Uh-oh…

After a string of bank runs in the U.S. last week, the last thing we needed was news that a major investment bank is in trouble.

But that’s what happening with Credit Suisse today.

It’s the world’s seventh largest investment bank. And today, its share price has plunged 25% at writing.

That’s the biggest one-day selloff on record for the company.

Shares fell on news that the bank found “material weaknesses” in its financial reporting.

That means investors and dispositors don’t know if they can trust the numbers Credit Suisse has been reporting. And they’re withdrawing their cash in droves.

This leaves the company’s share price down more than 75% over the past year.

And the selling pressure isn’t confined to Credit Suisse. It’s radiating out across the stock market.

Stocks in Europe cratered on the news. And so have stocks in the U.S.

The S&P 500 is down 1.6% at writing. And the Dow is down 1.8%.

It’s critical you play defense in your portfolio right now…

As we looked at in Monday’s dispatch (more on that below), that means having have plenty of cash in FDIC-insured accounts.

And if you want to keep your cash out of the bank altogether, you can also use short-term bond exchange-traded funds (“ETFs”) for some of your cash savings.

The SPDR Bloomberg Barclays 1-3 Month T-Bill ETF (BIL), for example, yields 2%. And the WisdomTree Floating Rate Treasury ETF (USFR) yields 2.5%.

Gold is another good way to play defense. Investors see gold as a haven when the financial system comes under strain.

That’s what sent gold soaring as much as 97% in the three years after the collapse of Lehman Brothers in October 2008.

You can even consider hedging falling stock prices with ProShares Short S&P 500 ETF (SH). It goes up 1% for every 1% fall for the S&P 500.

And it’s not all about playing defense. The traders we feature in these pages look forward to markets like this. Believe it or not, it’s when they tend to make their best gains.

It all comes down to volatility…

That’s Wall Street speak for how much stock prices move around.

When volatility is low, the stock market is relatively calm. As volatility rises, stock prices move more dramatically – up and down.

The most common volatility gauge is the CBOE Volatility Index (“VIX”).

It measures investors’ expectations of volatility for the blue-chip S&P 500 index over the next 30 days.

And as you can see, the VIX shot up 45% from 19.1 to 27.8 points since this time a week ago.

In other words, investors are expecting a lot more chop ahead for the stock market.

Regular readers have heard me say this before. But for newer folks, it’s critically important…

Rising volatility is challenging for buy-and-hold investors because it means there’s no clear trend. But traders thrive in a market like this.

Using the options market, they can profit from falling as well as rising stocks. They can also zero in on short-term moves and profit from what Wall Street types call “mean reversion.”

It describes how, after an extreme price move, asset prices tend to return to normal or average levels. And for traders like Larry, it’s the gift that keeps on giving. Especially in choppy market conditions like we’re seeing today.

Think of it like a rubber band…

The more you more you stretch it in one direction… the more likely it is to snap back. Here’s Larry…

I mainly look for two- or three-day mean reversion setups. If the market has two or three days up, it’ll likely head back down to the mean, or average, soon.

So, if the S&P 500 or the Nasdaq rallies hard for several days, I’ll look to place a trade that profits as they fall again. It works the opposite way, too. If stocks plunge over the course of two or three days, I’ll look for an entry point that allows me to profit as they shoot up again.

And the longer the market stays away from the mean, and the more overextended it gets, the stronger the move back to the center. That’s why I love volatile conditions like we have today. They deliver opportunity after opportunity to place these kinds of trades.

That’s how Larry was able to make $95 million for himself and his clients at his hedge fund, Banyan Capital, in 2008.

It may have been the worst bear market since the Great Depression for buy-and-hold investors. The S&P 500 fell 39% that year.

But the 2008 bear market also came with a ton of volatility. That included frequent rallies after big down moves.

There was a 24% spike that lasted 46 days toward the end of 2008 and early 2009.

There was also a four-day bear market rally in October 2008 that brought the S&P 500 up 15.7%… and a seven-day bear market rally in November 2008 that bought the index up by 18.7%.

So, it was a mean reversion trader’s paradise.

Larry has harnessed this month’s volatility surge for profits, too…

On March 6, he issued a trade recommendation at his One Ticker Trader advisory that would pay off if the tech-heavy Nasdaq fell.

This gave his subscribers the chance to capture a gain of 53% in eight days.

On March 13, Larry gave subscribers of his Opportunistic Trader advisory the chance to capture a 35% gain betting on a one-day rally in the S&P 500.

And today, he sent out a sell alert for them to close the second half of a bullish trade on gold for 78%. (He closed the first half for a 26% gain on Monday.)

That comes hot on the heels one of the most impressive streaks I’ve seen in my 20 years covering markets.

Last year, as another bear market raged, he gave subscribers of his One Ticker Trader advisory the chance to close out the year up 240% on cash.

He closed out 11 recommended trades in total. All of them were winners.

And so far this year, he’s had 16 winners out of 18 trades.

That’s an 88% win rate this year, as the rubber band stretches and snaps back.

So, make sure to check out the latest from Larry. He reveals on camera how you can make money in this market trading just one ticker.

A final word before I go…

Close readers of the Cut will know that we warned of the chaos engulfing markets in these pages last Monday.

I interviewed veteran market timer Mason Sexton for that dispatch. And this is what he told me…

I see a crushing decline in stocks starting as soon as tomorrow, March 7. This will be in full swing by March 17. And it will come with a recognition among investors that the Fed, in its commitment to tamp down inflation, will overcorrect and raise rates higher than previously expected.

We haven’t reached March 17 yet. It’s still two days away. But so far, everything Mason predicted came true.

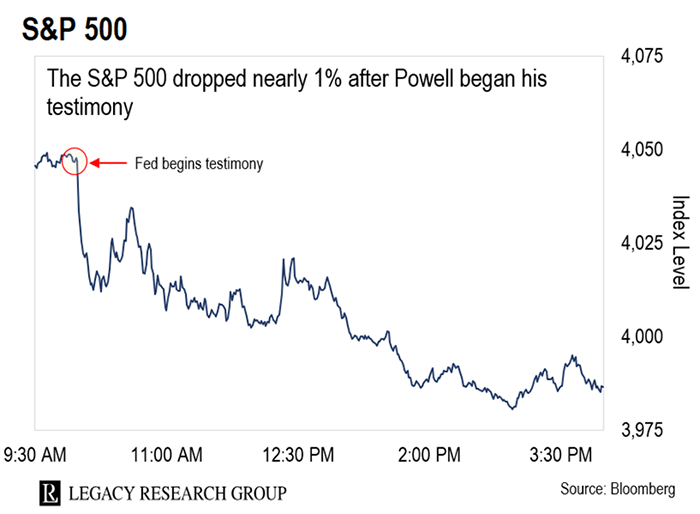

Stocks fell off a cliff last Tuesday morning, March 7, as Fed boss Jay Powell delivered prepared remarks in front of the Senate Banking Committee.

I’ve showed this chart before. But it bears repeating. Because it shows what happened – right on schedule – on the morning of March 7.

And since Mason’s warning, the S&P 500 is down 4.6%.

You can read his uncanny prediction in full here. Then pay close attention to the markets this Friday, March 17.

Mason says we’ll get a major announcement from the government around noon. It will make it clear that this new leg down in the bear market is in full swing.

Regards,

|

Chris Lowe

Editor, The Daily Cut