Chris’ note: Tonight’s the night… At 8 pm ET, our natural resource investing guru, Dave Forest, kicks off his Super Spike Summit. It’s all about recurring periods he calls Super Spikes. They’re when commodities prices skyrocket across the board. And 2022 is setting up for one of the biggest spikes in history.

There’s still time to secure your spot for Dave’s event. So if you haven’t already, make sure to register for free here.

Then read on to learn more from Dave on what past Super Spikes can teach us about how to profit from these windows. As you’ll see, one of the biggest Super Spikes was in the 1970s. And it’s no coincidence that inflation, war, and geopolitical turmoil were in the headlines back then too.

As I showed you yesterday, we’re at the start of something I call a commodities Super Spike.

These are recurring windows when prices for many key commodities skyrocket.

They typically happen when inflation, wars, and geopolitical turmoil hit the headlines.

That’s what makes this year’s Super Spike such a massive profit opportunity… particularly as tech stocks and crypto prices fall.

This year, the S&P 500 is down more than 13%. The tech-heavy Nasdaq is down about 23%. Bitcoin (BTC), the world’s largest crypto by market cap, is down almost 34%.

Supply chains have been strained – partly because of Russia’s ongoing war on Ukraine.

We’re more worried today about global instability and vanishing paper wealth than we’ve been since the Super Spike of the 1970s.

And although we tend to remember that decade as a dud for investors… commodities investors made fortunes.

Cast your mind back to October 6, 1973.

That’s when Egypt and Syria triggered the Yom Kippur War. They launched surprise attacks on Israeli forces in the Sinai Peninsula and the Golan Heights.

Six days later, President Nixon greenlit an airlift operation to supply the Israeli military with weapons and tanks.

Oil-exporting Arab nations hit back by choking off U.S. supply… And all hell broke loose.

Over the next six months, the price of oil rocketed 300%. This kicked off an inflationary spiral.

In 1973, the U.S. annual inflation rate more than doubled to 8.8%. That’s roughly the level we’re at now. By 1980, it was 14%.

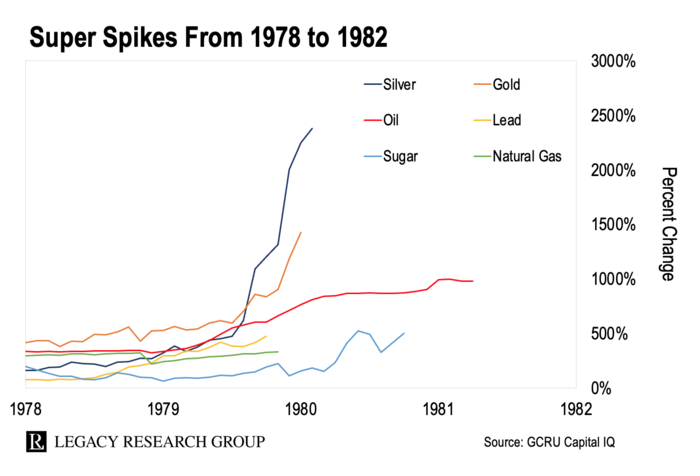

This kicked off a Super Spike. Take a look…

By early 1980, oil was up as much as much as 996%.

Gold soared as much as 1,423%.

And silver surged more than 2,379%.

That last one is enough to turn a $10,000 grubstake into more than $247,900.

With Super Spikes, you get this rolling boil effect. It’s one opportunity, then another, then another, then another.

Investors who caught the 1970s Super Spike made some of the most exceptional gains of the last century.

History gives us a blueprint to these Super Spikes. They have three phases…

-

The Profit Phase – Stock prices rise. Investor enthusiasm for tech and industrial trends increases. Investors start to move money into the hard assets that underpin these trends.

In the early 20th century, those were oil and rubber, which powered the automobile trend.

Today, they’re lithium, copper, nickel, and cobalt, which are essential for electric vehicles (EVs). These metals are what I call hard tech – the natural resources that go into technology.

-

The Plunge Phase – Rising prices for these commodities push up inflation. Most buyers can’t adjust to such a bump in costs. So they cut their spending. That sends the economy into recession. And it signals the end of the bull market in stocks. Rising inflation pushes even more investors into commodities to protect their buying power.

-

The Protection Phase – Skyrocketing commodities prices and the economic downturn torpedo the stock market. Gold and silver stocks surge as investors flock to the safe havens. These metals enjoy spectacular spikes in the final act of the Super Spike Window.

Right now, we’re still in the Profit Phase. Let me explain with an example…

Hard tech is booming.

Last year, I gave my paid-up Strategic Investor subscribers the chance to close out gains of 194%… 284%… and 385% on lithium mining stocks.

I also gave my International Speculator subscribers the opportunity to close out gains of 104%, 241%, and 247% on hard tech mining stocks.

And we continue to see lots of investor enthusiasm around hard tech.

Take what’s happening with the one of the biggest tech companies of our time – Tesla (TSLA).

In April, rumors began to swirl that Tesla would partner with tiny hard-tech firm Lithium Corporation (LTUM). It’s a junior mining firm with lithium projects in Nevada.

The hints of a Tesla deal sent shares in Lithium Corporation from 30 cents each to as high as $1.09 in hours.

That’s a 264% jump.

The Tesla deal turned out to be a head fake. But investors’ frenzied reaction to the rumor tells me there’s still enthusiasm – so we’re still in the first phase of the current Super Spike.

I expect we’ll see more spikes in hard-tech metals lithium and copper.

They’re not only crucial to the EV megatrend. We also need them to generate renewable energy from wind and solar and feed it onto the grid.

More demand means the spikes will get crazier… the swings will get wilder… and hard-tech mining stocks will enjoy bigger gains.

Whatever Super Spike phase we’re in, there are tiny natural resource stocks set to surge when the time comes.

Don’t miss this opportunity.

Inflation is eroding our wealth. Geopolitical turmoil and war are front-page news.

We’ve seen this before. And although it can seem scary… Super Spike investors have made huge profits when these conditions were in play.

So tonight at 8 p.m. ET, I’m holding a special broadcast to fully unveil my Super Spike blueprint. I’m calling it The Super Spike Summit.

During it, we’ll look at the massive profits past Super Spikes have generated… and how you can create even more wealth during the current one – all while shielding your portfolio from this rocky market and the devasting effects of inflation.

This is one of the most important events of my career. So I’ve made sure it’s free for you to attend. Reserve your spot right here.

Keep walking the path,

|

David Forest

Editor, The Super Spike Advisory