The first came last Friday. That’s when news broke that President Trump had tested positive for COVID-19.

It sent U.S. stock market bellwether the S&P 500 skidding 2%.

Then the second surprise hit…

Investors were betting President Trump would push for another round of coronavirus stimulus after he was discharged from the hospital.

Instead, he said he was pulling out of stimulus talks. As he tweeted before the closing bell on Wall Street yesterday…

I have instructed my representatives to stop negotiating until after the election when, immediately after I win, we will pass a major Stimulus Bill that focuses on hardworking Americans and Small Business.

The S&P 500 dived on the news. Take a look…

Trump has since tweeted that he wants the House and the Senate to pass a relief bill for the airline industry… and stocks have rebounded today.

But it’s yet another reminder of what I (Chris Lowe) have been warning you about this week… October is typically a highly volatile month for stocks. So you need to have a game plan.

It’s for good reason…

As I showed you Monday, the three most devastating stock market crashes in modern history – in 1929, 1987, and 2008 – all occurred in October.

So have half of the 10 worst single-day losses for the S&P 500.

Throw in that stocks have dropped going into every one of the last seven presidential elections… and October 2020 is likely to be even more full of surprises than usual.

We make poor decisions when we’re scared. So it’s important to stay rational when stocks start to bounce around.

That means putting a long-term plan in place when markets are calm. Then sticking with it through the bumps and shocks along the way.

If you’re invested in stocks, you’ll experience both… in spades.

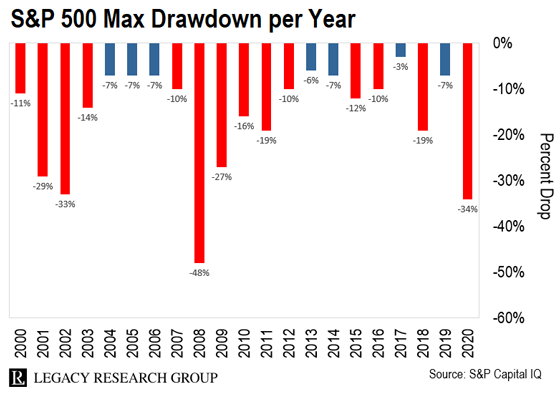

As you can see, over the past 20 years, the S&P 500 has fallen 20% or more in a year 5 times. And it’s fallen as much as 10% or more in a year 14 times.

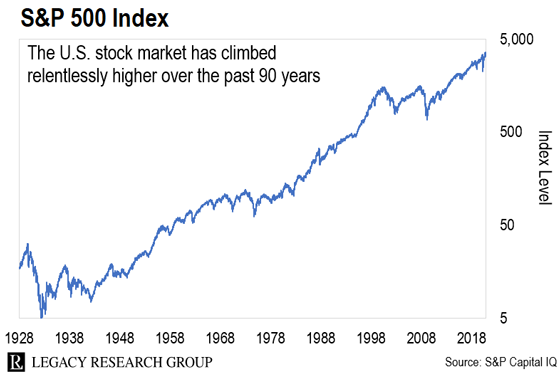

But here’s the thing… If you stick with stocks for the long term, the payout for stomaching all that volatility is worth it.

Take a look.

As you can see, over the past 90 years, the market has had some sharp downturns. But it’s still climbed relentlessly higher overall.

In February and March, investors started to figure out that the coronavirus pandemic was going to throw a wrench in the economy.

The news headlines were so scary… investors stampeded for the exits at once. These sellers were so keen to offload their shares, they were willing to accept lower prices.

It’s natural to panic and sell along with the crowd. But as Teeka Tiwari put it in our March 17 dispatch, it’s also a mistake…

I implore you to leave your long-term investments alone. If you try to get smart with your long-term money, you’ll fritter away your capital. And you’ll likely cause yourself an extra five to seven years of work just to recoup your losses.

Hear me when I tell you this: The best action to take in your long-term account is to do nothing.

I hope you tuned in and our campaign to spur you into action worked. After plunging 34% in 23 trading days, the S&P 500 bottomed on March 23 – a week after Teeka’s appeal. Since then, it’s up 52%.

That’s according to Jason Bodner, who heads up our Palm Beach Trader advisory.

Before joining the Legacy team, he was one of the few people on Wall Street authorized to make billion-dollar-plus trades.

Jason spent two decades at some of Wall Street’s most prestigious trading firms, Cantor Fitzgerald and Jefferies. He’s had a ringside seat to dozens of highly volatile market phases like the one we’re heading into.

And here’s what he just told his readers…

It’s natural for most investors to panic out of stocks when an October surprise hits and it seems like the whole world is crumbling. But selling a quality stock because of a seemingly disruptive news event is almost always the wrong thing to do – especially if it hasn’t hit your stop.

It’s a weak-hands move. It’s what the big money wants you to do so they can scoop up your shares at a discount.

Staying calm is critical… Because over the long term, U.S. stocks are one of the best investments on the planet. Jason again…

Unforeseen events will happen. Sometimes they’re scary, and cause anxiety or panic. Sometimes they tempt us to take our chips off the table too early.

But in the end, the best defense is a good offense. I believe in America and the power of American ingenuity and fortitude. That means I believe in buying and holding great stocks when the opportunity presents itself.

So, if we get more surprises this October – and I believe we will – keep Teeka’s and Jason’s advice in mind.

So keep your long-term plan front and center on your radar… and remember volatility is par for the course with stocks.

Your goal as a wealth builder is to stay invested in quality stocks over the long run. If you let short-term bouts of volatility shake you out of your holdings, you can’t reap the rewards that come to more patient investors.

Regards,

|

Chris Lowe

October 7, 2020

Bray, Ireland