It’s one of the biggest mistakes you can make as an investor…

When stocks are crashing, like they have been over the past year, it’s tempting to sell out and sit in cash instead.

Cash makes you feel safe. And in the hours and days after you sell your stocks you’ll feel a huge sense of relief.

Nobody likes to see the value of their stocks fall. And it’s especially hard when they don’t just fall… but plunge.

That’s what happened in 2000 and 2001 after the dot-com bubble burst. The S&P 500 plunged as much as 49%

It’s also what happened in 2008, following the subprime mortgage crisis. The S&P 500 plunged as much as 56%.

It also happened after the COVID-19 pandemic hit the U.S. in early 2020. The S&P 500 plunged by 31% in just over a month.

Still, trying to avoid the pain by selling your stocks would have been a terrible idea… every time.

Before we look at why, it’s critical you understand something very important about bear markets.

They’re a feature, not a bug, of the stock market…

There have been 27 of them since the 1929 Crash.

And they’ve taken the blue-chip S&P 500 down an average of 35%.

If you’re like millions of Americans, a large chunk of your nest egg is in stocks. Seeing your savings take a hit like that is agonizing.

You get to a point when the headlines get so scary… and the losses become so steep … that you just want out.

But selling your stocks and sitting in cash only makes things worse.

Once you go to cash, you get trapped there…

Investors have this naïve idea that they’ll just go to cash for a while. Then once the coast is clear, they’ll get back into stocks.

The problem is that by the time the next bull market swings around… and you feel confident owning stocks again you’ll have missed most of the gains.

It’s all in a study by investment company The Hartford.

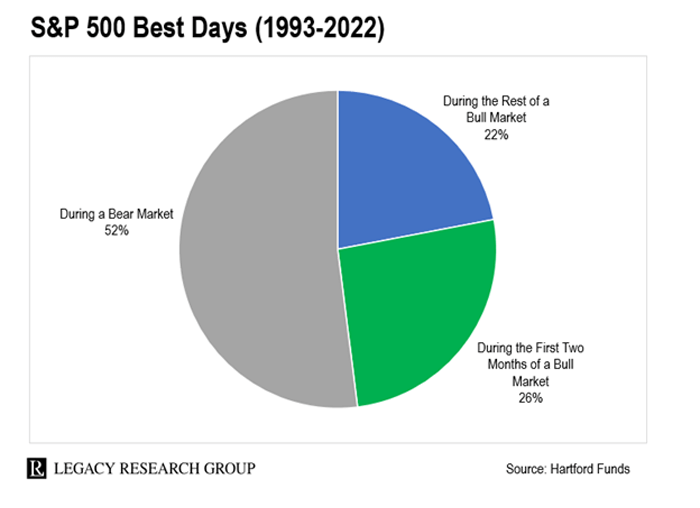

It shows 78% of the 50 best days for the S&P 500 happen during bear markets and the first two months of new bull markets.

And only 22% of the best days for stocks happen in the rest of the bull market.

Catching those big “up days” is crucial for building wealth…

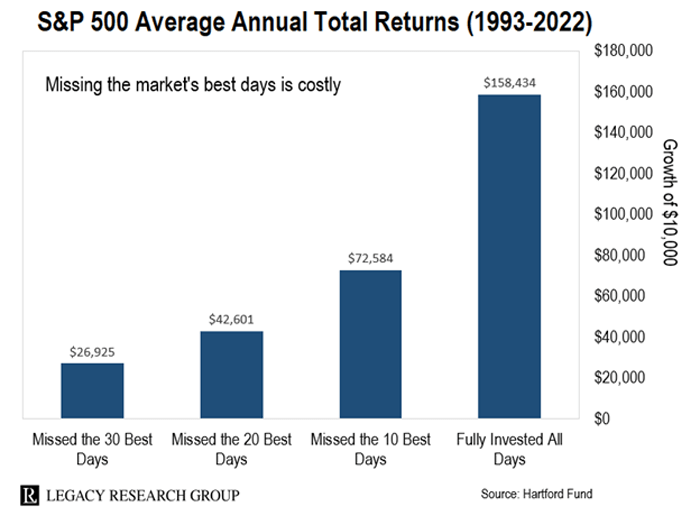

Missing out on the market’s 10 best days over the past 30 years would have cut your returns in half.

And missing the best 30 days would have slashed them down by 83%.

If you stayed invested in stocks from 1993 to 2022… and didn’t panic during the six bear markets over that time… $10,000 invested in the S&P 500 would have turned into $158,434.

That drops to $72,584 if you missed the best 10 days… and $26,925 if you missed the best 30 days.

That’s why it’s crucial you hear master trader Jeff Clark’s message…

He says we’re about to see a stock market opportunity similar to what we saw in March 2003 and March 2009 – the last two major bear market bottoms.

At that point, the potential gains in the market will dwarf the yield on cash in your bank account… or even bonds.

And when Jeff makes a big call like this, it’s worth paying attention.

As regular readers will know, Jeff has been trading professionally for more than 40 years.

He used to manage money for celebrities, entrepreneurs, and Silicon Valley moguls. Now, he helps everyday investors make money trading at his Jeff Clark Trader advisory business.

You’ll often hear me call Jeff our “bear market guru.”

In 2008, for example, he helmed a trading advisory called The S&A Short Report. He made 52 short-term recommendations – with an 80% win rate.

The average return of on these trades was 31%.

And so far this year at his Delta Report advisory, he’s notched an 88% win rate.

Over to Jeff for more on the opportunity ahead…

I don’t want to minimize the pain your readers have been through over the last year. If you’re a buy-and-hold investor, your nest egg almost certainly took a hit.

If you have the cash and the courage to buy stocks when they’re selling at the bargain counter, you can do very well. That’s because the lower the price you pay to own a stock, the higher your expected returns.

Many investors suffer in bear markets and do the wrong thing. And that’s such as shame. Because if you learn how to navigate them, you can turn bear markets into powerful wealth-building opportunities.

In the final stages of a bull market too much money chases stock prices higher. This pushes valuations to nosebleed levels. Bear markets correct these excesses.

Jeff will reveal exactly how the market bottom will play out… and the best sectors to profit from the upswing… this Wednesday, April 5, at 8 p.m. ET.

He’ll also show you how to capture triple-digit trading gains using the same strategy that’s led to an 88% win rate this year.

He’ll even share a free trade recommendation with the potential to double your money in a matter of days.

So make sure to clear some time in your schedule and reserve your spot, with one click, go here.

Regards,

|

Chris Lowe

Editor, The Daily Cut