Be fearful when others are greedy…

Be greedy when others are fearful…

So said Warren Buffett, one of the world’s most successful investors.

Today, we’ll show you why his advice points to a rare opportunity to buy bitcoin – at a discount to the regular price.

It’s all in your Weekly Pulse video update at the top of the page.

It’s where I (Chris Lowe) and host Tom Beal break down the single most important market story on our radar for the week.

Regards,

Chris Lowe

Editor, The Daily Cut and Legacy Inner Circle

P.S. If you prefer to read along, we’ve included a transcript of our conversation below.

| Click here to access the Legacy Inner Circle archive |

| Not yet a Legacy Inner Circle member? Join here. |

Transcript

Tom Beal: There are ways for you to benefit from the bitcoin craze inside your normal brokerage account. And there are times in history that you can get it at a discount.

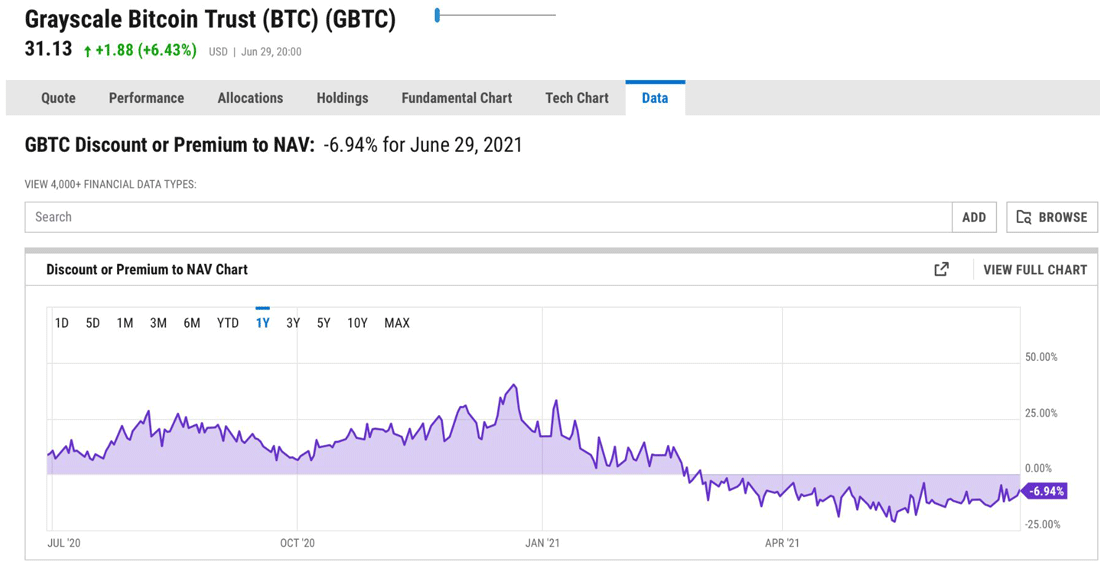

Now is one of those times. The chart below shows you the history of this particular topic we’ll be discussing today. And now is one of the times to get it at a discount.

Here’s the URL for that chart [so you can check current percentage]: https://ycharts.com/companies/GBTC/discount_or_premium_to_nav.

The percentage we talk about today is for the day this video was recorded. The day you see this, it will be different. So just click that URL to see where it falls into play for you at the time of watching this video.

My name is Tom Beal, host of the Weekly Pulse, where we break down the biggest wealth-growth story of the week.

I’m here today with Chris Lowe, editor of Legacy Inner Circle.

Chris, how do we kick off today’s conversation?

Chris Lowe: So, Tom, I thought we’d start today with a question for you. I want you to imagine that you’re buying a big-ticket item. It could be a new car, a new truck, a vacation, even a home. And you’re offered a 13% discount on that big-ticket item.

Would you be pleased about that?

Tom Beal: 100% pleased. Absolutely. There’s a saying I live by: “It’s not what you make or earn. It’s what you keep.” So any discount is greatly appreciated. 13% is pretty significant.

Chris: Yeah, it is. So today, I want to talk about how that applies right now to bitcoin, which is the first and most famous cryptocurrency. It’s also something we talk a lot about here on The Weekly Pulse.

What I want to do today is show you how, right now, you can avail of a 13% discount on the price that most folks are paying on the regular crypto exchange. I want to show how that’s possible. And then, I want to show folks how they can take advantage of it. Does that sound good for today’s topic?

Tom: I’m all ears. I’m excited to hear about this. And I’m sure the viewers are as well.

This week’s episode is brought to you by Legacy Inner Circle. That’s where editor Chris Lowe is able to peer into the model portfolios of all the Legacy Research experts to help you grow and protect your wealth at rates that are brag-worthy.

We have a very special offer for you as a Weekly Pulse viewer. Click below to learn more about that and Legacy Inner Circle. We look forward to seeing you inside the members’ area and the iOS and Android app.

Now, back to this week’s episode…

Chris: Well, this is not an official recommendation. I want to get that out of the way first. This isn’t something that Teeka Tiwari, our crypto expert, has come out and put in a portfolio. But he has been talking about it.

It relates to something called the Grayscale Bitcoin Trust (GBTC). Basically, it’s a way to get exposure to bitcoin through your brokerage account. GBTC is something called an exchange-traded trust.

I’m not going to get into the details too much on this video. I want to keep it short and sweet today.

But basically, you just log onto your regular brokerage account, your Schwab or your TD Ameritrade account, type in the ticker GBTC, click buy, and you can buy shares in that trust. That trust then holds bitcoin in custody for you. That’s how it works.

The discount I’m talking about happens when there’s just not a lot of demand for those shares. As is the case right now. So what is showing up is something folks on Wall Street call a discount to net asset value, or NAV. You might’ve heard that term on CNBC or in the financial press. Basically, the net asset value is the value of all the bitcoin in the trust.

Right now, buying shares in the Grayscale Bitcoin Trust (GBTC) effectively allows you to buy bitcoin at 13% off. You can go right now and do it in your brokerage account.

That’s what’s happening in the market today. And it’s possible because, at the moment, bitcoin is in the doldrums. It went up to $64,000, but it’s right back down toward $30,000 now.

Basically, demand for bitcoin is drying up. As a result, they’re selling at this discount.

Tom, I know you own some bitcoin. How did you purchase it?

Tom: I use Coinbase, Kraken, and a couple others. I used a couple others in the past, but I now use those two mainly. I also have some things that are similar to what you’re discussing here, inside my E*Trade account. So those are the tools I use. But for my bitcoin, right now, it’s mostly in Coinbase and Kraken.

Chris: I think that’s where most individual investors buy their crypto. Grayscale Bitcoin Trust (GBTC) is something that’s typically bought by big institutions. But it’s also available to regular investors via their brokerage account.

It’s a nice little kicker at the moment, if you are going to do what most professional investors and most successful investors do, and that’s buy when others are fearful and sell when they’re greedy. That Warren Buffett quote. You want to buy when others are fearful.

And right now, bitcoin is an asset that’s trapped in fear. As I said, it’s nearly been cut in half. By going into your regular brokerage account and buying those GBTC shares, you can actually pick bitcoin up for 13% less than you would get on your crypto exchange.

So it’s an idea for folks who want to make that contrarian trade today. I think it’s a great idea. 13% off. That’s phenomenal value.

Tom: Absolutely, Chris. Thank you for sharing this with me and the Weekly Pulse viewers.

Now, I, and hopefully they, have a homework assignment/action we can take – go look for that ticker, see if it makes sense to make some moves that can help us grow and protect our wealth at the 13% discount.

Thanks again for sharing that with us today.

Chris: Thanks, Tom.

Tom: If you’re still here, that means you’re not yet part of Legacy Inner Circle. That is where Chris peers into all of the Legacy Research experts’ model portfolios and brings to light why they’re getting such great returns and how you can benefit from that.

So Chris, for those who aren’t in Legacy Inner Circle yet, can you share why now is a perfect time to take a look and join us in the members area?

Chris: Well, Tom, I read something really cool from Teeka Tiwari recently. It was one of the insights he put out to his Palm Beach Research Group subscribers. He said that to succeed in the markets, you need to be early and be right. Those are the two things you need as an investor.

He proved that he was both early and right with bitcoin. He recommended bitcoin to his readers back in April 2016. And then, we at Legacy Inner Circle, because that’s what we do, we passed on that recommendation to our readers in July 2016.

Teeka got his folks in at about $428 per coin. We were closer to $650 per bitcoin. But as we just talked about on our video today, bitcoin went all the way up to $64,000 per coin. Right now, it’s down around $30,000. So huge profits from just those two things. Be early and be right.

At Legacy Inner Circle, as editor, my job is to pass on those kinds of early insights to our members. We did it as well with legal cannabis. We’ve done it with psychedelic medicine stocks. We’ve done it with 5G stocks. We’re pulling in all those insights from the analysts around Legacy Research. That’s really what we’re all about.

Like I said, we’ve done that with bitcoin. That was a huge win for anyone who took us up on that recommendation. We pounded the table subsequently on that, also.

So, if you want to look at the megatrends shaping the markets and get in there before it becomes headline news, before you see it all over social media, I think Legacy Inner Circle is a great way to do that. We’re able to look into all the model portfolios from guys like Teeka Tiwari, Jeff Brown, Dave Forest, Nick Giambruno, and the rest of the Legacy team, and also look at the big ideas they’re sharing with their readers, the really big, table-thumping ideas.

So, if you’re a member of Legacy Inner Circle, you get all of that in a once-a-week dispatch. We also share these videos with our subscribers. We really try to keep them on top of those big megatrends, so they can really move the needle in their portfolios.

That’s the ultimate aim, Tom – to help people grow their wealth beyond where they’d be able to by following mainstream advice.

Tom: Absolutely. So below this video, you’re going to see a link to learn more about Legacy Inner Circle. Click the link, go learn more, and see the special offer we have for you as a Weekly Pulse viewer. It’s going to be mind-blowing to you.

We look forward to seeing you inside the private members’ area and also the private iOS and Android app.

So click the button, watch the video, join us inside the app with this significant saving. And we look forward to seeing you inside that members’ area.

Thanks again, Chris.

Chris: Thanks, Tom.

| Not yet a Legacy Inner Circle member? Join here. |