Chris’ note: The Fed made one thing clear with yesterday’s rate hike… It doesn’t care if it breaks things. It will keep jacking up rates until it tames inflation.

And as colleague Nomi Prins has been warning, the cracks are starting to show in the real estate market. Already, one of the world’s biggest fund managers has faced a run on its real estate fund.

And Nomi believes there’s much worse to come.

She detailed it all in her Countdown to Housing Crisis 2.0 strategy session on Tuesday night. She showed how a wave of bankruptcies is on the way… and why it could rival the real estate crash in 2008.

She also revealed a strategy she learned on Wall Street that could help you turn the housing crisis into big profits.

Check that out here while it’s still online. Then read on for more from Nomi below on why you need to prepare for the coming housing crisis now.

Owning a home = the American Dream.

Think that’s farfetched?

A recent study revealed nearly three in four Americans believe owning a home is more important than career, family, or a college degree as a sign of prosperity.

And for the past decade, owning a home was also a great investment.

The S&P/Case Shiller U.S. National Home Price Index tracks prices across America for single-family homes.

It’s up 124% since 2012.

But earlier this month, developments at a prestigious Wall Street real estate fund proved all is not well in the housing market.

Today, I want to shed some light on this development and show you what it means for you.

Rushing for the Exits

Blackstone (BX) is the world’s largest alternative investment firm. It has about $900 billion in assets under management.

It’s best known as a private equity firm, meaning it buys stakes in businesses before they go public.

But it also runs a $125 billion private real estate fund called Blackstone Real Estate Investment Trust (“BREIT”).

It owns everything from apartment buildings… to office parks… to casinos.

And on December 1, it was forced to limit withdrawals.

Its investors have demanded more than the 2% of assets it’s prepared to pay back each month.

To be clear, most investors knew about the BREIT redemption limits. But nobody imagined they’d be breached.

BREIT was hit by a doubling of redemption requests in November. And the fund’s subscriptions plummeted to less than $500 million from $880 million in September.

Given these circumstances, I’m not surprised a private equity fund is locking its investors in… It’s trying to prevent a bank run.

Looming Housing Crisis

Blackstone’s real estate wobble lays bare the crisis facing the housing market today.

But the signs of a crisis have been visible for months.

Rising mortgage rates. Faltering home sales. Soaring rents. The skyrocketing number of late-rent tenants. The numbers are scary…

Last month, for instance, 4 in 10 small businesses in the U.S. failed to pay rent.

And nearly 6 in 10 beauty salons and barber shops were in the same boat. That’s up from about 4 in 10 in October.

New York fared the worst. Nearly half of all small business owners there couldn’t afford to pay their rent on time and in full in November.

And it’s not just commercial properties getting crushed.

Residential real estate has been cracking under the pressure, too.

For instance, a recent report from real estate brokerage Redfin shows investor home purchases are down 30% over the past year.

Aside from the first quarter of 2020, when the market cratered at the start of the pandemic, that’s the steepest plunge since the 2007–2008 housing crisis.

And the crash is just getting started.

It’s the Fed’s Fault

It ignored rising inflation because it thought it would pass once the effects of the Covid shutdowns were fully out of the system.

But it’s been much stickier than the Fed predicted.

In June, inflation hit 9.1%. That’s the highest since the end of 1981.

When the Fed finally acted in March by raising rates, it was too late. So, it did what any rational, all-powerful organization would do… It went into overdrive.

In July, it raised rates by three-quarters of a point for the first time this year. It was the biggest rate hike in almost three decades.

We had three more straight three-quarter-point hikes after that, plus a half-point hike yesterday.

This is hiking the cost of everything from credit card debt to corporate financing.

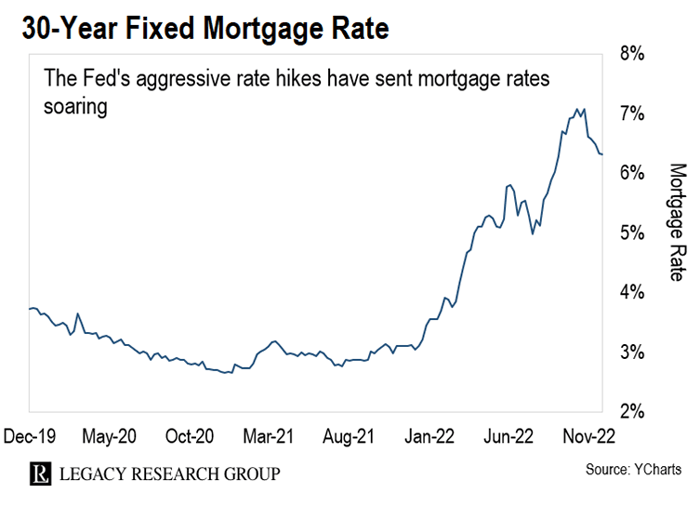

And as you can see from this chart, mortgage rates have skyrocketed.

See the peak in the top right corner?

That’s why sales are crashing. It’s made buying your first home the most unaffordable it’s been in 14 years.

Wave of Bankruptcies

The housing market is getting hit by a lethal mix of higher rates, higher rents, and lower property valuations.

Some economists are already warning that we could be on the verge of a housing meltdown.

And as Bloomberg put it…

The wave of [bankruptcies] that’s coming could be the worst since the housing bubble burst about 15 years ago.

This time, I want you to be prepared.

If you’re armed with the right strategy, it’s possible to turn this crisis into big profits. And I’m taking what I learned during my 15 years on Wall Street to give you the chance to do just that.

You can catch my Countdown to Housing Crisis 2.0 strategy session right here.

I tell the story of a legendary investor who’s already betting $200 million against the housing market…

We’ll look at the Washington event that could send this house of cards collapsing…

And I pass along a strategy Wall Street loves to use to play this kind of crisis. It gives you the chance to “flip” losers into big winners.

I even share a free recommendation. It’s an investment I believe could be one of the No.1 plays for 2023.

Here’s the link again to catch that.

Nomi Prins,

Editor, Distortion Report

P.S. This housing crisis could be the worst since the housing bubble burst in 2008. And if you’re not prepared, your portfolio will suffer.

During my strategy session, I showed how this crisis will play out… how you can protect yourself… and how you can profit through it.

I even gave away a free recommendation that I believe could be one of the top plays for 2023.

I can’t promise it’ll be online for long… but a replay is still available for a limited time. Go here to watch it now.