Chris’ note: Yesterday, we looked at six tech stocks set to profit from the AI revolution. But this isn’t the only route to profits.

Friend of Legacy Research Brad Thomas says you can also own the “brains” of AI – the giant data centers that house the advanced computers that make AIs such as ChatGPT possible.

It’s all down to a special kind of stock that lets you pick up rent checks from income-producing real estate.

Chris Lowe: Last year, the bear market spared no one. Folks are trying to figure out how to make back those losses in 2023. I know you lost millions in 2008… then made it back again. Let’s start there.

Brad Thomas: Before I became a newsletter writer, I spent 20 years as a real estate developer. And I was lucky enough to learn an invaluable lesson early in my career.

After I graduated from college, I went to work with a developer who had a large portfolio of properties. This gave me exposure to the retail and industrial property sectors. This guy even built a Gary Player golf course.

But no matter what he built he didn’t waver from the wealth-building course he’d set. He created wealth one rent check at a time. This harnesses the power of compounding.

You collect those checks… then you use them to buy more properties. This gives you more checks, which you use to buy even more properties. And so on.

I used this principle to build a real estate portfolio worth $30 million. At the peak of my career, I was collecting 100 rent checks a month. Then 2008 came along… and wiped me out.

That’s when I had an epiphany. I’d go back to investing in real estate… but this time through the stock market.

Chris: Most folks know you can invest in businesses through the stock market. They don’t know you can also invest in real estate through stocks.

Brad: I didn’t either. I learned it in the real estate development business.

I used to build freestanding buildings for Walgreens, Outback, and Dollar General. Then I’d sell them to a company called Realty Income (O). But this wasn’t an ordinary company. It was a type of company called a real estate investment trust, or REIT.

It owned a bunch of income-producing properties. And it passed most of the rental income it collected to shareholders.

This intrigued me. So, I decided to pay a visit to the CEO. We had a conversation about the business model. And a light went off for me. Owning shares in REITs is like being a landlord… without the hassle.

You buy shares in a REIT that owns commercial real estate. It’s bound by law to pay you at least 90% of the rental income it earns on those properties.

I had a business partner for two decades when I was a developer. Then we had a big split-up – a divorce, if you will – and it was difficult to liquidate our portfolio. I couldn’t sell as the 2008 storm approached.

As a REIT investor, you don’t have to worry about partners and controversy. Even better, you don’t have to deal with the three “T”s that torture landlords – toilets, trash, and taxes.

You just collect that rental income in the form of dividends and let it compound.

Chris: Our readers are battered and bruised from last year’s shellacking. The media is full of stories about a coming recession. And the residential housing market has taken a dive. Why would you invest in REITs today?

Brad: The great thing about real estate is you can invest in different sectors. You can focus on single family homes, apartments, office buildings. You can also invest in REITs that lease out healthcare facilities, facilities to grow legal cannabis, land to grow forests, and farmland.

One sector I wouldn’t touch right now is lodging. It covers hotels, motels, resorts, and conference centers. It always gets killed in recessions.

I’m also not interested in REITs that lease office buildings. Thanks to the work-from-home habits we picked up during the pandemic, folks aren’t going into the office. This is hitting restaurants, coffee shops, and stores that serviced areas with a lot of office workers.

But there are some recession-proof sectors as well.

Chris: What’s top of your list right now?

Brad: I’m particularly interested in data center REITs. They lease the properties that house the computing infrastructure we call the “cloud.”

This is where all the data we use on our phones is stored. It’s also where generative AIs such as ChatGPT… and self-driving cars… crunch all their data. So, there is rising demand.

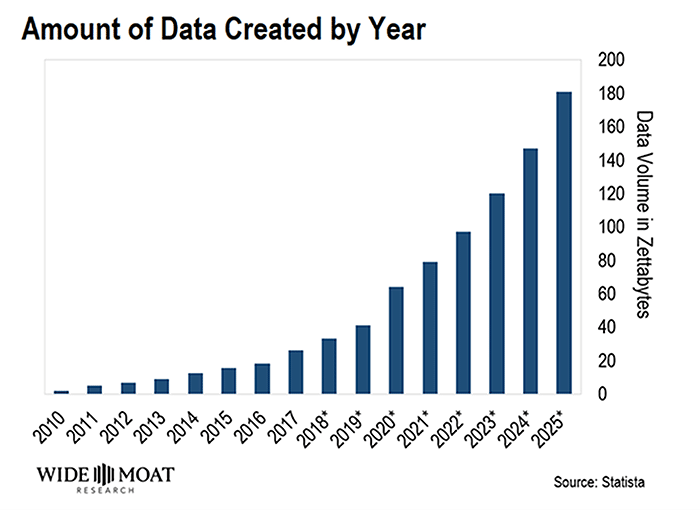

There’s a chart I show my readers. It’s of the amount of data we create every year measured in zettabytes.

A zettabyte equals a trillion gigabites (“GBs”). And a typical high-definition movie download is between 1 and 2 GBs. So, it’s a freakishly large amount of data.

And we’re on track for 175 zettabytes of total data storage by 2025 – nearly double where we are today.

Chris: How would a data center REIT operate? Paint a picture for folks who perhaps don’t know about them.

Brad: I’ve just finished writing the REITs for Dummies book. In there, I talk about how a lot of what we call “alternative property sectors” have opened up over the last 10 years.

That’s largely due to the IRS’ interpretation of real estate. It used to be limited to just brick and mortar. Now, the IRS has expanded its definition of what a REIT can own and operate. And one of them is data centers.

They are these giant industrial buildings. Except instead of housing plants and factories, they house the high-end computer kits needed to run the world’s computing demand in the cloud.

There are rows and rows of racks… and the servers on top of those racks. The IRS now considers these racking systems as real estate.

There’s a REIT called Equinix (EQIX) that I like. It carries a 2% yield. And it owns more of the racking system than the buildings that house them. But it’s still a REIT and operates in the same way. It leases these racks… collects the checks… and passes the income along to shareholders.

This has been getting the attention of private equity firms. Private equity firms bought publicly traded data center REITs. But despite strong earnings, Equinix’s valuation is way down from where these private equity firms bought in.

That makes now a great time to buy.

Chris: What would you say to folks who are fearful about getting back in the market right now?

Brad: I’m not saying it’s going to be all roses. We’re going to have a lot more volatility. So why not stay away from that volatility and just concentrate on those rent checks? REITs’ share prices will bounce around along with the rest of the market. But the good ones in the right sectors will keep paying out income like clockwork.

That’s key. Focusing on income is what allowed me to claw back from 2008. I fixated relentlessly on collecting income and the power of compounding. Now is another great time to take that approach.

Chris: Thanks, Brad. That was fascinating.

Brad: Anytime, Chris.

Chris here again – If you want to learn more about profiting as AI develops… without the guesswork of figuring out which tech stocks will come out on top… Brad recently recommended his favorite data center REIT to paid-up readers of his Intelligent Income Investor advisory.

He’s focused on helping his subscribers get in on the ground floor of America’s fastest growing companies – including reliable income plays in the AI revolution. So, go here to check out the presentation Brad put together.