Welcome to the weekly mailbag edition of The Daily Cut.

Coming up, we dive back into the controversy colleague Teeka Tiwari stirred up when he recommended his readers sell some of their gold and use the proceeds to buy bitcoin.

But first, an urgent comment about tech stocks for our tech expert, Jeff Brown. The tech sector, as you may have seen in the news, has been going through a bout of volatility.

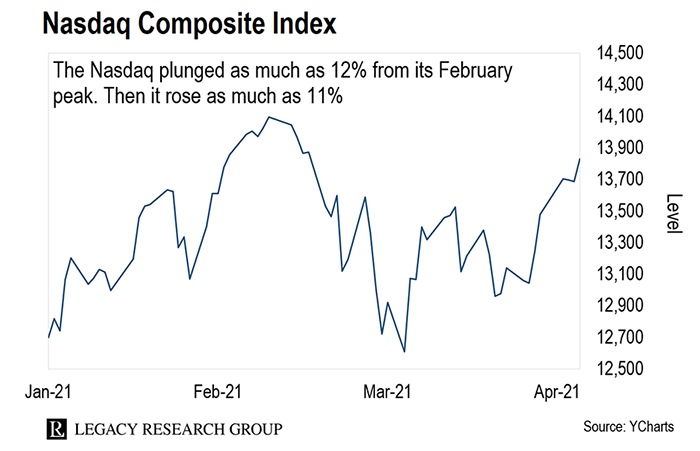

It’s all in this chart of the tech-heavy Nasdaq.

As you can see, the Nasdaq fell as much as 12% from its February peak before rising as much as 11%.

And some of Jeff’s readers are getting worried about these steep moves. But one reader urges you to keep your cool…

Reader comment: I hold a portfolio with quite a few biotech, tech, and other small-cap stocks. The volatility of them has been gut-wrenching the last week or so. I double- and triple-checked my stocks. None had even approached my mental stop-loss markers, yet the overall portfolio appeared to be in dire straits.

“DON’T PANIC!” is all I could shout to myself. I designed this portfolio for volatility, for the upside appreciation. These last few weeks have tested my resolve on enduring the downside of volatility.

Difficult, yes. Get grumpy and yell at loved ones? Yes. Explaining to non-investor loved ones why I was so grumpy calmed me down, and I was able to NOT PANIC. The market is trying to shake out the weak-willed investors, while we pick up shares at a discount. Don’t let them shake you loose! Just my satoshi’s worth.

– Gerald F.

Jeff’s response: Hi, Gerald. Thanks for writing in with your words of wisdom. You’re absolutely right. This isn’t the time to panic.

A handful of readers have written in lately to express concern about the volatility we’ve seen. This volatility has led many positions in our portfolios to pull back along with it.

But it’s important to keep our strategy in mind when we see volatility like this. As long as the market volatility isn’t related to our investment theses for our model portfolio companies, we shouldn’t worry.

Small-cap stocks tend to swing a bit more than large-cap stocks in moments like this. But it’s important for us to keep our composure and not allow short-term price swings to scare us out of our positions.

Rather than panicking, I’m hunting for great companies this dip has brought back to reasonable valuations.

So I encourage all readers to stay the course and not allow the big money that’s shuffling stocks around to push us out of great investment opportunities.

One more thing…

It’s normal to see higher volatility toward the end of each quarter… and especially at the end of the year. Why?

Well, all of the hedge funds and institutional funds that are incentivized on quarterly performance tend to rebalance portfolios to their advantage.

This creates a kind of artificial volatility. If it weren’t the end of the quarter, much of the trading wouldn’t have happened.

One way to weather volatility like this is to put the time frame in perspective. Most investments I recommend aim to capture long-term capital gains. Long-term gains mean a lower tax rate on those gains. All you need to do is hold your stocks for 12 months or longer.

So we’re really not worried much about some short-term volatility in those first 12 months. We’re just working toward our long-term capital gains.

Now back to the idea that’s been causing a stir among your fellow readers – whether bitcoin is a worthy replacement for gold to protect your wealth from inflation.

As I (Chris Lowe) covered in detail last month, Teeka says gold is no longer cutting it as wealth protection. That’s why he recently urged his readers to sell some of their gold and invest it in bitcoin (BTC).

Now, some of globetrotting gold bug Tom Dyson’s readers want to know his take on the bitcoin versus gold debate.

Tom, as regular readers know, made a $1 million bet – most of his life savings – on gold in 2018. He believes the yellow metal is the best way to preserve his buying power in the catastrophe he sees coming for government-issued currencies.

Reader question: I started buying gold back when it was at $250 an ounce. [It’s currently at $1,744.] But now, I am seeing bitcoin replace it as the safe haven to protect your assets.

Investors all over the world seem to be shunning gold in favor of bitcoin. To top it off, other big-name gurus are saying you should hold 10% of your assets in bitcoin and 1% in gold. Completely opposite of what my thinking has been. Tom, please give us your thoughts on this subject.

Tom’s response: My advice is don’t look at bitcoin and gold as substitutes. Consider the utility they each provide. Then decide if you need that utility.

Gold is like putting your cash under the mattress. It’s for people who don’t want to take any risk with their savings. It’s the safest place for your savings.

Bitcoin is an exciting but experimental new technology that promises great things but is extremely volatile. It’s for the visionaries… the speculators… the fence swingers.

What’s your appetite for risk? That should determine how much gold and bitcoin you own.

The good thing about bitcoin is it’s highly volatile. So a small position can go a long way up… without putting too much on the line.

Right now, I’m personally not interested in high-risk, high-reward investments. The whole financial system has been juiced by fake money, suppressed interest rates, and inflation.

I’m in maximum-safety mode, hunkering down, just hoping to get through the next decade with my buying power intact. So bitcoin is 0% of my personal portfolio, and hard metals (gold, silver, and steel) are 100% of my personal portfolio.

We’ll wrap up today with a small sample of the feedback we got from your fellow Legacy readers last time we tackled this thorny topic…

Bitcoin is finite in supply and easily divisible, and it can’t be double-counted. It has no borders or central authority. If you live in a country where fanatics take over, your bitcoin is encrypted online.

You can send any amount of bitcoin to anyone in the world in minutes, for cheap. No government or authority can control the transaction or confiscate it unless you let them.

In a world of high taxes, bail-ins, bailouts, and infinite currency creation, decentralized cryptocurrency is pretty brilliant.

Everyone is entitled to their opinion, but willful ignorance of the biggest change to money in modern history is pretty unproductive.

– Eric B.

Gold has been used as a store of value for millennia. But our puppet masters have ways of controlling gold by beating down the price. And if enough “deplorables” become interested in gold, I would not exclude confiscation.

Bitcoin is not as easy to handle and understand as gold. It needs computers and encryption to live. But it has the advantage that there is currently no known way of controlling the network. Even governments have failed so far to destroy it.

Conclusion: I am not willing to put all my reserves into gold. It’s too easy to manipulate. That’s why I prefer to trust both gold and bitcoin.

– Rudi S.

I’m in my mid-30s, and I’ve been into bitcoin and a lot of other cryptos over the last few years.

I’ve spoken with people aged 50 and above. 99% of them say bitcoin and digital assets just don’t make sense to them. But gold does, because it’s been around for a long time.

I’ve also spoken with people aged between 20 and 40 years old, and about 60% of them see the vision of bitcoin. They know where the world is headed. Cryptos make perfect sense to them.

It’s easy to see where we will be 10 years from now. Bitcoin will take a huge share of the gold market. And a ton of new money will come into the system.

We all invest for the future, not for today. So why would anyone want to own something that will devalue in the years to come? Change will happen. That’s just part of life. We got around on horses for 4,000 years. Look at us now!

– Mica L.

The world can crash and burn, or we can all hold hands around the campfire and sing Kumbaya… In either scenario, bitcoin rises in value over time. However, in the event of an EMP [electromagnetic pulse] attack or nuclear strike, those cryptos won’t mean much when the lights are out.

My parents instilled in me the “four Gs” for a successful life. God, gold, gardens, guns. If you’ve got those four things in your life, you can survive anything. God bless!

– David C.

Gimme a break. Asking an investor to choose between gold and bitcoin is like asking a healthy adult to choose between love and sex. They each have wonderful qualities. And you can achieve a good balance with a mix of both.

– Mike K.

That’s all for this week’s mailbag.

Remember, if you have a question for Jeff, Tom, Teeka… or any of the other experts on the Legacy team… be sure to send it to [email protected].

Have a great weekend.

Regards,

|

Chris Lowe

April 9, 2021

Barcelona, Spain