This is causing their valuations – and their share prices – to crater.

The Fed is both arsonist and firefighter when it comes to the blaze at the banks.

It’s the main bank regulator in U.S. It has a legal duty to make sure the system runs smoothly. But its rate hikes have kicked off the worst banking crisis since 2008.

So, is Fed chief Jay Powell stupid? Or is he doing this on purpose?

And what does it mean for markets – and our money – if the person charged with protecting the banks is actually their worst enemy?

Powell has three main missions at the Fed….

He’s responsible for overseeing the banks… helping the U.S. achieve maximum employment… and keeping inflation at bay.

And of these three roles, the most pressing right now is the fight against inflation.

No central banker wants to be remembered as the one who let the inflation genie out of the bottle.

The most standout example was Paul Volker. He took over as Fed chief in 1979. And his No. 1 priority was to get the double-digit inflation of the 1970s under control.

Volcker jacked up rates to 20%. This triggered the devastating 1981–1982 recession.

Things got so bad protestors burned him in effigy on the Capitol steps. Others marched on the Fed. And full-page ads began appearing in major newspapers denouncing his inflation-fighting policy.

But Volcker continued with his grim task. Inflation fell from 1980 through 1983 before stabilizing for the remainder of the decade.

And Powell is no different…

Everything he’s said and done over the last 12 months shows he’s equally committed to bringing inflation under heel.

That includes using the banks to do his dirty work…

Inflation is caused by too much money chasing too few goods and services. The way to get it under control is to curb spending.

That’s why the Fed hikes rates when inflation takes off. The idea is to make bank lending more expensive and reduce demand for loans.

But there’s another, more sinister, way to bring lending down… kick off a banking crisis.

It’s something colleague and former hedge fund manager Teeka Tiwari has been exploring with his readers…

As a result of the losses on banks’ bond portfolios, they’ll seek to keep capital buffers high and new loan risk low. This will cause a slowdown in lending. And when banks dramatically reduce the availability of loans, it’s called a “credit crunch.”

During these periods, loans become much tougher to get. And the rates banks charge on borrowing rises to compensate for the risk of lending in this kind of environment.

That makes it harder for folks to buy new homes and cars. It also makes it harder for businesses to hire new employees… open new offices… and build new plants. This slows the economy and makes a recession more likely. It also slows spending.

Teeka calls this a “stealth rate hike”…

Powell is a smart guy. He knows a credit crunch will do much of his inflation-fighting work for him. Some estimates I’ve seen show that a credit crunch could be the equivalent of a one-and-a-half-point interest rate hike.

It’s like a stealth rate hike. Powell is putting the burden of slowing spending on the nation’s banks. That allows him to bring inflation under control faster than he’d be able to do with rate hikes alone.

It’s no wonder bitcoin has been rallying…

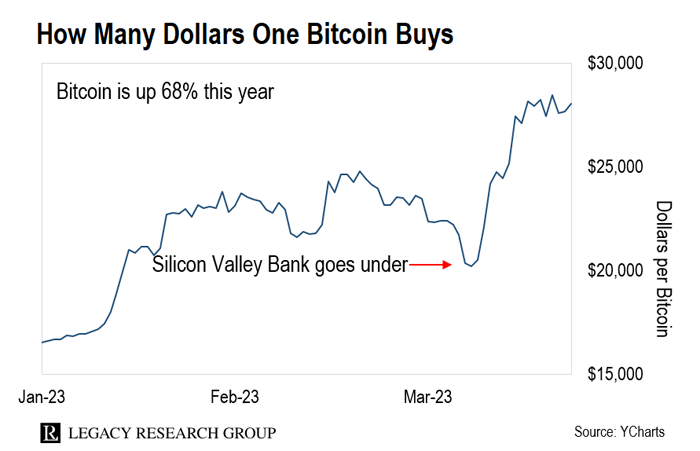

The world’s first decentralized currency had a brutal 2022. It fell as much as 76% from its all-time high of $67,617, which is set in November 2021.

But it’s up 37% since the banking crisis began.

And it’s up 68% this year. That makes it the best-performing asset of 2023.

That makes sense. Bitcoin was born out of the ashes of the 2008 banking crisis. The idea was to give people a way to store their cash… and transact with each other… without having to trust unstable banks.

When we say we have our money “in the bank,” what we mean is we have an IOU from the bank for that amount.

And banks don’t keep enough cash on hand to cover all deposits. We have to trust they’ll honor that agreement…. which doesn’t always work out so well.

Here’s bitcoin’s creator, Satoshi Nakamoto, in the white paper he published in 2008…

Commerce on the Internet has come to rely almost exclusively on financial institutions serving as trusted third parties to process electronic payments. While the system works well enough for most transactions, it still suffers from the inherent weaknesses of the trust-based model. […]

What is needed is an electronic payment system based on cryptographic proof instead of trust, allowing any two willing parties to transact directly with each other without the need for a trusted third party.

That’s why bitcoin is decentralized. It gets rid of the need for banks to sit in the middle of all transactions.

And without banks, there are no bank runs.

That’s why Teeka is so bullish on bitcoin…

Millions of people are awakening to this reality. As a result, he says billions of dollars will flow from unstable banks into bitcoin.

Sure, bitcoin is volatile. Its value bounces around a lot. But every time it’s crashed, it’s gone on to new all-time highs.

And you can self-custody your bitcoin in a wallet app on your phone. That means your funds are yours no matter who goes bankrupt… or what’s going on in the economy.

And you don’t have to worry about whether the government will step in if the bank you’re with starts to wobble.

In the U.S., you’ll likely to get your money back if a bank gets in trouble. But imagine you’re trying to save for retirement in a country where you can’t trust the government to rescue the banks. Or maybe you’re in a country where the government has a habit of seizing assets.

Then bitcoin becomes a no-brainer.

But bitcoin is NOT Teeka’s top crypto pick right now…

It’s set to be a huge beneficiary of this banking turmoil. And he says it will go much higher from here.

But for the really transformative gains, he says you want to target a tiny subsector of the crypto market about to be hit by a “buying panic.”

If you don’t own these coins, you’ll get wiped out as the broad crypto market (excluding bitcoin) gets crushed. But if you do, you’ll have the potential to make a killing from this buying panic.

Unlike most cryptocurrencies, these coins are programmed to pay you monthly income on top of capital gains. And they’re set to benefit from a surge of activity coming to one of crypto’s largest networks as early as next month.

During a special event he hosted last week, Teeka explained what the catalyst behind this panic is… and what types of tokens will benefit from it. For a limited time, you can stream it right here.

Regards,

|

Chris Lowe

Editor, The Daily Cut