Chris’ note: At Daily Cut AM… Market Mission Control, our job is to get you through the coronavirus panic with your health and your wealth intact.

Colleague Teeka Tiwari believes stocks will be back at new highs within the next 18 months. But there’s no denying that – right now – we’re in a bear market. That’s why, today, you’ll hear from master trader Jeff Clark…

Jeff used to manage money for Silicon Valley elites. Now, he shares his trading recommendations and expertise at his Delta Report advisory. And he’s created a roadmap for his paid-up subscribers that lays out the three phases to expect in this bear market.

Make sure to stick around to the end of Jeff’s insight. A debate is raging in the mailbag about the best way forward through this crisis…

It’s official: The greatest bull market of all time is dead.

Between March 2009 (the post-2008-crash low) and its peak in February, the S&P 500 rose 400%.

Since then, it’s down 27%.

And the definition of a bear-market is a 20% drop or more from a peak.

So today, I want to lay out my bear market roadmap.

My paid-up Delta Report subscribers and I will use this to trade in the coming weeks and months.

Be sure to keep this outline close at hand in that time.

It will be your guide for how to profit in what could be a prolonged bear market.

Over the past month, investors have done a lot of technical damage to the U.S. stock market.

We’ve seen the fastest 20% drop from an all-time-high level – ever.

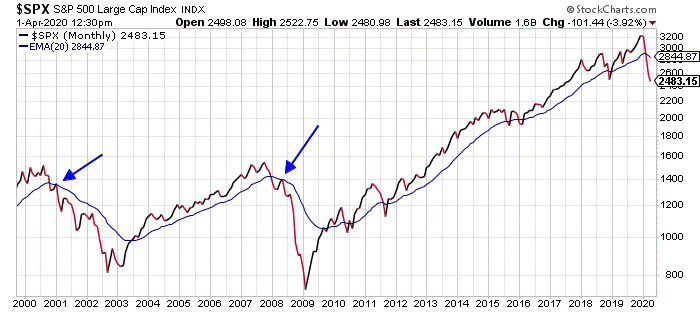

And, most important, the S&P 500 finished March below its 20-month exponential moving average (EMA).

Don’t worry about the jargon. The EMA is one of the trend-following indicators used in technical analysis to “smooth” out price action by filtering out large spikes and drops in a stock’s price. (Find my full trading glossary here.)

Think of the 20-month EMA as the dividing line between a bull and a bear market.

Have a look at the chart below…

It shows the price action of the S&P 500 on a monthly basis going back to 2000. (That simply means the price is recorded at the end of every month.)

It’s plotted against the S&P 500’s 20-month EMA. That’s the blue line on the chart…

If the S&P 500 is trading above the blue line, we’re in a bull market. If the index is below the blue line, the bear is in charge.

You can see how breaches of the line in late 2000 and early 2008 led to significantly lower stock prices in the months that followed.

Remember… this is a monthly chart. So all that matters is how this picture looks at the end of the month.

And as you can see on the chart, the S&P 500 ended March well below the line.

The bull market is dead. The stock market is headed lower in the months ahead.

But that’s not a bad thing…

Just as bull markets don’t go straight up, bear markets don’t go straight down. There’s lots of back-and-forth action… and lots of chances to trade stocks from both sides (bullish and bearish).

Bear markets, though, are typically more volatile.

The moves happen faster. Traders need to be willing to jump into and out of positions in a matter of just a few days or weeks. “Buy and hold” doesn’t work in a bear market.

It does help, though, to grasp how a bear market typically unfolds.

The bear market that started in 2000 lasted about 18 months. The bear market during the great financial crisis of 2008 lasted 15 months.

In both cases, the S&P 500 lost about half its value.

If this bear market follows the same pattern, it will likely end in the summer of 2021. And the S&P 500 will drop to about the 1,700 level.

Of course, no one knows for sure exactly how things will play out. But, based on history, 1,700 points on the S&P 500 looks like a pretty good downside target.

We’ll get there in three distinct moves…

1. The panic stage – That’s the initial move lower that kills the bull market and brings the bear out of hibernation. That’s what we’ve just experienced.

The S&P 500 plunged from a high of close to 3,380 points in late February to as low as 2,170 points on March 23. That’s a 1,200-point drop in less than a month.

Most folks would probably agree that qualifies as a panic.

2. The oversold bounce – This happens when the proverbial rubber band is stretched so far to the downside that a “snapback” move is inevitable. This bounce stage typically recovers 50% to 70% of the initial decline phase.

So, if that low of 2,170 points does indeed prove to be the low for the panic stage, then the oversold bounce should recover between 50% and 70% of the 1,200-point decline. That puts an upside target for an oversold bounce on the S&P 500 somewhere between 2,770 and 3,010.

Take another look at the monthly chart of the S&P 500…

3. Final plunge – Notice how, once the index broke below the 20-month EMA in 2000 and 2008, it rallied back up to “kiss” the line from below.

That “kiss” completed the oversold-bounce stage of those bear markets. It’s what marks the third phase of a bear market. (You can see that action in the blue arrows above.)

A similar “kiss” this time would have the S&P 500 rallying back up to its 20-month EMA, which is sitting at about 2,844. That’s right in the middle of the target range I mentioned above.

That’s the area at which traders should look to exit long positions and start adding exposure to the short side (betting stocks will fall).

What typically follows is a brutal plunge that takes out the panic-stage low… and wipes out about half the value of the stock market.

Again… no one knows for sure exactly how this bear market will play out.

But history gives us a roadmap. So, we have some general idea of what we’re in for over the next year or so.

I suspect we’ve completed the initial panic stage of the bear market. Now, the S&P 500 should be headed back up towards its 20-month EMA over the next month or two.

That’s a move that’s worth playing from the long side (betting stocks will rise).

Keep in mind, we’re not making a long-term bet on higher stock prices. We’re merely looking to capture what could be large gains over the next month or two as stocks work off their current oversold conditions and set the stage for an even stronger decline starting a few months from now.

So, right now, the roadmap suggests we should be working off the assumption that Monday, March 23 marked the low for the S&P at 2,170 (the panic-stage sell-off).

Now, we’re headed back up to retrace between 50% and 70% of that decline (the oversold bounce).

Once again… there are no guarantees in the stock market. No one knows exactly how things will play out.

But if this current bear market follows the same roadmap as the bear markets in 2001 and 2008, the S&P 500 is likely to be higher by the end of April than where it is today.

Traders should use short-term weakness over the next few days as a chance to add exposure to the long side.

We’ll look for opportunities to sell short once we get through the oversold-bounce phase.

Chris here – As regular readers know, each day, we put together a “community center” for you at the end of these dispatches.

It’s where you can send your thoughts about how the crisis is impacting your health and wealth… how you’re getting through your lockdown… and what you think is the best way forward.

It’s also where you can put your most pressing questions to our analysts.

So send your questions and stories my way. Reach out at [email protected].

I’ll get to as many of your emails as I can. And I’ll publish as many answers from our analysts as we can get through in these pages.

Yesterday, we heard from a reader living under lockdown in Belgium. She warned that the level of state control was like living behind the Iron Curtain, in communist East Germany.

And she’s not the only one worried about the feds’ new “emergency” powers. More on that below in our regular “Corona Watch” section.

First, we hear from a reader who’s a retired lung specialist… and a reader of our tech expert, Jeff Brown. He says this thing is a lot worse than some folks believe…

Yes, the news is bad. And it’s going to get worse. That needs to be broadcast widely.

As a retired lung specialist, I read the medical literature and the latest reports on COVID-19 hospital admissions. I know about the life-threatening, and often lethal, outcome of patients on ventilators. Doctors and nurses treating these patients are risking their lives.

The public needs to be afraid of this pandemic. It is bad news. I have never seen anything like it in my 40 years as a practicing lung disease specialist.

Americans need to listen and practice social isolation as much as possible.

Some individuals remain uninformed or disbelieving of the COVID-19 pandemic. This is a big risk to all of us. Please ease up on the media, they are doing their job!

– James J.

It’s true that Jeff is an optimist when it comes to this crisis. As he wrote about here, he believes there are plenty of reasons to be hopeful.

But not all his readers are convinced…

Jeff, I love your optimism. But I am afraid you are wrong about getting back to normal by mid-April. With the hair-on-fire, sky-is-falling news media, and our politicians shutting everything down, I’m afraid the damage to our economy will be awful.

Estimated numbers suggest GDP and unemployment will be worse than in the Great Depression. Our president was right. The cure is worse than the virus. And now, you tell us that things are slowing down dramatically with the FDA. Approved drugs will take longer to come to market. The result will be many people succumbing to disease. God help us.

– Marc D.

We also heard a lot from folks who are worried about the implications for our civil liberties and our freedoms.

As I’ll show you in today’s Corona Watch section below, many governments around the world are using this crisis to implement digital surveillance of their citizens. And I’m not the only one who’s worried…

First, I want to say THANK YOU to each of your wonderful analysts and writers at The Daily Cut, especially Jeff Brown for his in-depth coverage of the virus.

The “virus” is obviously real because people are dying (unless that news is being manipulated also). However, the media’s response to the virus has purposefully instilled fear and panic into the general population so they will lay down their freedoms and unknowingly allow government more control over their lives.

I expect to see new regulations coming out of this “pandemic” that will further limit our freedoms.

– Michael P.

Governments make people scared. Scared people become sheep for the government to lead. The wealthier people are, the more options they have. By making the middle class poor, it is easier to control them.

– Frank H.

Where do you come down on this? Are governments overreacting? Or are these lockdowns needed to save lives?

Write me at [email protected].

We launched The Daily Cut as a premium daily newsletter for Legacy Research subscribers back in August 2018.

And since the start, I’ve been sounding the warning that a sinister Surveillance Society is becoming a reality in China.

This is a new form of governance that gives the feds access to a vast trove of data on each and every citizen – including you, your friends, and your family members.

They then use this data to keep us under stricter control.

And I warned you that the U.S. is not far behind.

So it comes as no surprise to us that governments around the world have been ramping up their mass surveillance efforts in the wake of the coronavirus panic.

In last Tuesday’s mailbag, I showed how your cell phone’s built-in GPS (satellite location-tracking system) can help keep tabs on the coronavirus as it spreads.

Governments want to isolate cases of COVID-19. And they’re using our cell phone data to track those at risk of being infected.

Figures from this COVID-19 digital rights tracker reveal that 19 governments are tracking COVID-19 patients using data from their smartphones.

This ranges from tracking anonymized, aggregated data (with real identities “scrubbed”) to tracking individual suspected patients and their contacts.

This is becoming so obvious now… it’s finally getting attention from the mainstream press.

The Wall Street Journal had a story on this last week. It showed how the federal government is collecting billions of data points on hundreds of millions of smartphones.

The idea is to spot COVID-19 “clusters.” But the feds can also use this data to make sure you’re obeying their orders and staying at home. From the Journal…

The data can also reveal general levels of compliance with stay-at-home or shelter-in-place orders, according to experts inside and outside government, and help measure the pandemic’s economic impact by revealing the drop-off in retail customers at stores, decreases in automobile miles driven and other economic metrics.

The CDC [Centers for Disease Control and Prevention] has started to get analyses based on location data through an ad hoc coalition of tech companies and data providers – all working in conjunction with the White House and others in government, people said.

Now, for a lot of folks, that may sound like good news. And it’s true that phone-tracking can help us build a better picture of how the virus spreads.

The problem is this kind of ramped-up surveillance is likely to become the norm.

We saw it before with 9/11. That led to the ramping up of the U.S. surveillance state and the widespread eavesdropping operation by the National Security Agency (NSA) that Edward Snowden exposed in 2013.

We also saw it during the McCarthy era in the 1950s… when the government’s surveillance apparatus was turned against its citizens.

But we’ve gone on for too long already this morning… Stay tuned for more on how governments will use the coronavirus panic to build out their surveillance apparatus in this evening’s Daily Cut edition.

In the meantime, feel free to reach out with your own personal story about how you’re getting through the crisis. Write me at [email protected].

Stay safe… and take care.

Regards,

|

Chris Lowe

April 2, 2020

Dublin, Ireland

P.S. As you can see from the dateline above… I’ve finished my 14 days of self-isolation in a remote cottage in County Kilkenny. And I’m now back at home with my folks in Dublin. More about what it’s like this side of the Atlantic in future updates.

Like what you’re reading? Send your thoughts to [email protected].