That’s about all I (Chris Lowe) can say about it with certainty right now.

You probably heard folks in the mainstream media talk up the idea of a Democratic “blue wave” – a Democratic sweep of the House, the Senate, and the Oval Office.

Well, it never showed up.

President Trump did much better than polls suggested. But Biden still has a strong shot at winning.

As I write this at 1 p.m. ET, he’s ahead in Arizona, a state Trump won in 2016. And Trump hasn’t picked up any states Hillary Clinton won. So barring a Biden win in Georgia and North Carolina, it’s up to voters in Michigan, Wisconsin, and Pennsylvania to decide the outcome.

Michigan and Wisconsin should announce later today. But Pennsylvania may announce as late as Friday. So there may be no clarity this week on who won.

And if the count is close enough, there’s a high chance the candidates will then litigate the results. Those suits may work their way all the way up to the Supreme Court.

So we may not know the final results for several weeks… even months.

That means a lot of uncertainty for markets. And with uncertainty comes volatility – aka roller-coaster markets. So today, let’s take another look at our post-election volatility playbook.

It shows you how to not only sidestep volatility… but also profit as the clouds clear.

We’ll also look at two sectors that will boom – no matter how the election shakes out.

So if you’re a regular reader, you’ll have been well-prepared.

It’s based on research colleague Jason Bodner shared with paid-up subscribers of our Palm Beach Trader advisory.

Jason was one of the few guys on Wall Street authorized to put together trades worth $1 billion… and more. He’s also a self-confessed “data nerd.”

Like so many guys on Wall Street, he does his best to check his emotions and biases and instead rely on what the data tells him.

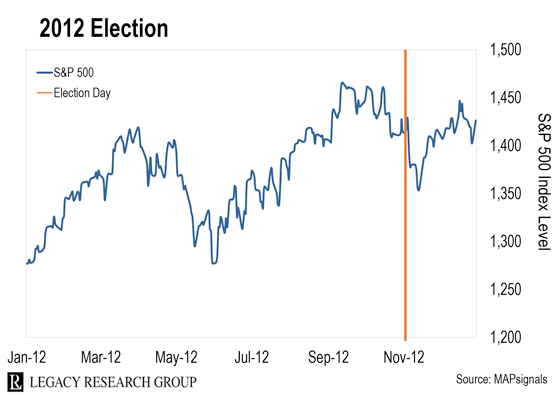

And when he looked at how stocks performed before and after every U.S. presidential election going back to 1992, he spotted a pattern…

For each of those years, U.S. stock market bellwether the S&P 500 sank heading into Election Day and rallied after the results were in. Take a look…

The exception was 2008. That was the year of the global financial crisis. And even then, the S&P 500 bottomed roughly four months after the election – and rocketed higher from there.

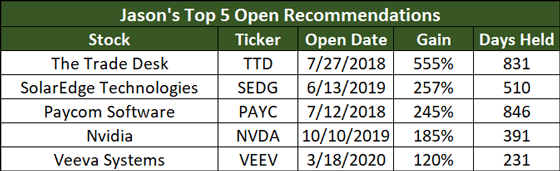

And he’s worth listening to… Fading out his emotions and focusing on the data instead has allowed him to knock it out of the park with his recommendations in the Palm Beach Trader model portfolio.

Of the 19 open recommendations, five are up triple digits. And the longest holding period for these five winners is just seven months…

And in case you think I’m cherry-picking, the average gain for all 19 recommendations is 82%.

Take a look for yourself.

The stock market peaked on September 2. Since then, it’s down 3%.

But Jason says he doesn’t expect the downtrend to last long…

Once we know the election outcome, and the country has a clearer picture of its direction for the next four years, stocks will get their mojo back.

I anticipate that within weeks after the election, there will be a COVID-19 vaccine. Slowly but surely, the big-picture uncertainty will move on.

This will make way for more trivial uncertainties, like whether or not a certain company will miss estimates by a few percentage points. That’s the kind of stock market big-money investors are no longer nervous about buying into.

Just be prepared for turbulence over the short term. Jason again…

Until we know the final election result, we’re in choppy waters. The stock market is vulnerable to big waves of selling pressure brought on by the slightest bit of news. So right now, the best bet is to wait out the election uncertainty and be ready to buy best-in-breed stocks once the dust clears. I expect stocks to go higher once we know the result.

As I showed you last week, some market sectors are going to do well – no matter who wins.

Take the legal cannabis industry. Last Thursday, I drew your attention to the fact that cannabis legalization was on the ballot in New Jersey, Arizona, Montana, South Dakota, and Mississippi.

And I showed you why yes votes in these states could grow the legal cannabis market in the U.S. by 20% – overnight.

Well, guess what… all five states approved these measures.

Voters approved ballot measures to legalize recreational cannabis use in New Jersey, Arizona, and Montana. South Dakota became the first state ever to approve medical and recreational cannabis use at the same time. And Mississippians voted to legalize medical cannabis.

As I showed you last Wednesday, the rollout of next-generation wireless internet is an unstoppable megatrend.

And according to our resident tech expert here at Legacy Research, Jeff Brown, it’s set to create about $12 trillion in new wealth.

And neither Donald Trump nor Joe Biden wants to spoil the party. That’s why both support 5G.

Becoming a global leader in 5G is a key strategic objective for the Trump administration.

That’s why in March, the president signed into law two pieces of 5G legislation – the Secure 5G and Beyond Act and the Broadband Deployment Accuracy and Technological Availability Act.

These will help ensure all Americans can access broadband and our 5G networks stay secure.

And if the race tips in Biden’s favor, he says that, as president, he’ll expand wireless broadband to every American by way of an accelerated nationwide 5G rollout.

This includes expanding home broadband connections in rural America using 5G.

You can catch up on my essays on the opportunities in legal cannabis and 5G stocks here and here.

And remember the lesson from history: Stocks are likely to be weak as uncertainty over the election results remains. But when that uncertainty lifts – and it will lift – stocks tend to power higher.

Regards,

|

Chris Lowe

November 4, 2020

Bray, Ireland