Chris’ note: The midterm results are in… Republicans are set to flip the House. Democrats keep control of the Senate.

But make no mistake… Inflation doesn’t care which party is in power. Republicans and Democrats are both big spenders. And that’s not going to let up.

In fact, as Teeka Tiwari shares below, it’s about to get a lot worse.

We’ve just been through another a brutal election cycle…

Republicans blamed Democrats for the inflation that’s crimping the pocketbooks of millions of Americans.

And Democrats charged the GOP with undermining American democracy.

If you’re a longtime reader, you know I don’t wade into the political muck. Regardless of which side wins, the American taxpayer loses every time.

And we’ll lose this time because of a sinister reason behind inflation politicians won’t tell you about…

The sinister force I’m talking about is the abandonment of American ideals.

People expect the government to take care of them from cradle to grave. They don’t believe in hard work.

It’s a major factor in determining fiscal and monetary policy.

I feel like people don’t connect this change to inflation. But it now seems as clear as day.

America is no longer the land of free enterprise. It’s more like the “land of give me free stuff.”

Now, I’m not saying the state shouldn’t help our senior citizens with Social Security… our veterans with medical assistance… or the neediest among us with food subsidies.

I’m talking about pandemic stimulus checks… the push for a universal basic income… and student debt forgiveness.

And when government spending goes haywire, inflation isn’t far behind.

In the late 1960s, President Johnson launched the “Great Society.”

This involved a host of welfare programs.

It increased spending so much that by the early 1970s, the government had trouble meeting its obligations.

Then, in 1971, to address rising inflation and stop foreign governments redeeming their dollars for gold, President Nixon took the U.S. dollar off the gold standard.

This allowed Washington to print more money without constraint… and opened the door to even more government spending.

It’s not discussed much today… But this pivotal moment in our history set the stage for what we’re seeing now.

So since 1971, the value of our money has been under siege…

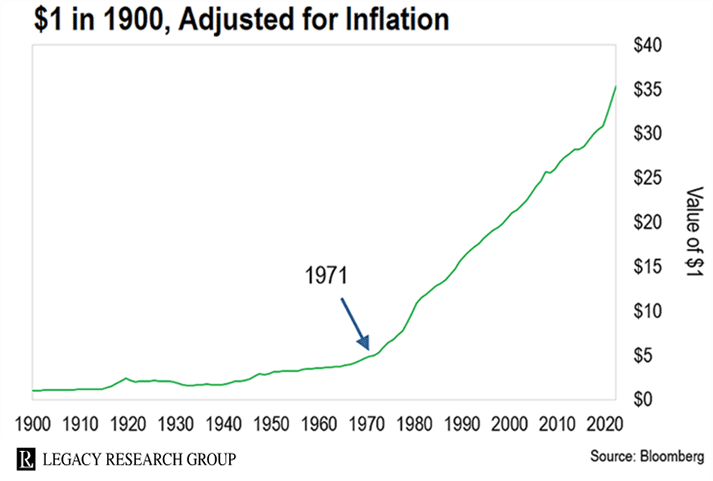

Take a look at the chart below. It shows the decline in the purchasing power of the U.S. dollar going back to 1900…

As you can see, it held its value until the early 1970s. But starting in 1971, the loss in value accelerated.

This is when what I call the New Order of Money took hold…

In this new order, inflation driven by government stimulus has perverted how money is supposed to work.

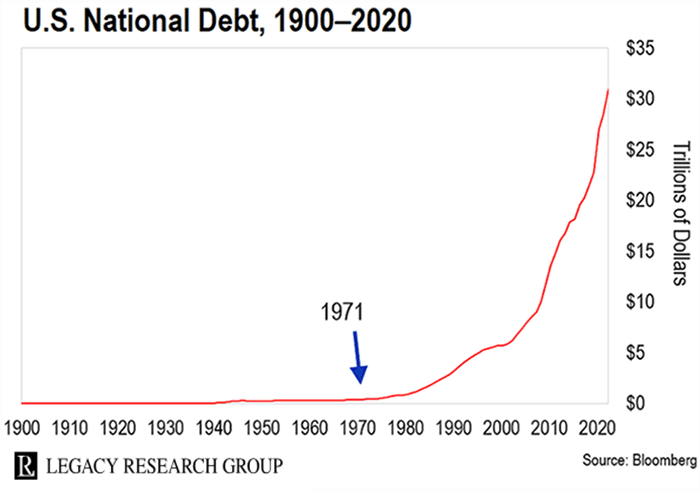

You can see that in the next chart. It shows the U.S. national debt going back to 1900…

As you can see, the devaluation of our money and government spending go hand in hand.

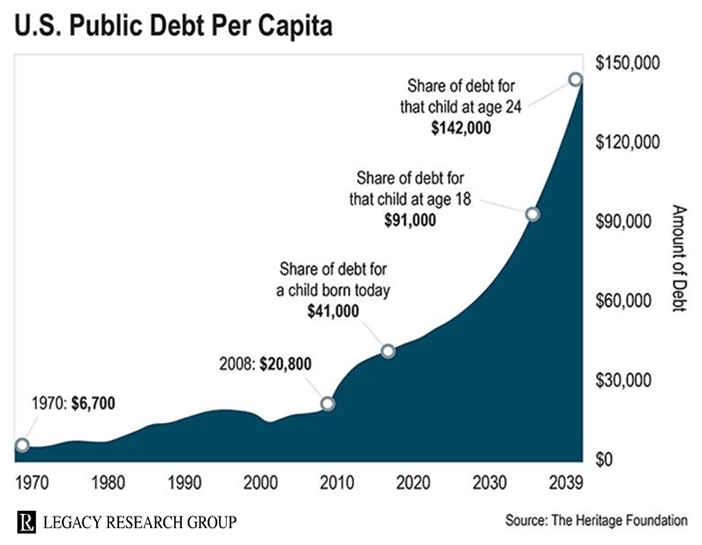

This next chart drives home the point even further.

It shows public debt per capita. That’s the share of the federal debt each American holds.

In 1970, public debt per capita was just $6,700. It’s now $91,000… And by 2030, it’s projected to be $200,000 per citizen

That’s an almost 3,000% increase.

You won’t hear about this from politicians or mainstream economists. It would mean they’d have to stop spending.

Friends, the government is quietly stealing from your hard-earned savings through inflation.

I know a lot of people folks think couldn’t possibly get worse…

But trust me when I say it can… and it will.

Right now, a trigger on the horizon could spark what I call “The Next Lehman.”

Here’s what I mean…

In 2008, Lehman Brothers went from being the fourth-largest U.S. investment bank to one of the largest bankruptcy filings in U.S. history.

The bank was hundreds of billions of dollars in debt when it finally collapsed… and its losses shook the market for years to come.

And we’re about to experience a crisis with the potential to be 155x larger than the Lehman collapse… one that will compound the pain we’re feeling from inflation and rampant money printing.

That’s why I’m going to share all the details on this “Next Lehman” tomorrow, November 16, at 8 p.m. ET.

I’ll also reveal how preparing now could give you a shot at 14x returns when the crisis hits…

It involves a little-known, recession-proof asset that’s less volatile than stocks but offers massive upside… an asset that Wall Street eagerly trades while leaving you in the dark.

I’ll even discuss my 2023 Recession-Proof Portfolio… and share the name of a stock on that list… for free.

All you need to do to join me is go here to automatically reserve your spot.

Friends, our country is being dismantled by a set of beliefs that is killing our retirement dreams.

It’s choking the life out of innovation. Worse, it’s brainwashing our kids to abandon personal exceptionalism in the pursuit of collective mediocrity.

This is not the America I know.

That’s why I’m hosting the Next Lehman. I want to give every American the information they need to survive this crisis.

I hope to see you there.

Let the Game Come to You!

|

Teeka Tiwari

Editor, Palm Beach Daily

P.S. Don’t forget to sign up for the event I’m hosting tomorrow night at 8 p.m. ET. I’ll even send you a bonus report on the three investments you need to avoid right now.

You can go here to learn more. You can sign up with one click… and get the report right away.