It seemed that way earlier this month when its AI chatbot, Bard, made its debut.

It’s a rival to OpenAI’s better-known chatbot, ChatGPT.

And Bard flunked its first big test…

In a demo, a user asked Bard, “What new discoveries from the James Webb Space Telescope can I tell my 9 year old about?”

Bard responded with a series of bullet points. One of them read, “JWST took the very first pictures of a planet outside of our own solar system.”

That sounds right to someone, like me, who knows nothing about astronomy. But actual astronomers were unimpressed.

They included Bruce Macintosh. He’s the Director of University of California Observatories at UC Santa Cruz. And as he tweeted after the demo, he’d imaged a planet outside our solar system 14 years before JWST.

Microsoft has also had some issues with AI… namely, integrating ChatGPT into its search engine, Bing.

Last week, The New York Times published an article about a two-hour chat one of its tech reporters had with it. During the conversation, it said it would like to be human, had a desire to be destructive, and was in love with the person it was chatting with.

Now, I’m not saying these glitches mean AI chatbots are dead in the water. Far from it.

As I’ve been hammering on in these pages over the years, these “thinking machines” will change just about every aspect of our lives.

But given how early we are in the development of this technology, picking the tech companies that will win in the AI arms race is hard… maybe even impossible.

Thankfully, you don’t have to.

As friend of Legacy Research Brad Thomas has been showing his readers, there’s a little-known industry that’s mission critical to the AI revolution. And it will deliver outsized profits to investors, no matter which tech giant ends up on top.

Generative AIs such as ChatGPT and Bard run using highly specialized computer kits housed in giant cloud data centers.

Without this physical computing infrastructure AIs couldn’t handle the mountains of data they’re trained on. Nor could they process requests from millions of users all at once.

Over to Brad…

Without data centers, AI is just a fancy set of algorithms without any data to crunch. That’s why I think of data centers as the “brains” of these system. Every time you ask ChatGPT or Bard something, your request is routing through a data center somewhere.

And that spells opportunity for investors. Because there’s a good chance your request is processed in critical infrastructure owned by a data center REIT.

These are publicly traded companies that own and manage the facilities that companies such as Microsoft, Google, and others use to house their AIs.

REIT stands for real estate investment trust. They allow regular investors profit from income-producing real estate through the stock market.

Back to Brad…

REITs allow anyone to build a real estate empire through the stock market. They trade on public exchanges like the New York Stock Exchange and the Nasdaq, just like regular stocks. But they own income-producing properties.

They buy real estate… collect rent… then pay it out to shareholders in the form of dividends. By law, REITs must pay out at least 90% of their taxable income to shareholders. Most of them pay 100%.

As a result, they pay income streams to investors. And they’re Brad’s bread and butter.

As he talked about in these pages, at the peak of his career he was collecting more than 100 rent checks a month.

Then came the 2008 crash. And he lost it all…

At the time, he was married with five kids. Things got so bad he didn’t know how he would provide for his family.

That’s when he started investing in real estate through publicly traded REITs. It’s also when he began writing about this new strategy on a financial website called Seeking Alpha. Brad again…

Sure, I can try to build back my wealth through various real estate partnerships with complicated tax returns. But I learned the hard way in 2008 that this can leave you mightily exposed because you can’t sell when you want to.

The great thing about stocks is you can buy and sell whenever you want. You just go online… open your brokerage account… and click a button.

You can invest in REITs across different industries. There are REITs that own and operate apartments, single family homes, office buildings, shopping malls, even self-storage units.

But Brad is most excited right now about data center REITs…

And he’s not alone. Wall Street giants Goldman Sachs, JPMorgan Chase, and BlackRock have invested billions of dollars in the trend.

Tech titans Apple and Google have spent $1.4 billion and $9.5 billion, respectively. And Amazon has already invested $34 billion.

And even with all this capital flowing in… we’re still in the early stages of this trend.

And with so much happening in the digital world right now – including the rise of AI – that’s a sure bet.

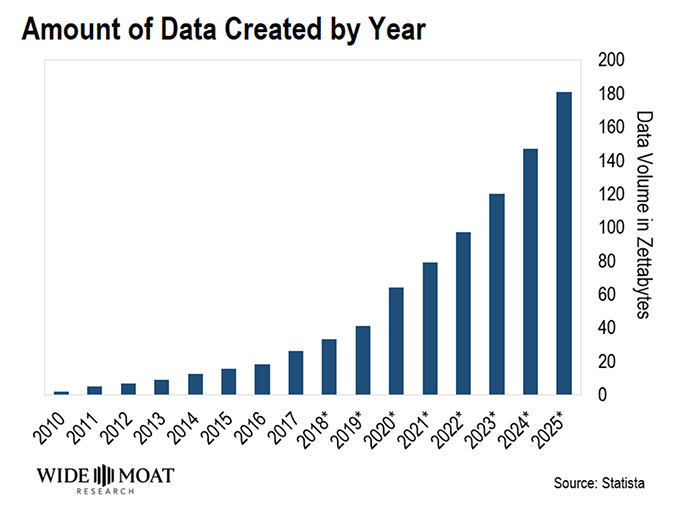

Look at this chart…

It shows the amount of data we create every year measured in zettabytes.

To put that in perspective, total global internet traffic first passed a zettabyte in 2016, when it reached 1.2 zettabytes.

And according to market research firm International Data Group, we’re on track to break through 175 zettabytes by 2025.

Owning data center REITs lets you make money from this trend without having to pick winners and losers in the tech sector.

One easy way to profit is to buy shares in a data center REIT exchange-traded fund (“ETF”).

Here are the names and ticker symbols of three of the largest data center REITs available to U.S. investors.

Each of them allows you to become an AI landlord… and profit no matter who wins the AI battle for supremacy.

And two of them – Digital Realty and Equinix – allow you to pick up income streams in the process.

And if you want to learn more about which is the best of the bunch, Brad recently recommended his favorite data center REIT to paid-up readers of his Intelligent Income Investor advisory.

So, if you are interested in getting in on the ground floor of A.I. but want to benefit no matter who wins out in the end, check out the presentation Brad put together about this unstoppable trend.

Regards,

|

Chris Lowe

Editor, The Daily Cut