Chris’ note: While most investors panicked as the stock market crashed in March 2020, tech expert Jeff Brown kept a cool head. He knew something others didn’t… and it gave his paid-up readers the chance to close out 2020 with average returns of 80% on open positions and 124% on closed ones.

It all has to do with what he calls “digital leaps”… events he says are the most lucrative in stock market history. He explains what they are – and what the big deal is – below.

But first, make sure you’re signed up for Jeff’s big event tomorrow night at 8 p.m. ET: America’s Last Digital Leap. He’ll share all the details on an $11.9 trillion industry he believes is about to go through the very last digital leap… setting the stage for you to make gains of 11x or more.

Reserve your spot for free here. Now, over to Jeff.

Just over a year ago – in March 2020 – we experienced one of the worst market crashes in history.

In the wake of COVID-19, governments were instituting strict economic lockdowns. Investors were panicking.

All the major indices were in free fall.

On March 9, the Dow plunged more than it ever had in one day up to that time. But it broke that record on March 12 and again on March 16.

That’s right. The three biggest one-day losses for the index all happened in March 2020.

The mainstream press was predicting an economic dark age. And many investors were rushing to liquidate their entire portfolios.

It was a very stressful time. But I told my readers we shouldn’t panic.

Here’s what I said to them on March 17 of last year:

First of all, and most important, things are absolutely going to get better. I know it’s a very uncomfortable time in the market.

In fact, I can remember in the past 45 years only three times that were like this. I’m talking about the notorious Black Monday, the period right after the tech bubble burst, and of course the financial crisis of 2008 and 2009.

But one thing is consistent with all three of those crises. They were some of the best times to invest in the stock market. They provided the best opportunities for the largest gains.

I went on to make a probably surprising announcement. I removed all the stop-losses from my recommendations. And I said we would even “shop” for some incredible companies trading at relative bargains.

I got pushback from several readers and even some of my colleagues for this announcement. But I knew it was the right decision.

By the end of 2020, our model portfolios had more than rebounded.

At my large-cap research service, The Near Future Report, we closed out the year with an 80% average return on open positions. And we enjoyed a 124% average return on closed positions.

How did we do it?

We knew something most investors didn’t…

Year of “Digital Leaps”

Of course, we knew the economic lockdowns would be terrible for some businesses.

The hotel industry suffered. Airlines had to be bailed out. Cruise ships sat dormant at their ports. And Hertz – the iconic rental car company – declared bankruptcy.

But this new world was a blessing for a select group of technology companies: ones that were enabling what I call “digital leaps.”

A digital leap is when an industry abandons slow analog systems and adopts new, bleeding-edge digital technologies.

Let’s look at an example…

In May 2020, I recommended my readers invest in a company called Infineon (IFNNY). It’s a key supplier to the electric vehicle and autonomous vehicle market.

This was during the strict economic lockdowns. Many investors were still avoiding stocks altogether.

But we knew Infineon was enabling a digital leap in the automotive industry.

Right now, carmakers are rushing to adopt electric and self-driving technologies. And with a worldwide pandemic, driverless cars have never been more important.

It’s no wonder we’re seeing returns of 146% in under a year.

Infineon wasn’t the only company that helped us profit in the wake of the coronavirus-induced crash…

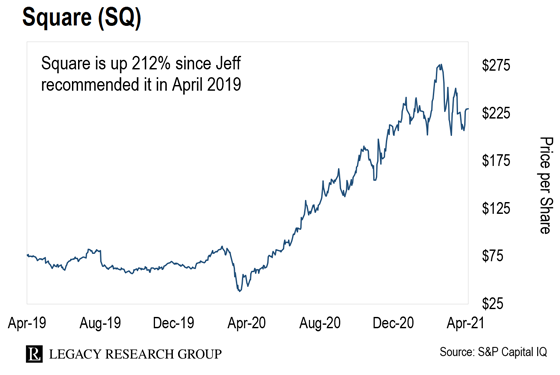

Square (SQ) is a company enabling a digital leap in the payment processing and peer-to-peer payments space.

Because of the pandemic, businesses and consumers were rushing to adopt digital, contactless transactions.

And thanks in large part to Square’s Cash App, this stock was a great way to play this trend.

I recommended Square to my readers in April 2019. We’re up 212% on it in the model portfolio as I write this.

Notice how we saw the bulk of returns after the economic lockdowns went into place. If we had sold Square during the fear-induced sell-off, those returns would have been off the table.

One more example… DocuSign (DOCU). It’s enabling a digital leap for business contracts.

The company’s technology allows us to securely electronically sign documents without ever visiting an office or handling physical paperwork.

I recommended DocuSign to my readers in June 2019. Our model portfolio is now showing 288% returns on this position.

Again, look where we see the sharp incline in share price. The stock took off in the months following the economic lockdowns.

It may sound strange to say anything good resulted from the economic lockdowns. But for companies powering these digital leaps, 2020 was a banner year.

In many ways, these companies had been waiting for a catalyst like this. They needed some major event that would “force” the world to use their products and services. Our response to COVID-19 was that event.

Pick almost any technology you want, and you’ll see its adoption has sped up 5 to 10 years.

But what if you missed these past digital leaps?

Don’t worry. Because I’ve found the next great one…

America’s Last Digital Leap

We’re in the early stages of the next digital leap – and it could be the last of these massive moneymaking opportunities.

It involves an $11.9 trillion industry we all depend on.

It’s been slow to adopt new technologies. But the time is finally here.

This will change all our lives for the better.

To get the full story… and to learn the details about my No. 1 pick at the center of this digital leap… join me for a special presentation tomorrow at 8 p.m. ET.

You can sign up for free right here.

I’ll see you then.

Regards,

Jeff Brown

Editor, Brownstone Research