Welcome to the Friday mailbag edition of The Daily Cut.

This is where you put your questions to your favorite Legacy Research analysts… and see responses in print.

As regular readers know, our job is to spot market megatrends early on so you can profit.

We do that by plugging you into the latest ideas from Teeka Tiwari, Jeff Brown, Bill Bonner, Doug Casey, Tom Dyson, Dan Denning, Nick Giambruno, Jason Bodner, John Pangere, Dave Forest… and the rest of the Legacy team.

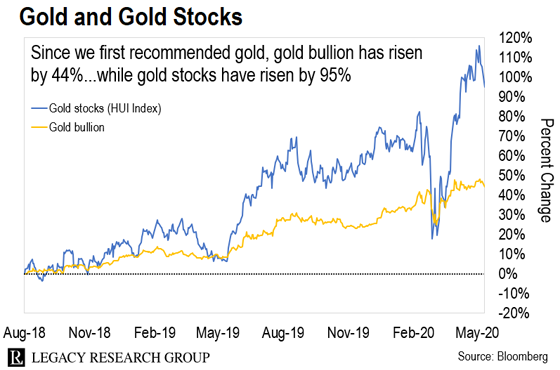

One of the market megatrends we’re tracking is the rally in gold and gold stocks. Teeka, Bill, Doug, Dan, Tom, Nick, John, and Dave all see higher prices ahead.

As you can see from the chart below, since we first put the rally on your radar in these pages back in August 2018, gold’s been a great place to be.

But gold investing can be a tricky subject, as there are many different ways to invest.

So we put our Legacy Research analysts on the case.

Let’s kick off today with a question we get a lot about owning gold…

As students of market history know, on April 5, 1933, President Franklin D. Roosevelt forbid U.S. citizens from owning gold with Executive Order 6102. It banned the “hoarding of gold coin, gold bullion, and gold certificates within the continental United States.”

This ban stayed in place until December 31, 1974. But at least one reader is worried that history will repeat.

It’s a concern Nick Giambruno, who heads up our Casey Report advisory, has a creative answer for…

Reader question: I’ve been a buyer of gold for many years, so I’m definitely a believer. But I follow various newsletters that encourage investing in gold. And no one ever discusses the probability that, if and when things get bad enough for gold to soar, our government will not just stand by and allow gold owners to continue to own their gold (and enjoy the profits).

Seems to me it will impose an exorbitant tax on it or just ban ownership altogether (as was done before). I will still continue to own gold because there’s no alternative. But it would just be nice if someone would begin a discussion of these unfortunate threats.

– Patricia D.

Nick’s answer: It’s a great question, Patricia. If the price of gold explodes, I wouldn’t be surprised if Congress passes a Fair Share Gold Windfall Profit Tax Act levying a tax of 80%, 90%, or more on gold profits.

What the heck is a windfall profit?

As far as I can tell, it’s whatever politicians decide it is. It’s completely arbitrary. There are no objective measures to define it.

In short, a windfall profit is a profit politicians don’t like. The whole idea is a scam – a word trick to camouflage and sanitize legalized theft.

Fortunately, there are some practical steps you can take to protect your wealth from this form of politically motivated expropriation.

One way you can avoid a windfall-profits tax on gold is to renounce your U.S. citizenship. But that’s a drastic step. It’s just not realistic for most people.

Thankfully, there’s a more practical option. You can do it from your living room. And you don’t have to turn in your passport.

The solution is to own physical gold and gold stocks in a Roth IRA.

A Roth IRA is a tax-free zone. You fund it with after-tax savings. But any future capital gains or income derived from investments in your Roth IRA is not taxable.

You can never be 100% sure what the U.S. government will do. But it’s far less likely a future tax increase – even a windfall-profits tax – would affect investments in a Roth IRA.

Next up, a question about two inventive ways to buy physical gold.

As I showed you, there’s a “gold crunch” right now. You can’t get your hands on physical gold without jumping through some pretty serious hoops.

You either have to wait up to three months before taking delivery of the bars and coins you buy. Or you have to pay a hefty “premium” – or extra charge – over the going market price for gold.

Some folks are paying as much as 45% over the market price just to get their hands on the stuff.

That’s why we’ve spilled so much ink on alternative ways to own physical gold.

One is through the Sprott Physical Gold Trust (PHYS). Another is through Perth Mint Certificates. Both allow you to own the metal without having to store it at home. But each has different features. And one reader wants to know more…

Reader question: What are the pros and cons of Perth Mint Certificates compared with the Sprott Physical Gold Trust (PHYS)?

– Paul Z.

Chris’ answer: Thanks for reaching out, Paul. I’m glad you’re taking an interest in these innovative ways to own physical gold.

Some folks are willing to pay those eye-watering premiums to get their hands on gold bars or coins they can hold in their hands. That’s one way to go.

But if you pay a premium like that, it will act as a pretty steep hurdle to profitability. For instance, if you’re paying a 45% premium over the gold “spot price” (its quoted market price) to buy a gold coin, you’re in trouble.

But PHYS and Perth Mint Certificates (PMCs) give you legal ownership of physical gold without the hassle of storing it at home or paying a bank to store it on your behalf in a safe deposit box.

PHYS is a mutual fund whose tradable units are fully backed by gold. You can buy and sell shares in it through your regular online broker. And the value of each trust unit moves in lockstep with the price of gold.

What makes this different from most gold exchange-traded funds (ETFs) is that PHYS allows you to redeem your shares for physical gold. (This is subject to a minimum delivery value of around $600,000.)

PMCs are legal titles to gold at the Perth Mint. That’s Australia’s official bullion mint. It’s fully owned by the government of Western Australia, one of Australia’s six states.

PMCs give you legal ownership to gold stored in the mint. You’re able to take physical delivery of your gold should you have the need for it.

You can buy or sell PMCs through a Certificate Program distributor (you can find a list here). But PMCs do not trade on an exchange like shares in PHYS do.

To make it as easy as possible for you to see the pros and cons of each, our researcher, Michael Gross, has put together a table for you.

Sprott Physical

Gold TrustPerth Mint Certificate Who is the custodian? Royal Canadian Mint, a Canadian Crown Corporation that acts as an agent for the Canadian government Perth Mint Depository, Australia’s official mint that is wholly owned by the state of Western Australia How is my gold stored? Fully allocated. Every dollar has a matching physical gold piece Allocated and unallocated options Is there a minimum? Entry amount = price of one share. The current price is about $13 $10,000 (USD) to open an account What fees do I pay? Annual management fee of 0.35% Allocated gold accounts have a storage fee of 1% per year, charged quarterly. Unallocated gold accounts have no storage fee. There’s also a 2.25% premium when you buy gold, and a 1.25% commission when you sell Can I redeem my gold? Can redeem units for physical gold on a monthly basis, subject to a minimum value equal to that of a London Good Delivery Bar (350 to 450 ounces) Can redeem a minimum of a 1-ounce bar or coin. Can arrange physical delivery of gold to most destinations around the world How easily can I buy or sell? Can buy and sell trusts just as easily as stocks The Perth Mint will buy back the metal on certificates based on current market prices If you want to know more, you can head over to the websites for the Sprott Physical Bullion Trusts and the U.S. partner for the Perth Mint Program, Asset Strategies International. You’ll find a lot of answers to your questions there.

Finally, some kind words for our globetrotting gold bug, Tom Dyson.

Tom made a personal investment of nearly $1 million in gold in November 2018. And he’s been writing about it since in his free daily newsletter, Postcards From the Fringe.

Tom also shares with his readers dispatches from his travels around the world with his ex-wife and three kids. And it’s been a hit with readers…

Reader comment: A world of thanks for your “postcards,” which my wife and I have enjoyed since they became available. And an even bigger thank-you to Tom and Bill [Bonner] for sharing the Dow-to-Gold ratio and explaining the underlying problems in our financial system.

It struck a chord with me and reinforced what I already felt. More importantly, it prompted me to finally convert the cash (USD) I had saved into “real money.”

As a pensioner, it is more important to protect what I have. That I am way up in gold is icing on the cake. On a side note, Tom, if you are traveling through southeast Arizona on your travels, you’re welcome to park at my rural home and avail yourself of the facilities for a day or two. Safe travels.

Reader comment: Dear Tom, so refreshing to hear your directness and clarity. No bullsh*tting hard sells with endless figures of gains. All sounds absolutely right, this flight to gold before government finances take us over that very high cliff.

Reader comment: Hi Tom, you are a beacon of light in a dark world. I have been collecting gold and silver for years, wondering if I was doing the right thing.

My wife has been extremely angry at me and thinks that I have been wasting money. I’m not looking forward to the prices going up, because I am worried what it might mean for the rest of the world. But at least I think we will be safe financially.

God bless you and your family. Safe travels.

I (Chris) hosted a panel discussion on gold at last year’s Legacy Investment Summit in Carlsbad, California.

The panel was called “Your Roadmap to Profits as Gold Shoots Higher.” On the stage with me were legendary natural resource investor Rick Rule… Bonner-Denning Letter coauthor Dan Denning… our globetrotting geologist, Dave Forest… and gold industry insider E.B. Tucker.

We went through the best ways you can get exposure – from gold coins and bars… to gold miners and royalty companies… to tax-advantaged trusts.

If you haven’t already seen it, it’s available to you for free as a Daily Cut reader here.

What about you? Have you already profited from one of our many recommendations to buy gold? If not, what’s holding you back?

Write us, always, at [email protected].

Regards,

|

Chris Lowe

May 29, 2020

County Wicklow, Ireland

Like what you’re reading? Send your thoughts to [email protected].