Inflation is running hot…

And judging by the feedback we get in from your fellow readers, it’s top of your mind.

That’s why, today, we’re turning to an investment Casey Research analyst Dave Forest calls the “perfect inflation hedge” – farmland.

Even better… you don’t have to own a farm directly to profit.

There’s a way to get exposure to the inflation-fighting benefits of farmland through your regular broker.

It’s all in your Weekly Pulse video update at the top of the page.

It’s where I (Chris Lowe) and host Tom Beal break down the most important story on our radar for the week.

Regards,

Chris Lowe

Editor, The Daily Cut and Legacy Inner Circle

P.S. If you prefer to read along, we’ve included a transcript of our conversation below.

| Click here to access the Legacy Inner Circle archive |

| Not yet a Legacy Inner Circle member? Join here. |

Transcript

Tom Beal: Is there a perfect hedge against inflation to help you grow and protect your wealth?

My name is Tom Beal, host of The Weekly Pulse, where we break down the biggest wealth-growth story of the week. And I think you’re going to be excited to hear today’s topic. I’m here today with the Legacy Inner Circle editor, Chris Lowe.

Chris, how do we kick off today’s conversation?

Chris Lowe: Today, we’re going to home in on something our commodities investing expert, Dave Forest, calls the perfect inflation hedge.

I want you to take a look at this chart. It’s of the S&P 500, our regular standin for the U.S. stock market, tracked against the Gladstone Land Corporation (LAND), a real estate investment trust, or REIT, that leases out farmland in the U.S.

You can see that land is up 103% over the past two years. That compares with a return of about 45% for the S&P 500. So land has more than doubled the performance of the U.S. stock market over the past two years. I think that is definitely worthy of some deeper investigation.

So today, I thought we’d do three things.

First, I thought we’d look at what a real estate investment trust (REIT) is and how it works with farmland.

Then, I thought we would look at the ways in which these REITs are actually a better way to gain exposure to real estate and farmland than real estate and farmland themselves.

And then finally, we’ll go back to inflation and look at why Dave believes this is the perfect inflation hedge.

So does that make sense to you, Tom?

Tom: Chris, it not only makes sense to me, it has me excited to learn more about what we’re going to be talking about shortly. I’m excited to dig in.

Chris: Great. Well, let’s kick it off with what is a REIT or a real estate investment trust. Basically, REITs allow investors get exposure to commercial property through their regular brokers, through buying shares in the REIT.

Now, what a REIT does is it goes out and acquires real estate. In the case of Gladstone, it acquires farmland. Then, it leases that farmland or real estate out to clients or tenants. They pay a rental income.

And then, the REIT is obliged by law to pay 90% of that income to shareholders. So in the case of Gladstone, it buys farmland, as I said, and it rents it out to experienced corporate and independent farmers.

It owns 137 farms in the U.S. It has more than 100,000 acres of arable land, across 13 states. So it’s a very diversified portfolio of farmland.

That’s basically it. A real estate investment trust allows you to get exposure to commercial real estate via your broker. And in the case of Gladstone, that real estate is in the form of farmland.

Tom: Chris, I think you explained real estate investment trusts pretty succinctly, in a manner that I understand, and I hope others, The Weekly Pulse viewers, can understand.

I had never heard of Gladstone. So now, we know what real estate investment trusts are, and Gladstone, who focuses on farmland, how we can look into that to see how it can help us grow and protect our wealth.

You said there’s other benefits as well.

Chris: So, Tom, the second thing we wanted to talk about today, as I mentioned, is how something like the Gladstone Land Corporation is actually a better deal than buying land itself.

For most people, buying farmland and farming is just going to be beyond them. We all have our day jobs. It’s a non-starter, really.

So the first thing I’d say is it’s going to be a lot easier to go onto your TD Ameritrade or your Schwab account and buy some shares in the Gladstone Land Corporation REIT (LAND) than it is to go out and buy some farmland. In other words, the shares are just a lot more liquid than farmland itself. That’s the first thing.

The second thing is diversification. As I mentioned, the Gladstone Land Corporation owns 137 farms. It leases those out to farmers across 13 states. So you have that extra protection from diversification.

If one or two, or even three or four, of those farms run into trouble, that’s not going to tank the entire value of the Gladstone Land Corporation. But if you were to own your own farm, and you had trouble on that farm with yields or a year’s crops due to weather, you’re going to run into trouble.

So you get this diversification benefit from owning land, the shares, versus land, the real thing.

Tom: Chris, you have my gears turning. Yes, it’s obviously much easier to go into my brokerage account and purchase a real estate investment trust, such as Gladstone, than the other option, which is to go research, find, and purchase land itself.

I would prefer this option you’re mentioning much more so than the latter. So yeah, my gears are turning. I’m excited to hear because there’s even more benefits, from what I’ve understood.

Chris: Tom, the final thing I wanted to talk about – perhaps the most important – is how farmland can protect you from the dreaded “I” word – inflation. We looked in past videos at how the inflation rate right now, according to the government’s statistics, is around 5% a year. That’s the highest it’s been in about a decade.

I’ve made it my focus at The Daily Cut and also at Legacy Inner Circle to really home in on the inflation question. I know it’s something a lot of our readers and viewers are worried about, because I read that in the mailbag comments that come in to our various publications.

Inflation is definitely on the rise. It’s a concern for people. Farmland is a great answer. And there’s a very simple reason for that, Tom. It’s because farmland is scarce. And as I’ve been banging the drum on in these videos, I think this year, we’re going to see a rally in scarcity.

It’s something we’re already seeing. I think it’s part of the reason why bitcoin is rising. It’s part of the reason we’re seeing scarce or unique artwork rising. That includes even these non-fungible tokens, or NFTs, representing scarce artwork – we saw one of those sell for $68 million earlier this year.

The tech metals – copper, lithium, cobalt – those are very important for electric vehicle (EV) production. They’re also scarce assets. There’s only so much of them available on Planet Earth.

Also, the rally in oil. We’ve looked at that on previous videos. Oil is up something like 80%, 90% over the past year. Again, oil is a scarce asset.

So when you have governments printing copious amounts of fiat currencies, you’re going to want to have investments in scarce assets. I keep talking about that.

Now, obviously, we’re not making any more farmland. You can’t make land. In fact, a lot of the farmland is receding, due to the effects of global warming.

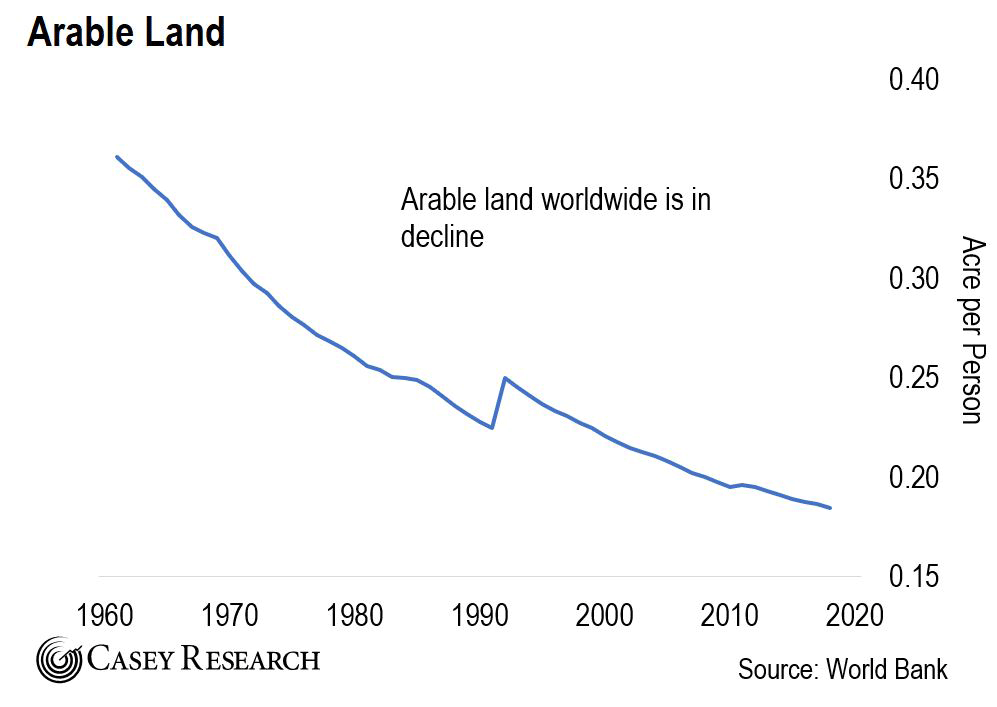

But when you also look at the population rise around the world, you see that the amount of arable land per person is shrinking very fast. It’s been in decline actually, as this chart shows, since about the 1960s.

So that scarcity squeeze, I believe, is going to really ramp up the price of farmland and the share price of the Gladstone Land Corporation (LAND). That’s something Dave has been banging the drum on over at his Strategic Investor advisory. It’s something he’s put on his readers’ radars.

The last thing, Tom, is that the Gladstone Land Corporation pays a dividend yield of 2.4%. That may not sound like a lot, but it’s seven times the yield on the average five-year CD in the U.S., which is only 0.3%. So you’re getting a good amount of income or yield from this investment.

Now, over at Strategic Investor, Dave has recommended two ways to play this long-term inflation-protection, capital-appreciation play. [Paid-up Strategic Investor members can catch up here.]

We’ll be talking to Dave in future Legacy Inner Circle issues, and I’ll be covering it in more detail in The Daily Cut.

That’s about it for this week, Tom. I think something like the Gladstone Land Corporation (LAND) is a very interesting thing to look at, if you’re worried about inflation and a big, long-term play on rising world population and the shrinking amount of arable land available.

Tom: Agreed. Gladstone is very interesting to look at. I’m looking forward to doing just that, and I hope others watching The Weekly Pulse will as well.

I’m also looking forward to upcoming discussions between you and Dave to go deeper on this topic. It seems like you have everything to gain and nothing to lose. I’m always excited to learn things from you and the experts within Legacy Research to help me grow and protect my wealth, as well as the viewers of The Weekly Pulse.

So, Chris, thank you, and thank Dave for bringing this to my and the viewers’ attention. We look forward to hearing more inside Legacy Inner Circle when you and Dave chat. Until next time. Make today great!

If you’re still here, that means you’re not yet a member of Legacy Inner Circle. That’s where Chris Lowe gets into the minds of the Legacy Research experts and also looks into their model portfolios. He brings to you, as a Legacy Inner Circle member, what’s working and why it’s working.

As he mentioned, he’s going to be doing another sit-down with Dave to learn more about the topic of REITs. And that’s just one of many of the experts he meets with to bring to you what’s working, why it’s working, and how you can take a closer look to see how it may be something to help you grow and protect your wealth in the upcoming days, weeks, months, and years.

So we have a special offer for you as a Weekly Pulse viewer. Simply click the button below to go learn more. We look forward to seeing you inside the members area and the members iOS and Android app. Go check it out. We’ll see you there soon.

| Not yet a Legacy Inner Circle member? Join here. |