This chart says it all… How to become a gold-mining “tax collector”… Don’t miss our “Stock Market Escape Summit”… In the mailbag: “Freedom is our legacy, not a guaranteed future”…

We’ve been telling you to prepare for a gold rally since colleague E.B. Tucker called the bottom last August.

And there’s a debate going on behind the scenes at Legacy Research that’s making us prick our ears.

It’s about the rise of socialism in America… and what it could mean for the price of gold.

| Recommended Link | |||

|

|||

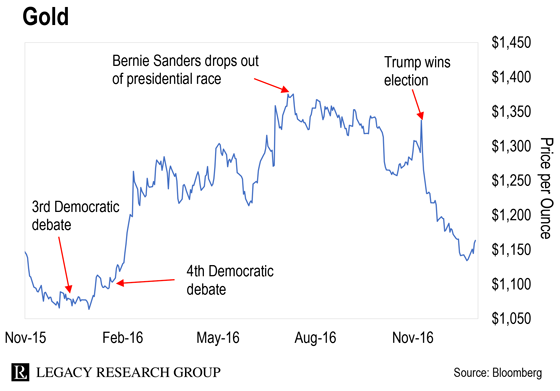

It tracks the gold price in the 12 months leading to the 2016 U.S. presidential election.

Houston Molnar, on our research team, put it together.

He says that when investors saw that Democratic Socialist Bernie Sanders was in range of winning the Democratic nomination, they piled into gold.

When Sanders dropped out, investors reversed course and sold gold. Here’s Houston with more…

When the third and fourth Democratic debates were narrowed down to three nominees, Americans started to “Feel the Bern.” And gold investors saw that Bernie’s big government spending programs had a chance of becoming a reality.

Gold soared 28% from the third Democratic debate until Sanders dropped out of the presidential race in July 2016. That’s a huge run-up. After Trump won the election, gold fell 12% in about five weeks.

This time around, a big-spending candidate could make it to the Oval Office. In that case, we could see another big run-up in gold.

But it’s not all about whether gold is headed higher over the short term…

First, it’s “disaster insurance.” It protects you from falling stocks and inflating currencies.

For protection, you want to own physical gold.

But gold is also a speculation. For that, you want to add some gold-mining stocks to your portfolio.

Today, we’ll show you a third way to profit in the coming gold boom – royalty companies.

They finance gold-mining projects in return for regular payments on the gold those projects produce. These payments are called royalties.

Colleague E.B. Tucker, who runs our Strategic Investor advisory, says royalty companies are the closest thing to the tax collection business he’s seen in his career. As he put it…

Gold royalty companies don’t operate mines. They don’t develop new mines. And they don’t explore for ore deposits. Instead, they own a diversified portfolio of royalties on third-party mining projects. In other words, they finance mining companies.

It’s a great business model. You buy a royalty in a gold-mining project. The mining company sends in a report of what it produced. And it sends you a check for whatever percentage of the production your royalty arrangement covers.

That’s it. Royalty companies completely avoid the costly, risky business of digging ore out of the ground. They just pick up checks and cash them. Then they use some of that cash to invest in new royalties.

One of the most important benefits of owning royalty companies is they’re relatively low-risk. E.B. again…

Like with the taxman, there’s no way to run from the royalty owner. That’s what makes it such a great business model.

Of course, if an earthquake hits the mine… and the mine stops producing for a time… the royalty payments stop. Say a royalty company is getting 1% of production. If production goes to zero for a year, so do its royalty payments.

But for the larger, more-established firms, it doesn’t matter if one of their royalties is down. Because they have royalties on many different mining operations on their books.

Royalty companies are a huge help with “diversification” – aka spreading your risk around.

And there’s no better way to avoid what Legacy cofounder Bill Bonner calls a “ruinous loss” than spreading your risk around.

| Recommended Link | |||

|

|||

It’s the world’s largest gold royalty company.

Since 2007, FNV’s stock has steamrolled other gold-related investments. Take a look…

You’re looking at Franco-Nevada shares (green line) relative to gold stocks (black line) and physical gold (yellow line), going back to 2007.

Since Franco-Nevada went public that year, its shares are up 479%.

Over the same time, gold bullion is up 70%. And the average gold-mining stock is down 48%.

Gold royalty companies are financiers to the mining business. So they have low overhead costs.

They need some office space… some desks… and a handful of employees. Unlike gold-mining companies, they’re not out there with heavy mining equipment… thousands of employees… sky-high energy costs… and political risks.

Those fat margins allow them to capture far more upside to the gold price than a gold-mining company could ever hope for.

Gold is a rock we dig out of the ground. It pays no interest. But royalty companies pay income via dividend payments.

That makes them a great deal if you’re a gold investor looking for income.

Right now, Franco-Nevada’s dividend yield is 1.28%. That’s not huge. But it’s a lot better than the zero interest rate on gold.

And management has been steadily raising the dividend payment since it took the company public just over a decade ago.

So if you’re looking for a best-in-breed royalty company, Franco-Nevada (FNV) is a good place to start your research.

It’s the heavyweight in the sector with a highly diversified portfolio of royalties. And it has a proven track record of rewarding shareholders – both through a rising share price and rising dividends.

As we’ve been telling you, E.B. says the rise in gold will be accompanied by a spike in stock market volatility… as the bull market in stocks gives way to the next bear market.

And tonight at 8 p.m. ET, he’s teaming up with Legacy Research cofounder Doug Casey for a special broadcast he’s calling the “Stock Market Escape Summit.”

At the Summit, E.B. will walk you through his top investing strategies for 2019…

How he knows when it’s time to be a contrarian…

And a little-known type of investment that can help you make 1,000% gains without touching the stock market. It has nothing to do with cryptos… options… or even gold.

If you haven’t yet, make sure and sign up for tonight’s Summit right here.

The hot topics of stock buybacks… America’s growing Surveillance Society… and whether we should stay out of politics at The Daily Cut continue to dominate the mailbag…

So many of your readers apparently do their “thinking” by listening to media and government spin, or to the talking points of politicians. Not only is there nothing wrong with stock buybacks, but they are in some ways superior to dividends for us as investors, because they do not trigger a taxable event – which a dividend always does!

If a company is buying back shares at an undervalued or historically low price, it might be the best thing that can be done for the company and its investors. If a company is buying back overvalued shares, it’s a terrible investment and should be avoided. But we never need the government to stick its nose into the business of “free” enterprise – we’ve lost way too much of our freedom, already!

– Tim S.

Great revelation [on Monday] about the Orwellian surveillance systems out there, and even better advice on how to go dark. I’ve already permanently deleted my Facebook account, but when I did, it was because I was so pissed off at being thrown into Facebook jail for every freedom-of-speech exercise I utilized in the comments section under political memes. The surveillance thing was just about as front-and-center a reason as the politically correct garbage!

As for the “ignore politics at your peril” debate, absolutely. They (the politicos and their handlers), pick our pockets on a continuous, ongoing daily basis.

– Vaughn M.

Great article but you are touching the tip of the iceberg. With all the new technology in our homes, cars, and on the street, there is not much any agency will not know about you.

Your refrigerator will notify you when you need to stop on the way home and buy more milk, your car will alert the local police when you are driving 50 mph in a 40-mph speed zone. If you spit on the sidewalk or litter on the streets of any city, the authorities will know.

– Bill H.

Did you take our advice to buy gold last August? Could a left-leaning president in 2020 kick off the next big rally in gold? Write us at [email protected].

Regards,

|

Chris Lowe

February 27, 2019

Barcelona, Spain

P.S. If you’re a paid-up Legacy Inner Circle subscriber, keep an eye on your inbox on Friday… In this week’s issue, I (Chris) will be catching up with E.B. Tucker about how he builds the ideal gold portfolio. So look out for that at the regular time of 12 p.m. ET.