Stocks are off to the races in 2019… Watch out for “Fed Mistake No. 3”… Why dollar weakness is gold’s strength… In the mailbag: “Dope is for dopes. Libertarians are all nuts”…

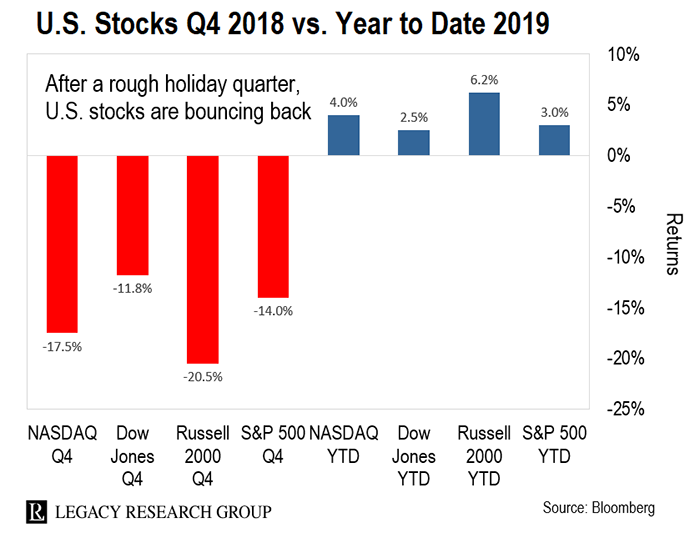

Last week, the U.S. stock market racked up gains for the second straight week.

The S&P 500 and the Dow closed the week up 3% and 2.5%, respectively. The tech-heavy Nasdaq ended the week 4% higher.

And the Russell 2000 small-cap index – which tracks newer, smaller companies that tend to do most of their business inside the U.S. – is up by nearly 6.2%.

That’s a big difference from the losses stock market investors experienced during the holiday quarter last year.

The question now: Is the pain over for stock market investors?

Or is Mr. Market luring them back into the bathtub, before he tosses in the hairdryer?

| Recommended Link | |||

|

|||

As he’s been showing his readers, bull markets move in three distinct phases… each linked to moves by the Fed.

The first phase is what Bill calls Fed Mistake No. 1. As he explains it…

Everybody wants cheap money. Because that’s what gooses up the economy.

So there’s this temptation for the Fed to keep rates lower than they ought to be longer than they should be. It doesn’t matter if you’re Alan Greenspan, or Ben Bernanke, or Janet Yellen, or Jerome Powell. That temptation proves irresistible.

The Fed keeps rates too low for too long because it gets their faces on the cover of magazines. That’s Mistake No. 1.

This phase is good news for stocks. In fact, between 2009 and 2015, when the Fed was in the Mistake No. 1 phase during the current cycle, the S&P 500 shot up 202%.

Realizing low interest rates have inflated various asset bubbles, the Fed gets the jitters… jacks up interest rates… and causes an allergic reaction on Wall Street.

It doesn’t matter if the asset is stocks, bonds, real estate, crypto, or the new bubble du jour. Everything goes up.

Here’s Bill again…

Mistake No. 1 leads inevitably to misallocations of capital. People borrow too much when interest rates are too low. They do things with the money they borrow that they wouldn’t do if they had to pay a higher rate for the capital. They make mistakes. The mistakes accumulate.

That’s when the PhDs at the Fed get worried again. They say, “Oh boy, we guess we kept rates too low for too long.” That’s when they make Mistake No. 2. They start to jack rates back up to where they ought to be.

This is when the cracks start to appear in the bull market. As interest rates rise, the cheap (or free) money starts to dry up. And asset prices drop.

| Recommended Link | |||

|

|||

Last year, the Fed – under Trump appointee Jerome Powell – raised rates four times. That’s the most hikes of any year going back to 2015, when it started to tighten.

Investors responded by pushing the S&P 500 to its first loss since 2008.

And the losses were steeper than a lot of people think…

On Christmas Eve, the S&P 500 was down 19.8% from its high set in September. That’s a hair’s breadth away from the 20% peak-to-trough fall that officially marks a bear market.

Desperate to avoid more bloodletting in stocks, Fed chief Jerome Powell is rushing in.

After raising rates (Mistake No. 2) in 2018, he’s now signaling to investors that he’s willing to lower them again (Mistake No. 3).

Powell says rates are now close to “neutral.” And he’s backed off his previous promise to raise rates twice more next year.

Instead of taking away the punchbowl… Powell is reaching for more liquor.

This appears (for now at least) to have brought back enthusiasm for stocks, which had all but vanished during December’s nearly 20% rout.

A big obstacle for gold of late has been a strong U.S. dollar.

Take a look at the chart below…

It tracks the exchange value of the U.S. dollar versus a basket of six trading-partner currencies going back to 1999.

And it tracks it relative to the gold price.

As you can see, the peaks in gold (black line) are accompanied by troughs in U.S. dollar strength (green line) and vice versa.

India and China are the two biggest importers of gold. The Swiss are also big importers.

When the dollar is strong, this makes gold expensive in local currency terms. And it crimps demand.

When the dollar is weak, on the other hand, buyers in non-dollar currencies can afford to buy more gold. This fuels demand. And since gold supply is relatively fixed, prices start to rise.

That’s why the Fed’s move matters.

As folks realize the Fed is making Mistake No. 3, the dollar will fall. And that will push up gold prices.

In the ongoing debate around pot legalization, Legacy Research cofounder Doug Casey argued that ALL drugs should be legal. As Doug put it at the time…

Your primary possession is your own body. If you don’t own it, and don’t have a right to do whatever you want with it, then you in fact have no rights at all.

That’s the main reason why the drugs war is criminal, and morally insane.

And it’s kicked off a firestorm in the mailbag…

Name one successful country with drugs as their national menace. Not one. Yes, I know big pharma produces drugs and millions are addicted to caffeine and nicotine. But meth, LSD, heroin, pot, and other such illegal substances all cause destruction, only adding to medical costs… and accidents, lower productivity, and the destroying of families.

We need better mental health care – not escapist drugs for losers. Dope is for dopes. Libertarians are all nuts. All of them.

– Patrick V.

I find it interesting that many who disagree with Doug do so generally on a moral basis. Everybody defines their own moralities and many of us have similar moral arguments, but I think it would be more practical to disagree with Doug’s position from a cost and safety position.

If there were no illegal drugs and people could take them legally if/when they wanted to, it would stand to reason that the school bus driver, fireman, the iron worker building a building, and your doctor could enjoy this freedom.

What happens to the rest of us if their consumption causes poor judgment performing their jobs? Who pays for that? Would Doug want to be driving on a road where a fire truck driver is speeding to an emergency scene while taking LSD? I know I wouldn’t.

We already know impaired driving causes accidents of all kinds. These accidents have injury and property costs. Maybe Doug’s OK with sharing the costs of replacing the property items damaged and the resultant higher insurance premiums with the drug users, but I’m not.

– Lester T.

Doug Casey is right on all fronts. It’s like the gun equation: If you outlawed guns and confiscated them, those who wanted to get a gun would get a gun. Same for drugs… those who want drugs are going to get drugs. In legalizing them, you will immediately reduce the number of deaths through the oversight required.

Colorado hasn’t gone up in flames since cannabis was legalized. We need to have more faith in our neighbors. Besides, I’m sick of the government telling me what I can and can’t do with my person. We are not a “free nation.”

– Mike B.

Why not? The poison big pharma spews out is legal!

– Ernest B.

Who do you agree with: Doug or his detractors? Should we have more faith in our neighbors, as Mike B. says? Or are the costs of drug legalization too great to take that chance?

We want to hear your take. Write us at [email protected].

Regards,

|

Chris Lowe

January 14, 2019

Dublin, Ireland