That’s how much Peter Thiel’s big data company, Palantir Technologies (PLTR), just shelled out on gold bars.

Palantir broke the news in an earnings statement earlier this month…

During August 2021, the Company purchased $50.7 million in 100-ounce gold bars. Such purchase will initially be kept in a secure third-party facility located in the northeastern United States and the Company is able to take physical possession of the gold bars stored at the facility at any time with reasonable notice.

That’s a head-scratcher.

We’ve seen tech companies MicroStrategy (MSTR), Square (SQ), PayPal (PYPL), and Tesla (TLSA) convert billions of dollars of their cash reserves into bitcoin (BTC).

But why is a bleeding-edge tech company loading up on fuddy-duddy gold?

Today, I (Chris Lowe) will show you why it’s not as odd as it sounds.

We’ll look at why, despite what a lot of folks believe, bitcoin and gold are “twin” assets.

Plus, I’ll show you why both belong in every prudent investor’s portfolio.

The Daily Cut is the premium e-letter we created for all paid-up Legacy Research subscribers.

Legacy is the publisher behind Teeka Tiwari, Jeff Brown, Dave Forest, Nick Giambruno, Jason Bodner, and Greg Wilson.

My job as editor is to bring you their best ideas on how to really move the needle on your wealth.

And since we launched the Cut three years ago, I’ve been urging you to own physical gold as part of a diversified portfolio.

And although there may not be a crisis happening right now, there’s sure to be one down the road.

We have a stock market that’s more richly valued than at any point since the 1990s tech bubble… Consumer price inflation is taking root… The world has more debt than ever before.

Besides, as U.S. economist Hyman Minsky said, “[Even] stable economies sow the seeds of their own destruction.”

That’s because stability – a sense of security – encourages people to take bigger risks. That risk eventually creates financial instability… which results in panic and crisis.

That’s why gold is so important. Here’s how I put it when I first began spreading the word on gold right after we launched the Cut in August 2018…

One reason you own gold and other hard assets is as “disaster insurance.”

They tend to rise in price when folks are worried about rising political and economic risks. And if the world goes to hell in a handbasket, these will be the last assets left standing.

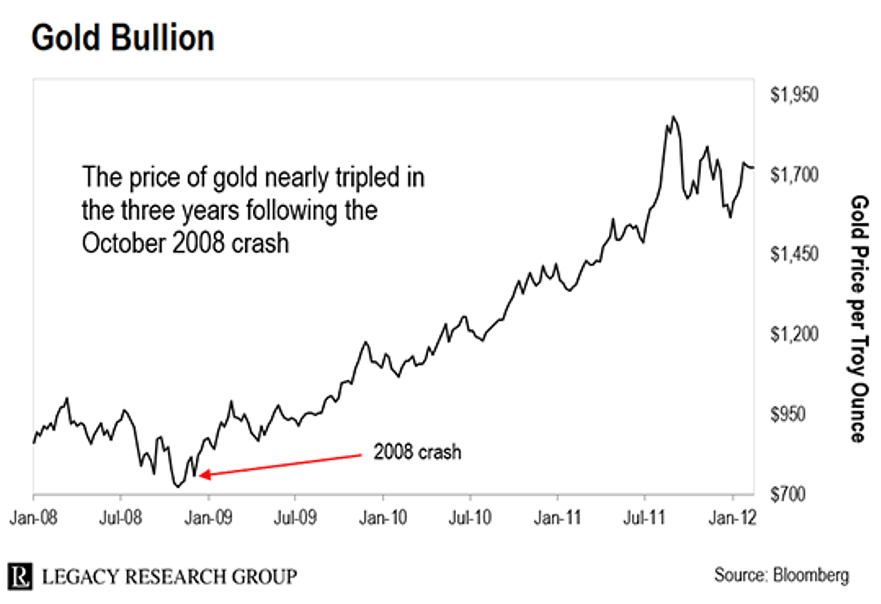

The stock market crash that followed it was a doozy. Our regular stand-in for the U.S. stock market, the S&P 500, plunged as much as 57%.

Gold initially fell along with stocks, as traders sold their gold to satisfy margin calls.

Then, over the next three years, it rocketed from $724 an ounce to more than $1,900 an ounce.

In other words, gold nearly tripled in price as stocks got shellacked.

Prices of “hard assets” – aka commodities – tend to spike in times of crisis.

Take it from colleague and international speculator Dave Forest over at Casey Research.

He and his team crunched the numbers on the CRB Index.

It tracks prices for a basket of 19 commodities – with 39% allocated to energy contracts, 41% to agriculture, 7% to precious metals, and 13% to industrial metals.

That makes it a good bellwether for the hard-assets trade. And the pattern of price spikes is clear. Dave…

The boom of the 1940s coincided with World War II – for a 295% gain in the CRB Index. The Arab oil embargo kicked off the commodities boom of the 1970s – for a 246% gain. And the commodities boom in the 2000s began right after 9/11 and the invasion of Afghanistan – for a 266% gain.

Bloomberg asked the chief operating officer, Shyam Sankar, why the company is buying gold.

His answer was, “You have to be prepared for a future with more black swan events.”

Sankar is referring to unpredictable catastrophic events.

Examples include World War I, the collapse of the Soviet Union, the 9/11 attacks, and the 2008 financial crisis.

He’s saying Palantir doesn’t have special insight on a coming crisis. But it knows that a crisis will come. And when it does, it’ll pay to own gold.

In May, a Wall Street analyst asked the company’s finance chief, Dave Glazer, an interesting question: Would Palantir consider putting bitcoin or other cryptocurrencies on its balance sheet in addition to gold?

He said, “The short answer is, yes, we’re thinking about it, and we’ve even discussed it internally.”

And Palantir says it welcomes both gold and bitcoin as forms of payment.

That makes sense to us…

A lot of folks see bitcoin and gold as rivals. (Check out the latest batch of feedback in our mailbag if you don’t believe me.)

But here at the Cut, we see them as complementary.

Regular readers have heard me say this before. But bitcoin, like gold, is a hard asset.

Thanks to an expensive “mining” process… and a supply schedule baked into its code… it’s hard to produce more bitcoin relative to existing supply.

That makes it a good inflation-fighter.

And that’s not where the similarities stop. Bitcoin, like gold, is also a bearer asset.

With a bearer asset, he who bears it owns it.

Bearer assets are different from stocks, bonds, and other financial assets in that you don’t have to store them with a centralized third party.

That means their value doesn’t derive from someone else’s promise to pay.

You can hold bitcoin in a digital wallet only you have access to. You can store gold in a safe in your home.

The chief difference between the two is the form they take. Bitcoin is digital. Gold is tangible. Otherwise, they’re essentially twins.

As you know by now if you’ve been with us for some time, Teeka is a former Wall Street vice president and hedge fund manager.

In April 2016, he became the first guy in our industry to officially recommend bitcoin (along with other cryptos) to his readers, at $428 a coin.

As I type, one bitcoin trades at $45,600 – a 10,554% gain for those who followed Teeka’s initial recommendation.

Here’s how he put it to me when I talked to him in July 2016 for our Legacy Inner Circle advisory…

We live in a time when the idea of money is changing more dramatically than at perhaps any other time in history. Up until now, we’ve had a faith in the U.S. dollar that’s really been unwavering. But that’s changing, because of the huge experiment going on among central banks.

People are looking for an ultimate source of value – something a central government can’t manipulate. In fact, they’re looking for something that can’t be manipulated at all.

Teeka prefers bitcoin over gold because he sees more upside ahead for bitcoin.

But if bitcoin isn’t for you, that’s fine. Own gold instead.

You can even follow what Palantir will likely do… and own some bitcoin along with some gold.

They’re both inflation-proof bearer assets.

That’s why big companies… along with millions of everyday investors… are adding them to their balance sheets.

If you haven’t yet joined them, now is a great time to take the first step.

You can learn all about buying gold in our free special report here.

And you can download our free one-page bitcoin buying guide here.

Regards,

|

Chris Lowe

August 18, 2021

Dublin, Ireland