No, really. How often do you think about the Argentine Empire?

Perhaps you know the reference.

If you don’t, a brief explainer…

A recent trend on TikTok had wives, girlfriends, and daughters asking their husbands, boyfriends, and fathers how often they thought about the Roman Empire.

Typically, the responses ranged between daily and weekly.

Such replies resulted in howls of laughter from the questioner.

We have no idea why.

In our view, a man isn’t a man unless he thinks of something Roman Empire-related at least once per week (Editor’s note: We kid… but only a little. Oh, and just wait until they find out how often their men think about the Second World War. It will be mind-blowing).

And so yesterday, after seeing the election news from Buenos Aires, Argentina, we wondered: how many folks think about Argentina’s “empire”… or rather, its tinpot economy?

Our guess is, very few. Certainly not daily or weekly.

And yet, if ever there was an economy folks should think about and learn lessons from, Argentina would be it.

We’ll do our best to explain why and give you our takeaway on the situation below. But first…

Market Data

The S&P 500 closed up 0.74% to end the day at 4,547.38… the Nasdaq gained 1.13%, to close at 14,284.53.

For individual stocks, Microsoft closed up 2.05% to $377.44… Apple ended higher by 0.93% at $191.45… and Tesla ended the day at $235.60, a 0.55% gain.

In commodities, West Texas Intermediate crude oil trades at $77.50… gold is $1,980 per troy ounce… and bitcoin is $37,479.

By the way, if you wrote in responding to last Friday’s Daily Cut, thank you. We’ve received your emails. We’ll begin replying to those emails in the Daily Cut over the next few weeks.

And now, back to our story from the South American Pampas…

Volatile Far-Right Libertarian?!

If you don’t know why we’ve suddenly put Argentina on your radar, the left-wing Guardian newspaper explains:

Javier Milei, a volatile far-right libertarian who has vowed to ‘exterminate’ inflation and take a chainsaw to the state, has been elected president of Argentina, catapulting South America’s second-largest economy into an unpredictable and potentially turbulent future.

The conservative National Review magazine has – as you may expect – a slightly different take:

In a surprising turn of events, Argentina has elected the libertarian outsider Javier Milei as its new president. The hotly contested presidential run-off saw Milei defeating left-wing candidate Sergio Massa – a consequential shift in the country’s political landscape. Massa brusquely conceded on Sunday night, stating, “Milei is the president elected for the next four years.”

Spot the difference.

One person’s “volatile far-right libertarian” is another person’s “surprising… libertarian outsider.”

As an aside, we like the idea that the Guardian thinks that unpredictability and turbulence are only in the future for Argentina. That everything has been just fine in the past.

Just remember that Argentina had one of its naval ships seized by an investment fund, with the permission of a U.S. judge.

That wasn’t so long ago. In 2012, in fact.

Granted, the naval ship was the ARA Libertad, a sailing ship built in 1956. It’s one of 47 vessels in the Argentine fleet… although, we presume, the only sailing ship.

Source: Żeglarz

In case you’re worried about the welfare of the sailing ship, the United Nations ordered the ship’s return to Argentina in 2013.

The point is, Argentina has a long history of economic incompetence.

The ship seizure was the result of its most recent example. That’s when the government defaulted on $82 billion of debt obligations in 2001 and 2002.

To put that in context, today, the U.S. Treasury auctioned $143 billion of 13-week and 26-week bills. And for the Treasury, that’s just a typical Monday. To be fair, we can only wonder what that tells you of the competence of American governments…

(Editor’s note: a “bill” is a government bond that matures in less than a year.)

…But anyway, that’s not entirely the theme of our story today. For now, we’ll stick with Argentina. We’ll come back to any lessons for America later.

We Don’t Trust Their Data Either

First, let’s check out Argentina’s inflation rate:

As a reminder to the Guardian, this inflation story is before Javier Milei takes office as Argentine president.

The latest data shows the inflation rate at 142%. In other words, that means every Argentinian has seen the value of their currency, the peso, lose more than half its value in the past year.

We’d say that feels hard to imagine. Although, if you compare your grocery bill today to what it was three or four years ago… maybe it’s possible to imagine.

Of course, just as we doubt the accuracy and truthfulness of official U.S. economic data, we doubt the accuracy and truthfulness of official Argentinian economic data too. Shocking as it might seem, the “official” inflation rate may be massaged for political reasons.

But regardless of the accuracy – whether Argentina’s real inflation is 142%, 250%, or 400%, it shows you just how much an economic system, a government, and a central bank, can destroy private wealth.

Let’s look at a couple of other charts. Again, to put everything in context (and to get us closer to explaining why this matters to you).

First, the Argentine peso against the dollar.

At the beginning of 2016, you could get 14 pesos for each U.S. dollar. Today, one dollar will get you 353 pesos. That’s a 2,421% increase in the dollar compared to the peso.

But let’s turn it around the other way, to see how destructive it is. The Argentinian who wanted to exchange pesos for dollars in 2016, would have received just over $7 for every 100 pesos.

Today, they’ll get just 28 cents. For the Argentinian, it means their currency has been devalued by 96.3%. And that’s against the dollar, which has also had some inflationary pressure over the past few years.

It makes you think. And that’s just in seven years. Argentina’s prior bouts of inflation have been equally destructive.

That’s what inflation in prices – and devaluation of a currency – looks like on Argentina’s scale.

The only source of comfort for Argentinians is that the price of beef in the famously beef-eating country hasn’t climbed as fast as other goods, as this chart from Bloomberg shows:

The red line (beef price inflation) shows two big dips, both due to the government implementing price controls on beef.

But even with those price controls, the beef price today is 72% higher than one year ago. And if other goods are more expensive, it likely means even the most carnivorous Argentinian is forced to buy cheaper cuts of beef.

That’s what inflation does.

Inflation Isn’t Just an Economic Concern

It’s not just a financial or economic concern, it’s a general welfare concern. Economists even have a term for this kind of thing. They call it “substitution.” As prices go up, people buy cheaper types of a product.

Instead of a branded product, they’ll buy the generic or non-brand version. Instead of a prime cut of steak, they’ll buy the cheaper cut… or switch to a cheaper meat, like chicken… and so on.

So what does any of this mean for the regular American investor, like you?

The answer to that is it’s a reminder to not be complacent.

One of the most sinister aspects of inflation is that it catches everyone off-guard. It can creep up on you… surprise you… and then perhaps worst of all, it continues to cause trouble, even when folks think the worst is over.

Does that sound familiar?

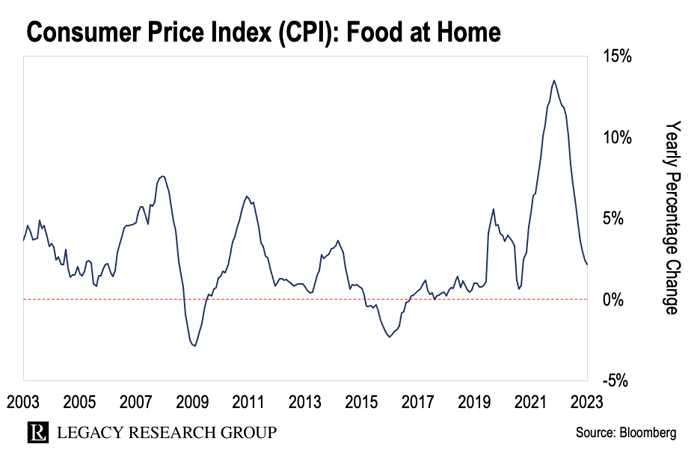

Check out the chart below. It shows the yearly percentage change in the Consumer Price Index (CPI) for the “food at home” category. In other words, food bought to consume at home, rather than restaurant or fast-food meals.

The big increase to the right is the inflationary period the Federal Reserve claimed would be “transitory”… except it wasn’t.

Hence the series of interest rate increases that have taken the Fed’s benchmark interest rate to 5.5%.

Importantly, you can see from the chart that it’s rare the line drops below zero. Meaning, for the most part, nearly every year like clockwork, prices are going up… and the cost of living increases.

Now, we’re certainly not saying this is on the same scale as Argentina. But we are saying that it’s easy to ignore the effects of inflation when the numbers seem so low in comparison.

After all, Argentina’s inflation is 142%. U.S. inflation overall is “only” 3.2%… and is much lower than the 7.8% it reached this time last year.

But it still means prices are higher than last year. It’s just that the rate of increase has slowed.

Our takeaway?

Don’t let these apparent lower inflation rates make you complacent.

According to the U.S. Inflation Calculator website, the cumulative rate of inflation since 2003 has been 67%. It means an item costing $10 in 2003 would cost you $16.72 today.

It’s true that the U.S. isn’t Argentina. So we’re not about to claim that hyperinflation is here to destroy your livelihood and your wealth.

But it’s certainly a mistake to ignore homegrown inflation, even though it’s lower, and the negative effects it can have on your wealth over time.

Dollar Competition

Of course, one of the advantages the U.S. has over other countries is that the U.S. dollar is effectively the world’s reserve currency.

Many international transactions happen using dollars, or the dollar is the reference price for the transaction (such as most commodities). Plus, many countries issue debt in U.S. dollars because it provides an extra level of security (supposedly) to the lender.

After all, the borrowing country can’t print dollars. And if they print more of their domestic currency, it will devalue their currency against the dollar, making repayments more expensive.

But could that change with the plans by the BRICS nations (Brazil, Russia, India, China, and South Africa) to begin settling international trade using their own currency? What will that do to the demand for the dollar?

What Does Teeka Say About This?

With all this in mind, we asked Legacy Research bitcoin and crypto expert, Teeka Tiwari, for his take on the story. Here’s what he told us by email last night:

I think it continues to add to the string of bullish developments that bitcoin has been experiencing over the last few weeks. BTC rallied 3% on the news of his election. I could see him adding bitcoin to Argentina’s Treasury and making it easier for the average Argentine to save in bitcoin.

As you know I have long been of the opinion that bitcoin will ultimately form the financial base layer of the financial establishment of the future. Right now, that role is filled by US Treasury Bonds.

Bitcoin as the new financial base layer will happen gradually at first then all at once in much the same way that transformative technology is slow to be adopted and then all of a sudden everyone everywhere is using it.

Milei has an opportunity to radically improve Argentina’s fiscal health by parking a percentage of his country’s wealth in bitcoin. It remains to be seen if he has the political will… and more importantly, the political capital to make that happen.

It’s an interesting take. Bitcoin, priced in Argentine pesos was around 5,500 at the beginning of 2016. Today, it’s around 13.1 million.

That’s a 238,000% gain. Priced in U.S. dollars, bitcoin has gained around 8,500%. And while most investors view bitcoin as well off its all-time highs… that’s not true in Argentinian pesos. The crypto hit an all-time high on November 16 when Milei took the lead in the polls.

We’re not claiming bitcoin is always a hedge against inflation… There is more nuance to it than that. But when you compare the performance of the same asset in different currencies, you can clearly see how much inflation destroys wealth over time.

The more you look at it, the more it makes sense for any sane investor to move at least some money out of cash, and park some of it in bitcoin.

More Markets

Today’s top gaining ETFs…

-

Global X MSCI China Consumer Discretionary ETF +3%

-

KraneShares MSCI China Clean TEchnolgoy ETF +2.6%

-

Invesco China Technology ETF +2.6%

-

iShares MSCI Chile ETF +2.4%

-

ProShares Ultra QQQ +2.4%

Today’s top losing ETFs…

-

WisdomTree Japan Hedged Small Cap Equity Fund -1.3%

-

WisdomTree Japan Hedged Equity Fund -1.0%

-

Franklin FTSE Japan Hedged ETF -1.0%

-

iShares Currency Hedged MSCI Japan ETF -0.8%

-

Xtrackers MSCI Japan Hedged Equity ETF -0.7%

Cheers,

|

Kris Sayce

Editor, The Daily Cut

P.S. We feel slightly nauseous admitting to using TikTok. Just know that we’ve since deleted the app. Forget about whether China is spying or not, it’s the ultimate time-wasting activity.