It’s the biggest question we’re getting in our mailbags…

Why is gold falling?

Today, I (Chris) have answers.

But before we get to them, I want to make sure you had the chance to check out colleague Teeka Tiwari’s crypto presentation. It’s about a little-known opportunity that will help you not just survive – but also thrive – in this volatile time.

It’s created a huge buzz. 30,000 people tuned in on Wednesday night, when Teeka opened it up to the public. To see what all the fuss is about, go here.

Now, back to what’s been going on with our favorite form of “disaster insurance” – gold.

Gold hasn’t performed the way a lot of folks thought it would.

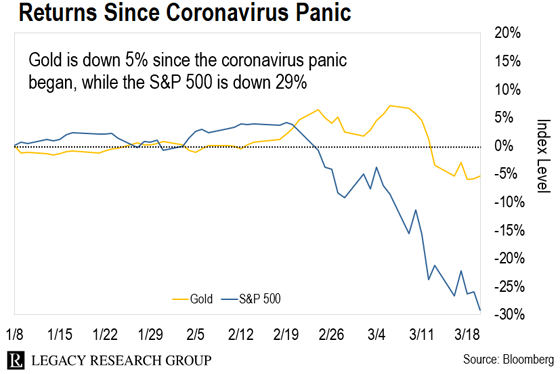

As you can see, since the coronavirus made front-page news in the U.S. two months ago, gold has fallen 5%.

Now, that’s not bad, given that the S&P 500 is down 29% over the same time. There’s a world of difference between losing $5,000 on every $100,000 of savings versus losing $29,000.

It’s still natural to be worried when you see gold falling like this. It’s alarming to think that your disaster insurance won’t protect you from the financial storm.

But be assured, the drop is nothing strange or startling. We’ve seen the same thing happen to gold initially in 2008… Then it soared 166%.

There are good reasons for this initial dip, as you’ll see in this gold-focused edition of The Daily Cut Friday mailbag.

We’ll kick it off with a question from Tom K.

Reader question: Hi Chris, why has the price of gold fallen dramatically, since the VIX [the Volatility Index, Wall Street’s “fear gauge”] has gone up, stocks are down, and there is panic about the C virus? This seems odd to me.

– Tom K.

Chris’ answer: It’s a great question, Tom. You’re just one of several Legacy readers who want answers on gold.

The short answer is that leveraged traders are selling it to satisfy “margin calls.” Let me explain…

Some traders borrow money from their brokers to buy extra shares and amplify their gains in a bull market. They often use their shares as collateral to back those loans.

If the value of those shares falls far enough… the broker who loaned an investor the money can issue a margin call. That means the investor must add cash to bring his account level back up to the required minimum.

Investors typically sell other assets to raise the cash to satisfy the margin call. If they don’t, their brokers could take their shares from them, and they’d lose everything.

Like I said, it’s nothing new. It’s exactly what we saw happen with gold back in 2008.

In the immediate aftermath of the 2008 stock market plunge, gold fell along with stocks (although not as hard). But after a 29% fall between March and November 2008, gold went on to rally 166%.

What made the situation worse this time around was that, at the start of February, the level of cash in investors’ accounts was the lowest since March 2013. This forced investors to sell even more of what they could get their hands on… including their gold.

And remember, the stock market sell-off has strengthened the case for owning gold.

As I predicted here, when the next recession hits, central banks will unleash a tidal wave of new cash. And that’s what we’ve been seeing.

The Fed has dropped rates to zero… and fired up a new version of its quantitative easing (QE) program… And on Capitol Hill, they’re talking about mailing out checks to every American.

This will cause investors to pile into gold to protect their buying power from the onslaught of inflation and paper money.

Sticking with gold, Jim S. wants to know why prices are plunging when demand is up…

Reader question: Can someone explain what is going on with gold and silver? They are usually safe havens. Sellers of bullion and bars are reporting zero inventories and delays in production. So with such demand, why are prices falling?

– Jim S.

For the answer… I turned to colleague Tom Dyson.

Tom, as you may already know, recently made an all-in bet on gold. And he’s been writing about his big call almost daily over at his Postcards From the Fringe e-letter (sign up for free here).

Tom’s answer: I wrote an entire essay on this on Tuesday. But the short answer is the price of gold is not set by buyers and sellers of physical gold. It’s set by the big institutions, banks, hedge funds, and commercial traders trading futures, options, leases, and other forms of “notional” or “paper” gold.

I’ve read the daily transaction volume of paper gold is 1000x times the daily transaction volume of physical gold.

So when these commercial traders answer margin calls… and unwind hedges… they sell their gold. That’s why the price can take big dumps sometimes. The only thing you can do is expect and accept the volatility.

Oh, and by the way… we’re in the ninth inning of the greatest financial experiment in history. We’re also on the cusp of a new monetary system. It’s not surprising there’s a little volatility in the gold price.

Sit tight. Ignore it. And keep an eye on the fundamentals, not the wild fluctuations in the crazy paper gold market.

In short, gold remains one of our favorite forms of disaster insurance. And we expect it to outperform just about every other asset as the printing presses start to whirl.

For more on how to pick up physical gold, you can access a special report from the folks at Casey Research. It will point you in the direction of some reputable gold coin dealers. It will also run through the other options available to you for getting exposure to the gold market.

Switching gears, on Monday, we set up a brand-new edition of The Daily Cut to cover all your concerns about the coronavirus and its impact on your wealth and the markets.

It’s called The Daily Cut AM. And as long as the crisis lasts, we’ll be tearing down our “paywall” and sending you our best research and recommendations about how to handle the pandemic.

Yesterday, I sent out an update from our tech expert, Jeff Brown, on the race to find a vaccine for the virus.

And this morning, I sent an excerpt from his latest recommendation over at our Near Future Report tech investing advisory. It’s all about a “virus-resistant stock” Jeff believes will double if you buy now.

As part of The Daily Cut AM editions… I’ve been asking your fellow Legacy readers how they’ve been getting through the crisis. And the feedback has been flooding in…

Reader comment: I have just received a video clip in which doctors at a hospital in Jaipur, India, have successfully treated and cured three coronavirus patients within five to eight days.

One of the patients was elderly with diabetes. We all hope this is solution that will be suitable for all patients. Wishing all stay well and safe from coronavirus.

– Amin G.

Reader comment: It’s clear media outlets and the American Medical Association (including most doctors that spent way too much time becoming pharma’s sales force) are not interested in advising the public how to take the best precautions at their immediate disposal.

The basics are hiding in plain sight. This is still fundamentally a type of flu. So before you ever have symptoms, make your immune system as healthy as possible. If you don’t already know, the cold/flu season exists because our bodies become vitamin-D-deficient. So take in the sun as much as possible.

If you are not in an area with much sun (think of everywhere you see high amounts of influenza), supplement with vitamin D. Always hydrate with water and take vitamin C. Eat healthy, protein-rich, and vitamin-rich foods.

The reason we will see this virus slow down is, as warmer weather arrives and our bodies start creating the natural vitamin D required to fight off viruses, we are much less susceptible to ailments.

– Giulio P.

Reader comment: This is what medical professionals, the American Medical Association, the American Doctors Association, and pharma should be screaming at the top of their lungs. But there’s no profit in this for the medical profession, or for pharmaceuticals.

You almost touched on it with this bullet point: “Research out of China shows that warmer, more humid weather slows down the spread of COVID-19. Cases in the northern hemisphere will dramatically fall as we enter spring (humidity) and early summer (warmer weather).”

– Christian T.

Reader comment: Thank you so much for your clear and positive emails. They’ve calmed some of my fears and given me hope! There are no cases in my town so far, but I know it’s just a matter of time.

My family and I are being careful and avoiding gatherings, but we still have to shop, and my husband has to go to work. I luckily already work from home. I have risk factors, so we are very cautious.

– Kathleen D.

Reader comment: I am very pleased to have you as a resource for information about this menacing virus. Please keep me informed about all of the new things and work that are happening to eradicate this pandemic from our world. May God bless and protect us all!

– Richard B.

Our team here at Legacy is standing by to answer all your questions. I’ll make sure to send them on to your favorite analysts myself.

I also want to hear your news. What are you doing to prepare during the outbreak? Do you have any local updates from your area? Are there resources you want to share with your fellow readers?

Let us know at [email protected].

Regards,

|

Chris Lowe

March 20, 2020

Kilkenny, Ireland

P.S. As cities across the U.S. go into lockdown, here at Legacy, we want to go the extra mile for you. It can be boring being stuck indoors with nothing to do. So we’re also unlocking a digital copy of Legacy cofounder Bill Bonner’s latest book for you.

It’s called Win-Win or Lose: A Modest Theory of Civilization. And it’s a Bonner classic. In fact, it’s one of the best insights into how society and the economy really work that I (Chris) have read. And it’s almost diametrically opposed to the mainstream view.

You see, Bill believes government bailouts… quantitative easing (QE)… zero interest-rate policy (ZIRP)… trade wars… and all other Washington boondoggles are win-lose deals. The remedy for the economy is something different entirely. You can access your free copy of Win-Win or Lose here, courtesy of Bill.

When you’ve read it, tell us what you think at [email protected].

Like what you’re reading? Send your thoughts to [email protected].